TABLE 1 Global Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 2 Global Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 3 Global Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 4 Global Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 5 Global Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 6 Global Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 7 Global Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 8 North America Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 9 North America Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 10 North America Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 11 North America Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 12 North America Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 13 North America Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 14 North America Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 15 U.S. Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 16 U.S. Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 17 U.S. Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 18 U.S. Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 19 U.S. Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 20 U.S. Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 21 U.S. Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 22 Canada Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 23 Canada Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 24 Canada Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 25 Canada Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 26 Canada Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 27 Canada Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 28 Canada Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 29 Rest of North America Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 30 Rest of North America Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 31 Rest of North America Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 32 Rest of North America Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 33 Rest of North America Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 34 Rest of North America Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 35 Rest of North America Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 36 UK and European Union Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 37 UK and European Union Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 38 UK and European Union Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 39 UK and European Union Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 40 UK and European Union Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 41 UK and European Union Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 42 UK and European Union Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 43 UK Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 44 UK Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 45 UK Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 46 UK Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 47 UK Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 48 UK Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 49 UK Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 50 Germany Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 51 Germany Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 52 Germany Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 53 Germany Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 54 Germany Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 55 Germany Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 56 Germany Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 57 Spain Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 58 Spain Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 59 Spain Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 60 Spain Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 61 Spain Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 62 Spain Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 63 Spain Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 64 Italy Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 65 Italy Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 66 Italy Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 67 Italy Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 68 Italy Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 69 Italy Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 70 Italy Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 71 France Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 72 France Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 73 France Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 74 France Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 75 France Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 76 France Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 77 France Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 78 Rest of Europe Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 79 Rest of Europe Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 80 Rest of Europe Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 81 Rest of Europe Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 82 Rest of Europe Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 83 Rest of Europe Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 84 Rest of Europe Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 85 Asia Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 86 Asia Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 87 Asia Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 88 Asia Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 89 Asia Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 90 Asia Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 91 Asia Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 92 China Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 93 China Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 94 China Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 95 China Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 96 China Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 97 China Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 98 China Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 99 Japan Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 100 Japan Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 101 Japan Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 102 Japan Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 103 Japan Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 104 Japan Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 105 Japan Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 106 India Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 107 India Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 108 India Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 109 India Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 110 India Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 111 India Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 112 India Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 113 Australia Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 114 Australia Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 115 Australia Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 116 Australia Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 117 Australia Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 118 Australia Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 119 Australia Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 120 South Korea Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 121 South Korea Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 122 South Korea Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 123 South Korea Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 124 South Korea Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 125 South Korea Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 126 South Korea Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 127 Latin America Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 128 Latin America Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 129 Latin America Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 130 Latin America Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 131 Latin America Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 132 Latin America Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 133 Latin America Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 134 Brazil Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 135 Brazil Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 136 Brazil Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 137 Brazil Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 138 Brazil Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 139 Brazil Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 140 Brazil Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 141 Mexico Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 142 Mexico Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 143 Mexico Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 144 Mexico Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 145 Mexico Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 146 Mexico Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 147 Mexico Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 148 Rest of Latin America Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 149 Rest of Latin America Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 150 Rest of Latin America Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 151 Rest of Latin America Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 152 Rest of Latin America Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 153 Rest of Latin America Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 154 Rest of Latin America Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 155 Middle East and Africa Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 156 Middle East and Africa Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 157 Middle East and Africa Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 158 Middle East and Africa Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 159 Middle East and Africa Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 160 Middle East and Africa Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 161 Middle East and Africa Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 162 GCC Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 163 GCC Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 164 GCC Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 165 GCC Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 166 GCC Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 167 GCC Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 168 GCC Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 169 South Africa Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 170 South Africa Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 171 South Africa Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 172 South Africa Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 173 South Africa Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 174 South Africa Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 175 South Africa Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 176 North Africa Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 177 North Africa Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 178 North Africa Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 179 North Africa Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 180 North Africa Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 181 North Africa Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 182 North Africa Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 183 Turkey Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 184 Turkey Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 185 Turkey Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 186 Turkey Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 187 Turkey Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 188 Turkey Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 189 Turkey Virtual Events Market By Use-Case, 2022-2032, USD (Million)

