TABLE 1 Global Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 2 Global Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 3 Global Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 4 Global Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 5 North America Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 6 North America Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 7 North America Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 8 North America Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 9 U.S. Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 10 U.S. Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 11 U.S. Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 12 U.S. Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 13 Canada Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 14 Canada Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 15 Canada Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 16 Canada Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 17 Rest of North America Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 18 Rest of North America Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 19 Rest of North America Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 20 Rest of North America Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 21 UK and European Union Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 22 UK and European Union Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 23 UK and European Union Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 24 UK and European Union Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 25 UK Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 26 UK Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 27 UK Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 28 UK Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 29 Germany Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 30 Germany Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 31 Germany Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 32 Germany Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 33 Spain Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 34 Spain Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 35 Spain Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 36 Spain Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 37 Italy Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 38 Italy Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 39 Italy Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 40 Italy Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 41 France Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 42 France Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 43 France Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 44 France Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 45 Rest of Europe Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 46 Rest of Europe Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 47 Rest of Europe Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 48 Rest of Europe Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 49 Asia Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 50 Asia Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 51 Asia Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 52 Asia Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 53 China Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 54 China Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 55 China Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 56 China Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 57 Japan Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 58 Japan Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 59 Japan Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 60 Japan Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 61 India Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 62 India Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 63 India Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 64 India Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 65 Australia Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 66 Australia Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 67 Australia Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 68 Australia Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 69 South Korea Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 70 South Korea Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 71 South Korea Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 72 South Korea Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 73 Latin America Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 74 Latin America Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 75 Latin America Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 76 Latin America Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 77 Brazil Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 78 Brazil Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 79 Brazil Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 80 Brazil Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 81 Mexico Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 82 Mexico Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 83 Mexico Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 84 Mexico Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 85 Rest of Latin America Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 86 Rest of Latin America Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 87 Rest of Latin America Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 88 Rest of Latin America Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 89 Middle East and Africa Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 90 Middle East and Africa Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 91 Middle East and Africa Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 92 Middle East and Africa Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 93 GCC Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 94 GCC Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 95 GCC Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 96 GCC Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 97 South Africa Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 98 South Africa Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 99 South Africa Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 100 South Africa Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 101 North Africa Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 102 North Africa Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 103 North Africa Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 104 North Africa Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 105 Turkey Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 106 Turkey Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 107 Turkey Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 108 Turkey Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

TABLE 109 Rest of Middle East and Africa Virtual Content Creation Market By Content Type, 2022-2032, USD (Million)

TABLE 110 Rest of Middle East and Africa Virtual Content Creation Market By Videos, 2022-2032, USD (Million)

TABLE 111 Rest of Middle East and Africa Virtual Content Creation Market By Solution Type, 2022-2032, USD (Million)

TABLE 112 Rest of Middle East and Africa Virtual Content Creation Market By End-Use, 2022-2032, USD (Million)

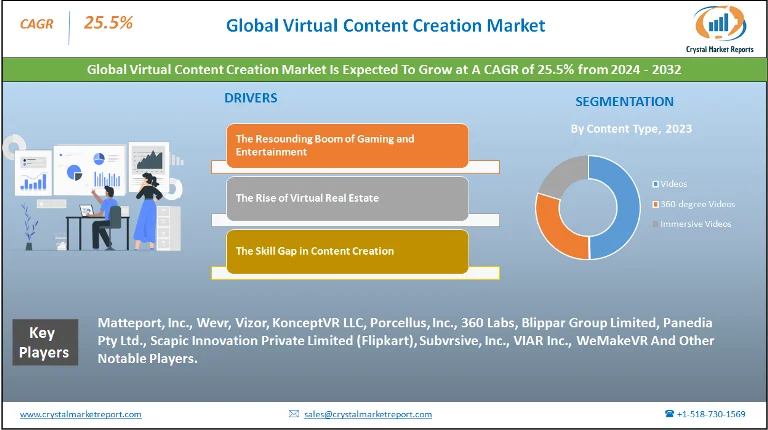

Market Overview

The virtual content creation market encompasses the diverse tools, platforms, and methodologies involved in producing digital and immersive content, particularly for virtual realities (VR), augmented realities (AR), and mixed realities (MR). This market has surged in popularity and relevance with the proliferation of VR headsets, AR applications on smartphones, and the continual integration of MR in various professional sectors. The virtual content creation market is estimated to grow at a CAGR of 25.5% from 2024 to 2032.

