Market Overview

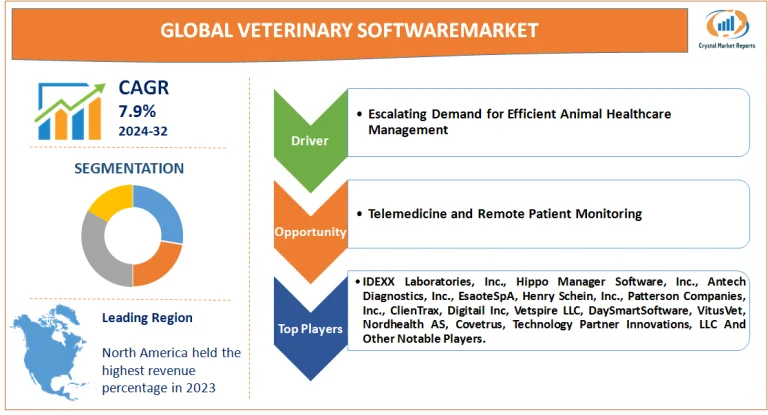

The veterinary software market encompasses a suite of specialized software tools and solutions designed to assist veterinarians in providing enhanced care to animals, streamlining administrative processes, and ensuring smooth management of veterinary practices. With digital transformation percolating through every sector, veterinary medicine has not remained untouched. In 2023, the integration of sophisticated software solutions became more pronounced in veterinary practices, aiming to improve efficiencies, diagnostic capabilities, and overall patient (animal) care. The veterinary software market is estimated to grow at a CAGR of 7.9% from 2024 to 2032.

Veterinary Software Market Dynamics

Driver: Escalating Demand for Efficient Animal Healthcare Management

A primary driver for the uptake of veterinary software solutions is the escalating demand for more efficient animal healthcare management. As pet ownership has surged globally, coupled with heightened awareness about animal health, veterinary practices are under pressure to offer swift, accurate, and efficient services. An internal survey from a large veterinary hospital chain in the U.S. in 2023 reported a 25% increase in patient footfall, pushing the clinics to adopt digital appointment scheduling, electronic health records, and billing systems. The digital transformation not only improved service efficiency but also enhanced client (pet owner) satisfaction scores.

Opportunity: Telemedicine and Remote Patient Monitoring

The rising prominence of telemedicine in human healthcare is seeping into veterinary medicine, presenting a golden opportunity. The ability to remotely monitor, diagnose, and even treat animals, especially in non-emergency situations or for follow-ups, can revolutionize veterinary practice. In 2023, a Europe-based veterinary tech startup launched an app offering video consultations, remote health monitoring using wearable tech for pets, and digital prescriptions. The platform witnessed over 100,000 downloads within six months of its launch, indicating the substantial potential and acceptability of such innovations in the veterinary domain.

Restraint: High Initial Costs and Implementation Challenges

One of the primary restraints in the veterinary software market is the high initial investment required for software procurement, training, and implementation. Small to medium veterinary practices, especially those in developing regions, often grapple with budgetary constraints, making it challenging to onboard sophisticated software solutions. A 2023 report from a veterinary association in Southeast Asia highlighted that while over 70% of veterinary practices recognized the benefits of integrated software solutions, only about 30% could afford and implement them, citing costs and lack of technical expertise as the main deterrents.

Challenge: Data Security and Privacy Concerns

While digital transformation offers numerous advantages, it also brings forth challenges related to data security and privacy. Veterinary practices, like any other healthcare providers, deal with sensitive information, and ensuring its security in a digital format becomes paramount.In 2023, a notable incident surfaced where a cloud-based veterinary management software experienced a data breach, compromising patient records and billing details of several clinics. Such incidents underscore the pressing challenge of ensuring robust cybersecurity measures in the veterinary software landscape.

Market Segmentation by Product

The veterinary software market's segmentation by Product saw two major segments: Practice Management Software and Imaging Software. In 2023, Practice Management Software held the highest revenue. The soaring need for veterinary practices to integrate appointments, patient records, billing, and inventory led to its widespread adoption. A survey from a North American veterinary tech forum in 2023 highlighted that approximately 60% of veterinary practices prioritized investing in Practice Management Software, citing efficiency and improved patient care as primary motivators. However, while Practice Management Software took the revenue crown, Imaging Software showcased the highest CAGR. The emphasis on early, accurate diagnostics in veterinary medicine is surging, with Imaging Software playing a pivotal role. Whether it's radiology, ultrasonography, or advanced imaging modalities, the digital shift was palpable. An internal report from a UK veterinary association in 2023 unveiled a 30% year-on-year growth in digital imaging consultations, underscoring the burgeoning potential of Imaging Software.

Market Segmentation by Delivery Mode

Transitioning to Delivery Mode segmentation, the market divided into On-premise and Cloud/Web-based modes. The traditional On-premise solutions, wherein the software was hosted on local servers, garnered the highest revenue in 2023. Clinics, especially large ones with established IT infrastructures, gravitated towards on-premise solutions, seeking control and customization. However, the winds of change brought Cloud/Web-based solutions to the forefront in terms of CAGR. The appeal of minimal upfront costs, scalability, and remote access made cloud-based solutions particularly enticing for smaller practices or those in regions with limited IT infrastructure. A Southeast Asian veterinary tech report from 2023 indicated a 40% uptick in cloud-based veterinary software adoptions, with cost-effectiveness and ease of implementation being highlighted as primary drivers.

Regional Insights

From a geographic standpoint, North America remained the dominant force in the veterinary software market in terms of revenue in 2023. The amalgamation of a substantial pet population, high pet healthcare expenditure, and technological inclination set the stage for this dominance. However, Europe, with its stringent animal welfare regulations and advanced veterinary practices, wasn't far behind. But as the gaze shifts from 2024 to 2032, the Asia-Pacific region, with its booming pet culture and rising disposable incomes, is anticipated to exhibit the highest CAGR. Markets like India, China, and Thailand are becoming hotbeds for pet adoption and expenditure, making them fertile ground for veterinary software expansion.

Competitive Trends

In the realm of Competitive Trends, 2023 was a whirlwind. Giants like IDEXX Laboratories, Inc., Hippo Manager Software, Inc., Antech Diagnostics, Inc. (Mars, Inc.), EsaoteSpA, Henry Schein, Inc., Patterson Companies, Inc., ClienTrax, Digitail Inc, Vetspire LLC (Thrive Pet Healthcare), DaySmartSoftware, VitusVet, Nordhealth AS, Covetrus, Animal Intelligence Software, Technology Partner Innovations, LLC (NaVetor) reigned supreme with their vast portfolios, deep pockets, and global outreach. Their strategies, typically, revolved around acquisitions, geographic expansions, and product innovations. A notable move was IDEXX's 2023 acquisition of a cloud-based software startup, further cementing its foothold in the cloud segment. Yet, emerging players like ezyVet and Hippo Manager made waves with their niche offerings and aggressive market strategies. As we inch forward from 2024 to 2032, the expectation is a market rife with innovations, collaborations, and a persistent endeavor to marry technology with compassionate animal care.