TABLE 1 Global Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 2 Global Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 3 Global Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 4 Global Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 5 North America Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 6 North America Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 7 North America Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 8 North America Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 9 U.S. Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 10 U.S. Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 11 U.S. Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 12 U.S. Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 13 Canada Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 14 Canada Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 15 Canada Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 16 Canada Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 17 Rest of North America Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 18 Rest of North America Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 19 Rest of North America Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 20 Rest of North America Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 21 UK and European Union Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 22 UK and European Union Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 23 UK and European Union Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 24 UK and European Union Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 25 UK Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 26 UK Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 27 UK Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 28 UK Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 29 Germany Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 30 Germany Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 31 Germany Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 32 Germany Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 33 Spain Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 34 Spain Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 35 Spain Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 36 Spain Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 37 Italy Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 38 Italy Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 39 Italy Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 40 Italy Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 41 France Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 42 France Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 43 France Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 44 France Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 45 Rest of Europe Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 46 Rest of Europe Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 47 Rest of Europe Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 48 Rest of Europe Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 49 Asia Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 50 Asia Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 51 Asia Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 52 Asia Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 53 China Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 54 China Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 55 China Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 56 China Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 57 Japan Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 58 Japan Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 59 Japan Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 60 Japan Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 61 India Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 62 India Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 63 India Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 64 India Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 65 Australia Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 66 Australia Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 67 Australia Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 68 Australia Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 69 South Korea Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 70 South Korea Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 71 South Korea Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 72 South Korea Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 73 Latin America Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 74 Latin America Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 75 Latin America Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 76 Latin America Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 77 Brazil Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 78 Brazil Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 79 Brazil Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 80 Brazil Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 81 Mexico Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 82 Mexico Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 83 Mexico Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 84 Mexico Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 85 Rest of Latin America Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 86 Rest of Latin America Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 87 Rest of Latin America Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 88 Rest of Latin America Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 89 Middle East and Africa Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 90 Middle East and Africa Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 91 Middle East and Africa Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 92 Middle East and Africa Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 93 GCC Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 94 GCC Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 95 GCC Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 96 GCC Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 97 South Africa Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 98 South Africa Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 99 South Africa Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 100 South Africa Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 101 North Africa Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 102 North Africa Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 103 North Africa Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 104 North Africa Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 105 Turkey Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 106 Turkey Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 107 Turkey Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 108 Turkey Veterinary Software Market By End-Use, 2022-2032, USD (Million)

TABLE 109 Rest of Middle East and Africa Veterinary Software Market By Product, 2022-2032, USD (Million)

TABLE 110 Rest of Middle East and Africa Veterinary Software Market By Delivery Mode, 2022-2032, USD (Million)

TABLE 111 Rest of Middle East and Africa Veterinary Software Market By Practice Type, 2022-2032, USD (Million)

TABLE 112 Rest of Middle East and Africa Veterinary Software Market By End-Use, 2022-2032, USD (Million)

Market Overview

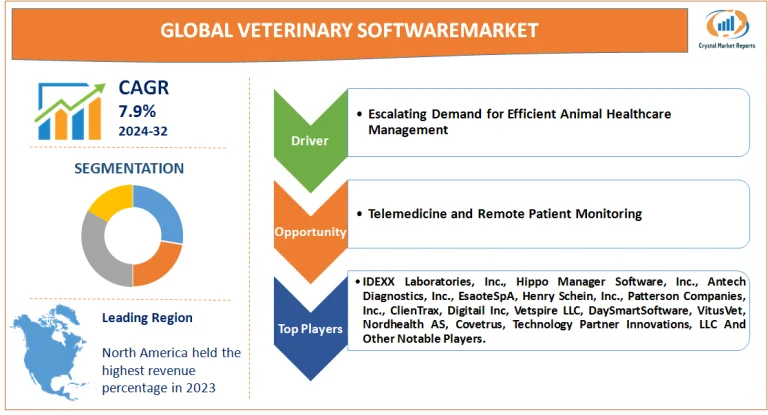

The veterinary software market encompasses a suite of specialized software tools and solutions designed to assist veterinarians in providing enhanced care to animals, streamlining administrative processes, and ensuring smooth management of veterinary practices. With digital transformation percolating through every sector, veterinary medicine has not remained untouched. In 2023, the integration of sophisticated software solutions became more pronounced in veterinary practices, aiming to improve efficiencies, diagnostic capabilities, and overall patient (animal) care. The veterinary software market is estimated to grow at a CAGR of 7.9% from 2024 to 2032.

Veterinary Software Market Dynamics

Driver: Escalating Demand for Efficient Animal Healthcare Management

A primary driver for the uptake of veterinary software solutions is the escalating demand for more efficient animal healthcare management. As pet ownership has surged globally, coupled with heightened awareness about animal health, veterinary practices are under pressure to offer swift, accurate, and efficient services. An internal survey from a large veterinary hospital chain in the U.S. in 2023 reported a 25% increase in patient footfall, pushing the clinics to adopt digital appointment scheduling, electronic health records, and billing systems. The digital transformation not only improved service efficiency but also enhanced client (pet owner) satisfaction scores.