Virtual Content Creation Market Dynamics

Driver: The Resounding Boom of Gaming and Entertainment

One of the most striking drivers propelling the virtual content creation market forward has been the booming gaming and entertainment sector. Immersive gaming experiences have become a staple expectation among modern gamers. High-end VR games like "Half-Life: Alyx" showcased the depth and realism possible with current VR technology, providing gamers an unprecedented level of engagement. Moreover, the entertainment industry is seeing a notable uptick in VR concerts, AR movie promotions, and interactive MR experiences. As per a report from the International Data Corporation (IDC), global AR and VR spending was projected to grow from $12 billion in 2020 to over $72.8 billion by 2024. A significant portion of this growth can be attributed to the entertainment and gaming sectors.

Opportunity: The Rise of Virtual Real Estate

An emerging opportunity in the virtual content creation realm is the concept of virtual real estate. Platforms like Decentraland or Somnium Space allow users to buy, sell, or build upon virtual land using blockchain technology. These virtual environments offer endless content creation possibilities, from designing interactive art installations to establishing virtual businesses. According to a Forbes article, the virtual real estate market experienced transactions worth millions in 2021 alone, indicating a lucrative venture for digital content creators, architects, and artists.

Restraint: The Skill Gap in Content Creation

While the demand for virtual content has skyrocketed, the industry faces a significant restraint: the skills gap. The realm of virtual content creation demands a unique set of skills, from 3D modeling to understanding the nuances of user immersion. Many companies find it challenging to hire proficient virtual content creators because the pool of qualified candidates remains limited. A LinkedIn Workforce Report highlighted that role related to AR and VR had an evident shortage of talent, particularly in cities known for their tech industries like San Francisco and Los Angeles.

Challenge: Technology's Double-Edged Sword: Keeping Up with Rapid Advancements

The virtual content creation market is in a continuous state of evolution, thanks to the rapid technological advancements in both hardware and software domains. This pace poses a significant challenge. For instance, what's considered cutting-edge today might become obsolete in just a few years, forcing content creators to perennially update their skillsets and tools. Additionally, as noted in a Deloitte Insights piece, with the advent of quantum computing and more advanced AI algorithms, there's potential for even faster evolution in AR, VR, and MR technologies, making it daunting for creators to keep up.

Market Segmentation by Content Type

In 2023, the virtual content creation market experienced remarkable growth, attributable to various segments. By Content Type, Videos, 360-degree Videos, and Immersive Videos emerged as primary categories. Videos, with their versatility and applicability across platforms, dominated in terms of revenue. They became the go-to for sectors ranging from education to marketing due to their vast reach and user engagement. However, 360-degree Videos witnessed the highest CAGR, driven by the increasing popularity of VR headsets and the push for more interactive content. These videos offer users a panoramic view of scenes, making them particularly appealing for industries like real estate and travel. On the other hand, Immersive Videos are expected to gain momentum from 2024 to 2032. With advancements in AR and VR technologies, these videos will likely offer unparalleled user immersion, making them a prospective frontrunner in the coming decade.

Market Segmentation by End-Use

Considering End-Use, sectors like Media & Entertainment and Gaming held significant market shares in 2023 due to their early adoption and intensive usage of virtual content. Media houses incorporated 360-degree and immersive videos into their content repertoire, providing audiences with novel viewing experiences, whereas the gaming industry leveraged these technologies to offer players more engaging environments. Yet, it was the Real Estate sector that showcased the highest CAGR. Virtual property tours, interactive home previews, and 360-degree property overviews became selling points for many realty firms. Despite this, in terms of sheer revenue, the Media & Entertainment sector took the lead, given the vast global consumption of entertainment content.

Market Segmentation by Region

Geographically, North America held the highest revenue percentage in 2023, credited to its advanced technological infrastructure and high adoption rate of VR and AR technologies. Silicon Valley's continuous innovations played a pivotal role in driving this regional dominance. Meanwhile, the Asia-Pacific region is anticipated to register the highest CAGR from 2024 to 2032. Factors such as increasing smartphone penetration, expanding internet infrastructure, and a growing interest in VR gaming in countries like China, South Korea, and Japan will likely propel this growth.

Competitive Trends

In terms of competitive trends, 2023 saw companies like Matteport, Inc., Wevr, Vizor, KonceptVR LLC, Porcellus, Inc., 360 Labs, Blippar Group Limited, Panedia Pty Ltd., Scapic Innovation Private Limited (Flipkart), Subvrsive, Inc., VIAR Inc., and WeMakeVR reigning supreme due to their comprehensive virtual content creation tools and platforms. These players continuously upgraded their offerings, ensuring they stayed relevant amidst fast-evolving technological landscapes. Their strategies largely revolved around acquisitions, R&D investments, and collaborations.