TABLE 190 Rest of Middle East and Africa Virtual Events Market By Type, 2022-2032, USD (Million)

TABLE 191 Rest of Middle East and Africa Virtual Events Market By Service, 2022-2032, USD (Million)

TABLE 192 Rest of Middle East and Africa Virtual Events Market By Establishment Size, 2022-2032, USD (Million)

TABLE 193 Rest of Middle East and Africa Virtual Events Market By End-Use, 2022-2032, USD (Million)

TABLE 194 Rest of Middle East and Africa Virtual Events Market By Application, 2022-2032, USD (Million)

TABLE 195 Rest of Middle East and Africa Virtual Events Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 196 Rest of Middle East and Africa Virtual Events Market By Use-Case, 2022-2032, USD (Million)

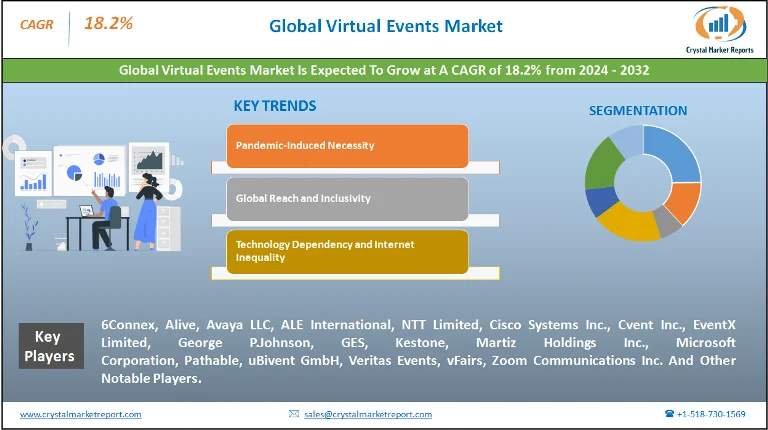

Market Overview

The virtual events market can be succinctly defined as a digital platform where events, traditionally hosted in a physical venue, are replicated virtually to facilitate real-time hosting and attendance from any global location. These events may encompass webinars, virtual expos, online workshops, and even digital versions of conferences and product launches. The virtual events market is estimated to grow at a CAGR of 18.2% from 2024 to 2032. In recent years, the adoption of virtual events has grown exponentially, transcending geographical boundaries, reducing operational costs, and offering a more flexible alternative to traditional events. This surge has been particularly apparent in the corporate sector, the educational realm, and even within personal celebratory occasions.

Virtual Events Market Dynamics

Driver: Pandemic-Induced Necessity

Global Health Crisis Dictates the Terms: The emergence of COVID-19 compelled businesses, institutions, and even social communities to rethink their strategies. Physical events, given their nature of congregation, became potential hotspots for virus transmission. This posed not only a health risk but also a reputational risk for businesses. With lockdowns and travel restrictions in place, virtual events emerged as the sole viable option to maintain business continuity, sustain educational programs, and even commemorate personal milestones. Evidence of this can be gleaned from the sharp increase in subscriptions and user base of platforms like Zoom, Microsoft Teams, and Cisco Webex during the early months of the pandemic.

Opportunity: Global Reach and Inclusivity

Dissolving Geographical Constraints: The digital nature of virtual events effectively eliminated geographical barriers. Businesses could now target a global audience without incurring the logistical nightmares or the steep costs associated with international events. An example that stands testament to this is Apple's WWDC 2020, which, for the first time, was hosted virtually and garnered a global viewership that previously was limited to those who could physically attend the event in California.

Restraint: Technology Dependency and Internet Inequality

A Digital Divide: While the virtual model presents numerous advantages, it also assumes that attendees have access to reliable internet and compatible devices. However, vast swathes of populations, especially in developing regions, still grapple with internet connectivity issues or lack the necessary hardware. The "Digital 9" initiative, a collaboration of digital nations aiming to share best practices, has repeatedly highlighted the disparities in global digital access, emphasizing that nearly half the global population still lacks basic internet access.