Opportunity: Telemedicine and Remote Patient Monitoring

The rising prominence of telemedicine in human healthcare is seeping into veterinary medicine, presenting a golden opportunity. The ability to remotely monitor, diagnose, and even treat animals, especially in non-emergency situations or for follow-ups, can revolutionize veterinary practice. In 2023, a Europe-based veterinary tech startup launched an app offering video consultations, remote health monitoring using wearable tech for pets, and digital prescriptions. The platform witnessed over 100,000 downloads within six months of its launch, indicating the substantial potential and acceptability of such innovations in the veterinary domain.

Restraint: High Initial Costs and Implementation Challenges

One of the primary restraints in the veterinary software market is the high initial investment required for software procurement, training, and implementation. Small to medium veterinary practices, especially those in developing regions, often grapple with budgetary constraints, making it challenging to onboard sophisticated software solutions. A 2023 report from a veterinary association in Southeast Asia highlighted that while over 70% of veterinary practices recognized the benefits of integrated software solutions, only about 30% could afford and implement them, citing costs and lack of technical expertise as the main deterrents.

Challenge: Data Security and Privacy Concerns

While digital transformation offers numerous advantages, it also brings forth challenges related to data security and privacy. Veterinary practices, like any other healthcare providers, deal with sensitive information, and ensuring its security in a digital format becomes paramount.In 2023, a notable incident surfaced where a cloud-based veterinary management software experienced a data breach, compromising patient records and billing details of several clinics. Such incidents underscore the pressing challenge of ensuring robust cybersecurity measures in the veterinary software landscape.

Market Segmentation by Product

The veterinary software market's segmentation by Product saw two major segments: Practice Management Software and Imaging Software. In 2023, Practice Management Software held the highest revenue. The soaring need for veterinary practices to integrate appointments, patient records, billing, and inventory led to its widespread adoption. A survey from a North American veterinary tech forum in 2023 highlighted that approximately 60% of veterinary practices prioritized investing in Practice Management Software, citing efficiency and improved patient care as primary motivators. However, while Practice Management Software took the revenue crown, Imaging Software showcased the highest CAGR. The emphasis on early, accurate diagnostics in veterinary medicine is surging, with Imaging Software playing a pivotal role. Whether it's radiology, ultrasonography, or advanced imaging modalities, the digital shift was palpable. An internal report from a UK veterinary association in 2023 unveiled a 30% year-on-year growth in digital imaging consultations, underscoring the burgeoning potential of Imaging Software.

Market Segmentation by Delivery Mode

Transitioning to Delivery Mode segmentation, the market divided into On-premise and Cloud/Web-based modes. The traditional On-premise solutions, wherein the software was hosted on local servers, garnered the highest revenue in 2023. Clinics, especially large ones with established IT infrastructures, gravitated towards on-premise solutions, seeking control and customization. However, the winds of change brought Cloud/Web-based solutions to the forefront in terms of CAGR. The appeal of minimal upfront costs, scalability, and remote access made cloud-based solutions particularly enticing for smaller practices or those in regions with limited IT infrastructure. A Southeast Asian veterinary tech report from 2023 indicated a 40% uptick in cloud-based veterinary software adoptions, with cost-effectiveness and ease of implementation being highlighted as primary drivers.

Regional Insights

From a geographic standpoint, North America remained the dominant force in the veterinary software market in terms of revenue in 2023. The amalgamation of a substantial pet population, high pet healthcare expenditure, and technological inclination set the stage for this dominance. However, Europe, with its stringent animal welfare regulations and advanced veterinary practices, wasn't far behind. But as the gaze shifts from 2024 to 2032, the Asia-Pacific region, with its booming pet culture and rising disposable incomes, is anticipated to exhibit the highest CAGR. Markets like India, China, and Thailand are becoming hotbeds for pet adoption and expenditure, making them fertile ground for veterinary software expansion.

Competitive Trends

In the realm of Competitive Trends, 2023 was a whirlwind. Giants like IDEXX Laboratories, Inc., Hippo Manager Software, Inc., Antech Diagnostics, Inc. (Mars, Inc.), EsaoteSpA, Henry Schein, Inc., Patterson Companies, Inc., ClienTrax, Digitail Inc, Vetspire LLC (Thrive Pet Healthcare), DaySmartSoftware, VitusVet, Nordhealth AS, Covetrus, Animal Intelligence Software, Technology Partner Innovations, LLC (NaVetor) reigned supreme with their vast portfolios, deep pockets, and global outreach. Their strategies, typically, revolved around acquisitions, geographic expansions, and product innovations. A notable move was IDEXX's 2023 acquisition of a cloud-based software startup, further cementing its foothold in the cloud segment. Yet, emerging players like ezyVet and Hippo Manager made waves with their niche offerings and aggressive market strategies. As we inch forward from 2024 to 2032, the expectation is a market rife with innovations, collaborations, and a persistent endeavor to marry technology with compassionate animal care.