TABLE 1 Global Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 2 Global Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 3 Global Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 4 Global Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 5 North America Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 6 North America Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 7 North America Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 8 North America Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 9 U.S. Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 10 U.S. Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 11 U.S. Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 12 U.S. Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 13 Canada Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 14 Canada Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 15 Canada Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 16 Canada Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 17 Rest of North America Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 18 Rest of North America Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 19 Rest of North America Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 20 Rest of North America Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 21 UK and European Union Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 22 UK and European Union Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 23 UK and European Union Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 24 UK and European Union Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 25 UK Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 26 UK Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 27 UK Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 28 UK Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 29 Germany Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 30 Germany Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 31 Germany Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 32 Germany Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 33 Spain Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 34 Spain Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 35 Spain Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 36 Spain Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 37 Italy Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 38 Italy Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 39 Italy Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 40 Italy Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 41 France Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 42 France Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 43 France Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 44 France Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 45 Rest of Europe Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 46 Rest of Europe Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 47 Rest of Europe Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 48 Rest of Europe Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 49 Asia Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 50 Asia Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 51 Asia Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 52 Asia Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 53 China Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 54 China Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 55 China Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 56 China Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 57 Japan Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 58 Japan Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 59 Japan Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 60 Japan Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 61 India Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 62 India Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 63 India Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 64 India Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 65 Australia Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 66 Australia Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 67 Australia Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 68 Australia Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 69 South Korea Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 70 South Korea Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 71 South Korea Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 72 South Korea Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 73 Latin America Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 74 Latin America Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 75 Latin America Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 76 Latin America Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 77 Brazil Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 78 Brazil Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 79 Brazil Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 80 Brazil Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 81 Mexico Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 82 Mexico Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 83 Mexico Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 84 Mexico Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 85 Rest of Latin America Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 86 Rest of Latin America Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 87 Rest of Latin America Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 88 Rest of Latin America Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 89 Middle East and Africa Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 90 Middle East and Africa Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 91 Middle East and Africa Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 92 Middle East and Africa Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 93 GCC Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 94 GCC Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 95 GCC Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 96 GCC Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 97 South Africa Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 98 South Africa Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 99 South Africa Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 100 South Africa Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 101 North Africa Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 102 North Africa Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 103 North Africa Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 104 North Africa Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 105 Turkey Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 106 Turkey Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 107 Turkey Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 108 Turkey Vitamin Supplement Market By End User, 2022-2032, USD (Million)

TABLE 109 Rest of Middle East and Africa Vitamin Supplement Market By Type, 2022-2032, USD (Million)

TABLE 110 Rest of Middle East and Africa Vitamin Supplement Market By Form, 2022-2032, USD (Million)

TABLE 111 Rest of Middle East and Africa Vitamin Supplement Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 112 Rest of Middle East and Africa Vitamin Supplement Market By End User, 2022-2032, USD (Million)

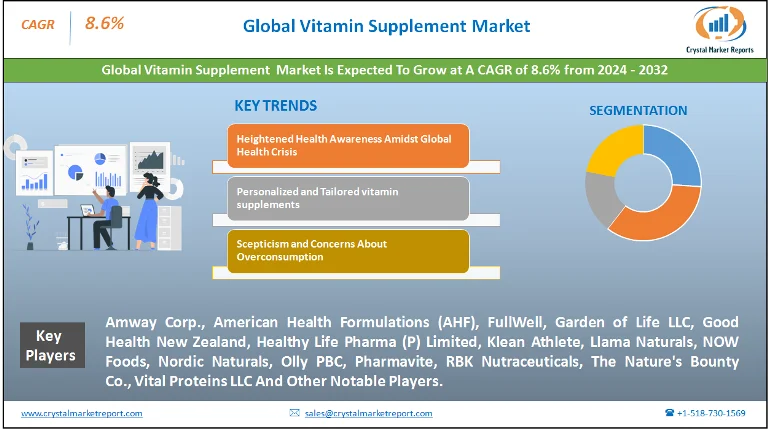

Market Overview

The vitamin supplement market encompasses the range of products containing concentrated sources of vitamins, usually in the form of pills, tablets, capsules, liquids, or powders. These products aim to supplement the diet and provide nutrients that might not be consumed in sufficient quantities. The vitamin supplement market is estimated to grow at a CAGR of 8.6% from 2024 to 2032.

