Market Overview

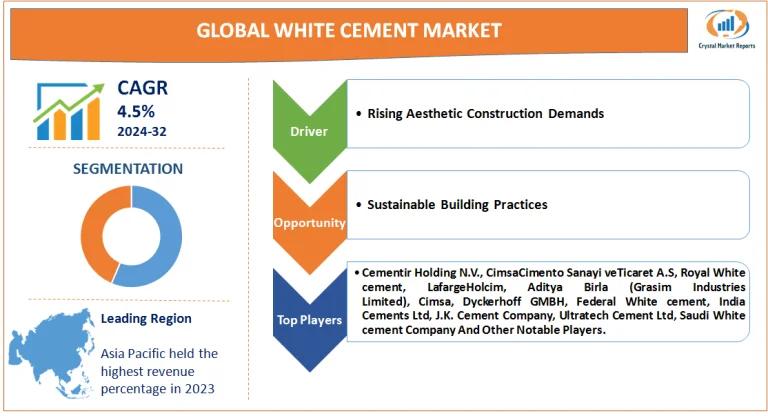

The white cement market is essentially defined by the production and sale of white cement, a product derived from raw materials that contain negligible amounts of iron and manganese - the elements responsible for the gray hue of ordinary cement. Contrasted with its gray counterpart, white cement offers a pristine whiteness, making it a preferred choice for aesthetic applications in construction. Historically employed in the crafting of architectural designs and ornamental fixtures, white cement has gained momentum as a foundation material for infrastructure worldwide. The white cement market is estimated to grow at a CAGR of 4.5% from 2024 to 2032.

White Cement Market Dynamics

Driver: Rising Aesthetic Construction Demands

One cannot overlook the tremendous surge in aesthetic construction activities, especially in developing nations. Urbanization, combined with a burgeoning middle class, has led to an increased demand for visually appealing infrastructures. The intrinsic property of white cement to blend seamlessly with color pigments, ensuring vibrant shades, has made it the go-to option for decorative concrete projects. Evidences of this trend can be seen in regions like the Middle East, where palatial homes and commercial edifices increasingly utilize white cement for their intricate designs. Moreover, cities globally have shown an incline towards artistic public spaces, further boosting the market.

Opportunity: Sustainable Building Practices

Green building certifications, like LEED (Leadership in Energy and Environmental Design), often prioritize materials that are sustainable and have reduced carbon footprints. White cement, due to its production process, emits less carbon dioxide compared to traditional cement. This environmental advantage provides it an upper hand in green construction projects. In countries like Sweden, several public infrastructures are increasingly adopting white cement, showcasing a shift towards eco-friendly building materials. This sustainable appeal of white cement is not just restricted to the West. Even in densely populated regions like Southeast Asia, there's an evident shift towards environmentally conscious construction, presenting a golden opportunity for white cement manufacturers.

Restraint: Cost Concerns

Despite its numerous advantages, the cost of white cement is relatively higher than that of gray cement. This cost disparity primarily stems from the meticulous production process of white cement, which demands specific raw materials and stringent manufacturing conditions. For instance, in India, where cost often dictates construction choices, gray cement remains the dominant player, primarily because of its affordability. Moreover, several real estate projects in African nations, where budget constraints are paramount, often sidestep white cement due to its higher price point.

Challenge: Availability of Alternatives

The construction industry, in its relentless quest for innovation, has birthed several alternatives to white cement. Materials like fly ash and slag cement, which are by-products of other industrial processes, are now being incorporated into construction practices. Their dual advantage of being cost-effective and environmentally friendly has led to their increased adoption. A prominent example is China's Belt and Road infrastructure initiative, where alternative cementitious materials are being used extensively. This rising preference for alternatives, especially in mega-infrastructure projects, poses a significant challenge to the white cement market.

Market Segmentation by Product

In 2023, the White Portland Cement segment held the lion’s share in terms of revenue. Owing to its superior strength and durability, it emerged as the preferred choice for both structural and decorative purposes. Furthermore, its compatibility with pigments made it a sought-after product in regions valuing aesthetic construction. On the other hand, when it comes to the CAGR, the White Masonry Cement is anticipated to register the fastest growth from 2024 to 2032. This growth can be attributed to its versatility in masonry applications, such as in plastering, brick or stone works, etc. The "Others" category, inclusive of specialized white cements for niche applications, also exhibited steady demand, but neither its revenue nor growth rate eclipsed the aforementioned categories.

Market Segmentation by Application

The residential segment was the market’s revenue leader in 2023, driven primarily by the global boom in residential constructions and renovations. As homeowners worldwide aspired for aesthetically pleasing abodes, the allure of white cement became hard to resist. Meanwhile, the commercial sector is predicted to surpass others in terms of CAGR over the next decade. With more corporations emphasizing brand aesthetics and green constructions, white cement’s properties align perfectly with these objectives. Other applications, including public infrastructure and artistic installations, while significant, trailed behind in terms of both revenue and growth rate.

Geographic Trends

From a geographical standpoint, the Asia-Pacific region dominated the market revenue in 2023. Rapid urbanization coupled with substantial infrastructure investments, especially in countries like India and China, spurred this dominance. However, the Middle East and Africa are forecasted to showcase the highest CAGR from 2024 to 2032. The fusion of architectural grandeur and swift infrastructural developments in countries such as the UAE and Saudi Arabia augments this growth trajectory. Europe and North America, with their mature markets, are expected to witness stable demand, driven by renovation activities and the increasing emphasis on sustainable construction materials.

Competitive Landscape

The competitive arena of the White cement market is both dynamic and intense. In 2023, key players like Cementir Holding N.V., CimsaCimento Sanayi veTicaret A.S, Royal White cement, LafargeHolcim, Aditya Birla (Grasim Industries Limited), Cimsa, Dyckerhoff GMBH, Federal White cement, India Cements Ltd, J.K. Cement Company, Ultratech Cement Ltd, and Saudi White cement Company led the market, backed by their vast distribution networks and brand reputation. Their strategies revolved around expanding production capacities, innovating product portfolios, and establishing collaborations for sustainable production techniques. With green building trends gaining traction, many players are now investing in R&D to reduce the carbon footprint of their products. As we look forward to 2024-2032, these market leaders, along with emerging players, are expected to delve deeper into eco-friendly production methodologies, and strategic mergers and acquisitions to consolidate their market position.