Market Overview

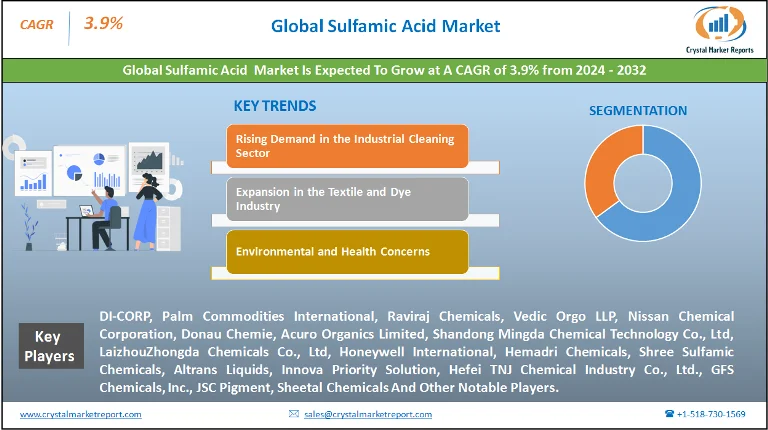

The sulfamic acid market is a culmination of intricate dynamics shaped by industry needs, global demands, and technological advancements. sulfamic acid, a colorless, water-soluble compound, is widely used as an acidic cleaning agent, especially for metals and ceramics, and in the manufacturing of dyes, paper, and textiles. The sulfamic acid market is estimated to grow at a CAGR of 3.9% from 2024 to 2032.

Sulfamic Acid Market Dynamics

Market Driver: Rising Demand in the Industrial Cleaning Sector

One of the most significant drivers for the sulfamic acid market has been its escalating demand in the industrial cleaning sector. Industries are in perpetual need of efficient, cost-effective cleaning agents to ensure the maintenance and longevity of their machinery. Enter sulfamic acid, with its properties that can effectively descale and clean, especially in removing rust, limescale, and deposits from metallic surfaces. The rise in industrial activities across developing nations necessitates machinery maintenance, subsequently propelling the demand for sulfamic acid. Evidence to this trend can be gleaned from the growth rates of industrial sectors in countries like India and Brazil, where machinery upkeep has become integral to sustain production rates. Moreover, as per global industrial growth statistics, there's been a consistent rise in machinery imports and exports, indirectly pointing towards a growing need for effective cleaning agents like sulfamic acid.

Opportunity: Expansion in the Textile and Dye Industry

The textile and dye industry presents a lucrative opportunity for the sulfamic acid market. With the global fashion industry surging, there's a heightened demand for dyes that are vibrant, long-lasting, and eco-friendly. Sulfamic acid plays a crucial role in enhancing the fixation of dyes on fabrics, ensuring color longevity. The global fashion market's growth, which saw a significant uptick in online sales and fast fashion trends, indicates a sustained demand for dyes. This, in turn, provides a promising avenue for sulfamic acid providers to tap into. Additionally, the shift towards sustainable and eco-friendly dyes necessitates the use of compounds that ensure dye adherence without compromising environmental concerns, putting sulfamic acid in the spotlight.

Restraint: Environmental and Health Concerns

However, every market has its set of challenges. A significant restraint in the sulfamic acid market is the growing environmental and health concerns associated with its production and disposal. Prolonged exposure to sulfamic acid can cause respiratory and skin problems. There have been multiple instances globally where industries were scrutinized for not adhering to safety standards, leading to health issues among workers. Additionally, the improper disposal of sulfamic acid residue can lead to environmental degradation, affecting aquatic life. Regulatory bodies worldwide have been stringent about chemical disposal, and any negligence can lead to hefty penalties, as observed in recent environmental protection laws getting fortified across Europe and North America.

Challenge: Fluctuating Raw Material Prices

The sulfamic acid market also faces challenges in the form of fluctuating raw material prices. Being derived from sulfuric acid, any volatility in the sulfur market directly impacts the pricing of sulfamic acid. Recent economic instabilities, trade wars, and geopolitical tensions have led to erratic sulfur prices, making it challenging for sulfamic acid manufacturers to maintain consistent pricing. A case in point is the US-China trade tensions that saw significant fluctuations in commodity prices, impacting global supply chains.

Product Insights

Within the sulfamic acid industry, the differentiation by product primarily bifurcates into solid and liquid forms. As of 2023, the solid form of sulfamic acid registered the highest revenue, attributed to its extensive usage in varied applications due to its easy storage, longer shelf life, and convenience in transportation. This form is predominantly used in industrial cleaning to remove rust and scale from metals, and its stable, non-hygroscopic nature ensures it remains a preference among manufacturers. On the other hand, the liquid sulfamic acid segment displayed the highest CAGR, with its growth propelled by the increasing demand in specialized industrial applications where precise concentration and immediate application are paramount. Liquid sulfamic acid's ease of mixing and application has made it a favored choice in areas like electroplating and electrorefining.

End-use Insights

Delving into its end-use applications, sulfamic acid finds its role in sectors ranging from industrial cleaning to electrorefining. In 2023, the industrial cleaning sector dominated the market revenue-wise, driven by the global surge in industrial activities and the essential need for machinery maintenance. Cleaning agents that can efficiently remove scales and residues are always in demand, and sulfamic acid's prowess in this regard has cemented its position. However, looking at growth rates, the chlorine water treatment sector showcased the highest CAGR. With the increasing emphasis on purified water and stringent regulations about water quality, the role of sulfamic acid in chlorine water treatment as a descaling agent is expected to gain more traction from 2024 to 2032.

Regional Insights

Geographically, Asia-Pacific (APAC) emerged as the dominant force in 2023 in terms of revenue. With manufacturing hubs like China and India within its fold, the demand for sulfamic acid for industrial cleaning and chemical manufacturing soared in the region. The proliferation of industries and the emphasis on machinery maintenance were pivotal in this growth. However, Europe, with its strict environmental regulations and emphasis on water quality, is expected to register the highest CAGR over the forecast period of 2024-2032. The shift towards eco-friendly chemicals and the need for efficient descaling agents in water treatment plants in countries like Germany and France are anticipated to drive this growth.

Competitive Trends

The competitive landscape of the sulfamic acid market is marked by the presence of both global giants and regional players. As of 2023, companies such as DI-CORP, Palm Commodities International, Raviraj Chemicals, Vedic Orgo LLP, Nissan Chemical Corporation, Donau Chemie, Acuro Organics Limited, Shandong Mingda Chemical Technology Co., Ltd, LaizhouZhongda Chemicals Co., Ltd, Honeywell International, Hemadri Chemicals, Shree Sulfamic Chemicals, Altrans Liquids, Innova Priority Solution, Hefei TNJ Chemical Industry Co., Ltd., GFS Chemicals, Inc., JSC Pigment, and Sheetal Chemicals were among the market leaders, primarily due to their expansive distribution networks and R&D capabilities. Their strategies often revolved around product innovation and ensuring the production of eco-friendly and efficient sulfamic acid variants. Furthermore, strategic partnerships and mergers became prevalent as companies aimed to expand their geographical reach and diversify their product portfolios. As the market navigates from 2024 to 2032, it's expected that companies will intensify their R&D efforts, with a focus on producing sustainable and green sulfamic acid solutions to cater to the evolving demands of end-use industries and comply with global environmental standards.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.