Vitamin Supplement Market Dynamics

Driver: Heightened Health Awareness Amidst Global Health Crisis

The global health crisis, particularly the COVID-19 pandemic, acted as a significant catalyst for the vitamin supplement market. A vast population turned their focus on building immunity and ensuring optimal health to combat the virus, and vitamin supplements, especially Vitamin C, D, and Zinc, came to the forefront. Many health practitioners and articles advocated for their benefits. For instance, a report in The Lancet journal underscored the potential of Vitamin D in modulating innate and adaptive immune responses. While there was a disclaimer regarding the direct correlation between vitamin intake and COVID resistance, this piece, along with others, propelled a surge in vitamin supplement consumption.

Opportunity: Personalized and Tailored vitamin supplements

With advancements in health tech and diagnostics, there's a growing trend towards personalization in the healthcare sector. Start-ups and health companies have begun offering services where individuals can undergo tests to identify specific vitamin deficiencies. Based on these results, they receive tailored vitamin supplement packages. One such example is the rising trend of at-home blood tests that gauge Vitamin D levels, with recommendations given based on the findings. This personalization ensures consumers receive the exact nutrients they lack, optimizing health benefits and minimizing potential side effects from overconsumption.

Restraint: Scepticism and Concerns About Overconsumption

On the flip side, the market faces restraint due to skepticism surrounding the actual benefits of vitamin supplements. There's a growing narrative, backed by some studies, suggesting that for individuals without deficiencies, these supplements might not offer notable benefits. The Journal of the American College of Cardiology published a review indicating that most mineral and vitamin supplements don't prevent chronic diseases in average risk individuals without known nutrient deficiencies. This sentiment, combined with concerns about potential side effects from overconsumption, has made a section of the potential market hesitant.

Challenge: Regulatory Hurdles and False Claims

The vitamin supplement market, while burgeoning, is not without challenges. One of the most significant is navigating the complex and often stringent regulatory landscape. Different countries have varying regulations regarding supplement formulations, health claims, and marketing. Moreover, there have been instances of companies making unfounded claims about the health benefits of their supplements. In the US, the FDA has issued warnings to several companies making misleading claims about their vitamin products, especially those suggesting they can treat or prevent COVID-19. Such instances not only pose challenges for the concerned companies but also can dent the overall market reputation.

Market Segmentation by Type

In 2023, when dissecting the market based on Type, the Vitamin D segment emerged with the highest revenue. The heightened awareness about its benefits, especially in bone health and immune system bolstering, spurred its demand. Numerous reports highlighting Vitamin D's potential role in mitigating the severity of respiratory illnesses further fueled its prominence. On the other hand, Multivitamin supplements are charting the highest Compound Annual Growth Rate (CAGR). Their appeal lies in offering a comprehensive solution to consumers, negating the need to purchase multiple single-nutrient supplements. As health-conscious consumers seek holistic options, this segment's growth is expected to remain robust from 2024 to 2032.

Market Segmentation by Form

Regarding the market segmentation by Form, in 2023, Tablets dominated in terms of revenue. Their long shelf life, ease of storage, and affordability made them a preferred choice for many consumers. However, the form expected to exhibit the highest CAGR from 2024 to 2032 is Gummies. This can be attributed to their palatability, making them an ideal choice for both children and adults averse to traditional pills or capsules. Furthermore, brands have been marketing gummies innovatively, emphasizing their taste and convenience.

Market Segmentation by Region

From a Geographic perspective, North America dominated the market in 2023 with the highest revenue percentage. The region's well-established healthcare infrastructure, combined with high health awareness levels, has been instrumental. However, the Asia-Pacific region is anticipated to register the highest CAGR from 2024 to 2032. Rising disposable incomes, coupled with increasing health consciousness in countries like India and China, will likely drive this growth. Additionally, local players entering the vitamin supplement market and international brands expanding their footprint in this region will further fuel this trend.

Competitive Trends

Analyzing Competitive Trends, 2023 saw market leaders like Amway Corp., American Health Formulations (AHF), FullWell, Garden of Life LLC, Good Health New Zealand, Healthy Life Pharma (P) Limited, Klean Athlete, Llama Naturals, NOW Foods, Nordic Naturals, Olly PBC, Pharmavite, RBK Nutraceuticals, The Nature's Bounty Co., and Vital Proteins LLC continuing to solidify their positions. Their success can be ascribed to robust R&D investments, vast distribution networks, and efficient marketing strategies. However, the competitive landscape is expected to evolve from 2024 to 2032. There's a visible shift towards natural and organic vitamin supplements. Players that can incorporate such trends, offer personalized solutions, and expand in emerging markets will likely gain a competitive edge.