Market Overview

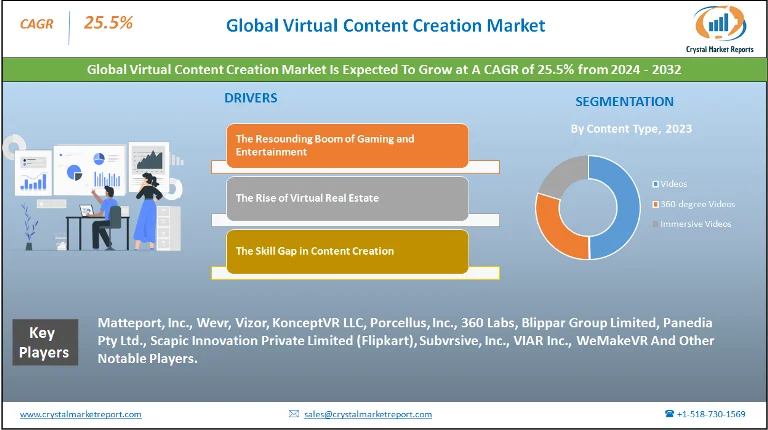

The virtual content creation market encompasses the diverse tools, platforms, and methodologies involved in producing digital and immersive content, particularly for virtual realities (VR), augmented realities (AR), and mixed realities (MR). This market has surged in popularity and relevance with the proliferation of VR headsets, AR applications on smartphones, and the continual integration of MR in various professional sectors. The virtual content creation market is estimated to grow at a CAGR of 25.5% from 2024 to 2032.

Virtual Content Creation Market Dynamics

Driver: The Resounding Boom of Gaming and Entertainment

One of the most striking drivers propelling the virtual content creation market forward has been the booming gaming and entertainment sector. Immersive gaming experiences have become a staple expectation among modern gamers. High-end VR games like "Half-Life: Alyx" showcased the depth and realism possible with current VR technology, providing gamers an unprecedented level of engagement. Moreover, the entertainment industry is seeing a notable uptick in VR concerts, AR movie promotions, and interactive MR experiences. As per a report from the International Data Corporation (IDC), global AR and VR spending was projected to grow from $12 billion in 2020 to over $72.8 billion by 2024. A significant portion of this growth can be attributed to the entertainment and gaming sectors.

Opportunity: The Rise of Virtual Real Estate

An emerging opportunity in the virtual content creation realm is the concept of virtual real estate. Platforms like Decentraland or Somnium Space allow users to buy, sell, or build upon virtual land using blockchain technology. These virtual environments offer endless content creation possibilities, from designing interactive art installations to establishing virtual businesses. According to a Forbes article, the virtual real estate market experienced transactions worth millions in 2021 alone, indicating a lucrative venture for digital content creators, architects, and artists.

Restraint: The Skill Gap in Content Creation

While the demand for virtual content has skyrocketed, the industry faces a significant restraint: the skills gap. The realm of virtual content creation demands a unique set of skills, from 3D modeling to understanding the nuances of user immersion. Many companies find it challenging to hire proficient virtual content creators because the pool of qualified candidates remains limited. A LinkedIn Workforce Report highlighted that role related to AR and VR had an evident shortage of talent, particularly in cities known for their tech industries like San Francisco and Los Angeles.

Challenge: Technology's Double-Edged Sword: Keeping Up with Rapid Advancements

The virtual content creation market is in a continuous state of evolution, thanks to the rapid technological advancements in both hardware and software domains. This pace poses a significant challenge. For instance, what's considered cutting-edge today might become obsolete in just a few years, forcing content creators to perennially update their skillsets and tools. Additionally, as noted in a Deloitte Insights piece, with the advent of quantum computing and more advanced AI algorithms, there's potential for even faster evolution in AR, VR, and MR technologies, making it daunting for creators to keep up.

Market Segmentation by Content Type

In 2023, the virtual content creation market experienced remarkable growth, attributable to various segments. By Content Type, Videos, 360-degree Videos, and Immersive Videos emerged as primary categories. Videos, with their versatility and applicability across platforms, dominated in terms of revenue. They became the go-to for sectors ranging from education to marketing due to their vast reach and user engagement. However, 360-degree Videos witnessed the highest CAGR, driven by the increasing popularity of VR headsets and the push for more interactive content. These videos offer users a panoramic view of scenes, making them particularly appealing for industries like real estate and travel. On the other hand, Immersive Videos are expected to gain momentum from 2024 to 2032. With advancements in AR and VR technologies, these videos will likely offer unparalleled user immersion, making them a prospective frontrunner in the coming decade.

Market Segmentation by End-Use

Considering End-Use, sectors like Media & Entertainment and Gaming held significant market shares in 2023 due to their early adoption and intensive usage of virtual content. Media houses incorporated 360-degree and immersive videos into their content repertoire, providing audiences with novel viewing experiences, whereas the gaming industry leveraged these technologies to offer players more engaging environments. Yet, it was the Real Estate sector that showcased the highest CAGR. Virtual property tours, interactive home previews, and 360-degree property overviews became selling points for many realty firms. Despite this, in terms of sheer revenue, the Media & Entertainment sector took the lead, given the vast global consumption of entertainment content.

Market Segmentation by Region

Geographically, North America held the highest revenue percentage in 2023, credited to its advanced technological infrastructure and high adoption rate of VR and AR technologies. Silicon Valley's continuous innovations played a pivotal role in driving this regional dominance. Meanwhile, the Asia-Pacific region is anticipated to register the highest CAGR from 2024 to 2032. Factors such as increasing smartphone penetration, expanding internet infrastructure, and a growing interest in VR gaming in countries like China, South Korea, and Japan will likely propel this growth.

Competitive Trends

In terms of competitive trends, 2023 saw companies like Matteport, Inc., Wevr, Vizor, KonceptVR LLC, Porcellus, Inc., 360 Labs, Blippar Group Limited, Panedia Pty Ltd., Scapic Innovation Private Limited (Flipkart), Subvrsive, Inc., VIAR Inc., and WeMakeVR reigning supreme due to their comprehensive virtual content creation tools and platforms. These players continuously upgraded their offerings, ensuring they stayed relevant amidst fast-evolving technological landscapes. Their strategies largely revolved around acquisitions, R&D investments, and collaborations.