Challenge: Virtual Fatigue and Engagement Concerns

The Screen Burnout Syndrome: As businesses and institutions scrambled to migrate everything online, from meetings to workshops, people found themselves spending inordinate amounts of time staring at screens. This led to a phenomenon commonly termed as 'Zoom Fatigue'. Such extended screen time not only impacts physical health, manifesting as eye strain and postural issues, but also takes a toll on mental well-being. The "Remote Work Burnout" study, conducted in mid-2020, showcased that over 50% of the participants felt considerable fatigue and stress due to prolonged virtual engagements.

Market Segmentation by End-Use

For end-use segmentation, Educational Institutions remained the frontrunners. The transition to e-learning and remote teaching methods necessitated virtual events for orientations, open houses, and graduation ceremonies. Revenue statistics from 2023 confirm this, with educational institutions contributing the highest revenue to the Virtual events market. On the growth curve, however, Enterprises recorded the highest Compound Annual Growth Rate (CAGR). Enterprises, ranging from tech giants to startups, adopted virtual events for product launches, team meetings, and even recruitment. The very essence of corporate adaptability amidst pandemic-induced changes is evident from their switch to virtual platforms, signaling a robust growth trajectory for the coming decade. Organizations, mainly non-profits, and other groups, leveraged these platforms for fundraisers, awareness campaigns, and stakeholder meetings. The segment tagged "Others" primarily encompasses individual users and influencers, marking their territory in the digital space through personalized events, webinars, and workshops.

Market Segmentation by Application

Diving into application-based segmentation, Conferences topped the revenue charts in 2023. The convenience of attending global conferences from the comfort of one's home or office, minus the travel expenses and logistics, is an allure hard to resist for most professionals and academics. Meanwhile, Exhibitions/Trade Shows are expected to record the highest CAGR from 2024 to 2032. The virtual representation of stalls, interactive product demos, and the ability to cater to a global audience without physical constraints provides a fresh perspective and ample growth opportunities for businesses. Summits, especially those with international attendees, found their virtual counterpart to be a more feasible and eco-friendly option. The "Others" in this segment are an amalgamation of workshops, product launches, and virtual team-building events, each of which contributes its share to the market dynamics.

Market Segmentation by Region

Geographically, North America, with its tech-savvy population and the presence of major market players, contributed the most substantial revenue chunk in 2023. The region's adaptability to technology and its investments in digital infrastructure account for its dominant stance. Yet, it's the Asia-Pacific region that's anticipated to have the steepest CAGR from 2024 to 2032. With emerging economies, increasing internet penetration, and a massive user base, countries like India and China are on the brink of a virtual revolution. As businesses and institutions in these regions recognize the potential of virtual events, their growth is expected to skyrocket in the forecasted period.

Competitive Trends

In the competitive arena, platforms like 6Connex, Alive, Avaya LLC, ALE International, NTT Limited, Cisco Systems Inc., Cvent Inc., EventX Limited, George P.Johnson, GES, Kestone, Martiz Holdings Inc., Microsoft Corporation, Pathable, uBivent GmbH, Veritas Events, vFairs, and Zoom Communications Inc. were ubiquitous in 2023. Their strategies centered on user-friendliness, scalability, and integration capabilities. However, niche players like Hopin and Run the World, specializing exclusively in virtual events, began gaining traction. Their unique selling points included interactive event spaces, networking lounges, and engagement tools that recreated the essence of physical events. From 2024 to 2032, the market is expected to witness a surge in innovations, strategic collaborations, and a focus on enhancing user experience as the pivotal strategy.