TABLE 1 Global Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 2 Global Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 3 Global Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 4 North America Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 5 North America Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 6 North America Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 7 U.S. Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 8 U.S. Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 9 U.S. Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 10 Canada Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 11 Canada Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 12 Canada Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 13 Rest of North America Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 14 Rest of North America Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 15 Rest of North America Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 16 UK and European Union Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 17 UK and European Union Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 18 UK and European Union Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 19 UK Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 20 UK Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 21 UK Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 22 Germany Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 23 Germany Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 24 Germany Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 25 Spain Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 26 Spain Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 27 Spain Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 28 Italy Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 29 Italy Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 30 Italy Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 31 France Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 32 France Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 33 France Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 37 Asia Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 38 Asia Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 39 Asia Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 40 China Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 41 China Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 42 China Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 43 Japan Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 44 Japan Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 45 Japan Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 46 India Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 47 India Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 48 India Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 49 Australia Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 50 Australia Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 51 Australia Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 52 South Korea Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 53 South Korea Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 54 South Korea Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 55 Latin America Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 56 Latin America Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 57 Latin America Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 58 Brazil Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 59 Brazil Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 60 Brazil Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 61 Mexico Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 62 Mexico Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 63 Mexico Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 70 GCC Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 71 GCC Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 72 GCC Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 73 South Africa Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 74 South Africa Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 75 South Africa Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 76 North Africa Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 77 North Africa Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 78 North Africa Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 79 Turkey Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 80 Turkey Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 81 Turkey Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Stand-up Zipper Pouch Market By Material Type, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Stand-up Zipper Pouch Market By Capacity, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Stand-up Zipper Pouch Market By End-Use, 2022-2032, USD (Million)

Market Overview

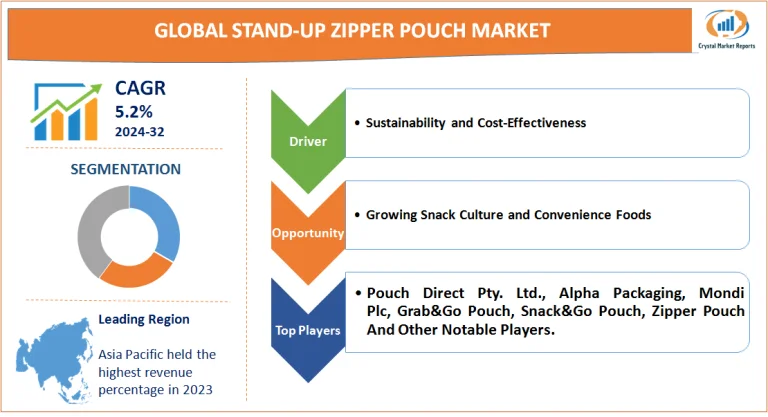

The stand-up zipper pouch market has garnered substantial attention in recent times. Essentially, this market revolves around pouches that, thanks to their design, can stand upright on shelves, providing both convenience and aesthetic appeal to consumers. These pouches are commonly equipped with a zipper mechanism that ensures the contents remain secure and fresh. The combination of functionality, design, and practicality has made them favorites among both manufacturers and consumers. The stand-up zipper pouch market is estimated to grow at a CAGR of 5.2% from 2024 to 2032.

Stand-up Zipper Pouch Market Dynamics

Key Driver - Sustainability and Cost-Effectiveness

One of the main drivers propelling the stand-up zipper pouch market is their sustainable and cost-effective nature. Traditional packaging solutions often involve the use of rigid plastic containers or boxes, which are not only bulkier but also contribute more waste to the environment. In contrast, stand-up zipper pouches typically use less material, translating to decreased manufacturing costs. Additionally, their lightweight nature ensures reduced shipping and transportation costs. These savings often get passed down to consumers, making products housed in these pouches more appealing in price-sensitive markets.Moreover, as concerns about environmental degradation intensify, businesses are more motivated than ever to adopt eco-friendly packaging solutions. Stand-up zipper pouches often fit the bill as they're typically easier to recycle, and many manufacturers have begun producing them from biodegradable or compostable materials. Evidence of this shift is visible in various industry sectors. For instance, a notable percentage of organic food producers have transitioned to stand-up zipper pouches, citing both environmental and economic benefits.

Opportunity - Growing Snack Culture and Convenience Foods

The booming snack culture, particularly in urban areas, presents a significant opportunity for the stand-up zipper pouch market. Modern lifestyles, characterized by busyness and constant movement, have given rise to the need for convenient and portable food options. This is where stand-up zipper pouches shine. Their resealability ensures that consumers can eat on-the-go without worrying about freshness or spillage.Evidence of this trend can be seen in the rise of health-centric snacks – like nuts, seeds, and dried fruits – being packaged in these pouches. Additionally, many new-age beverage powders and drink mixes targeting fitness enthusiasts have adopted this packaging format, emphasizing its portability and convenience.

Restraint - Concerns About Freshness Preservation

However, it's not all smooth sailing for the stand-up zipper pouch market. One restraint is the concern about the pouches' ability to preserve freshness over extended periods. While they are undeniably convenient, some argue that stand-up zipper pouches are not as airtight as traditional containers, potentially compromising product freshness.For instance, in a survey of coffee aficionados, a segment expressed reservations about buying premium coffee beans in zipper pouches, fearing potential flavor loss. This sentiment has made some premium brands hesitant to make the packaging switch, limiting the pouches' penetration in certain market segments.

Challenge - Fluctuations in Raw Material Prices

The stand-up zipper pouch industry faces challenges stemming from fluctuations in the prices of raw materials. The pouches, while efficient, rely on polymers and compounds that can experience price volatility due to factors like petroleum prices, environmental regulations, and global trade dynamics. Such fluctuations can impact the cost of production, posing challenges for manufacturers who aim to keep retail prices stable.For instance, in 2021, the global surge in crude oil prices indirectly affected polymer costs, making it costlier for manufacturers to produce stand-up zipper pouches. This kind of volatility requires businesses to either absorb the additional costs or pass them onto consumers, both of which are not ideal.

Market Segmentation by Material Type

Among the materials, plastic led the market in terms of revenue in 2023. Its cost-effectiveness and versatility have been pivotal, catering to diverse industries. Plastic pouches, given their durable nature and lightweight, became the go-to choice for manufacturers, especially in the food and consumer goods sector. Paper pouches, on the other hand, are witnessing the highest CAGR. As the sustainability wave gains momentum, paper, with its biodegradable properties, is expected to garner immense traction from eco-conscious brands and consumers. Brands are leveraging the "eco-friendly" tag, and paper pouches, often combined with minimalistic design elements, have become synonymous with environmentally responsible packaging. Aluminum pouches, recognized for their superior barrier properties and ability to keep contents fresh, have found significant adoption, especially in premium product segments like gourmet coffee and specialty teas.

Market Segmentation by End-Use

Diving into the end-use, the food sector dominated the market revenue in 2023. The omnipresent demand for snacks, coupled with the convenience of zipper pouches, played a significant role. On the horizon, the cosmetics & personal care segment is expected to witness the highest CAGR from 2024 to 2032. This projection stems from the increasing number of brands transitioning to flexible packaging solutions, emphasizing portability and user-friendly designs. Notably, the healthcare & pharmaceuticals segment, driven by the demand for over-the-counter medicines and nutraceuticals, is fast adopting zipper pouches, lured by their tamper-evident and freshness-preserving features.

Geographic Segment

Geographically, Asia-Pacific accounted for the lion's share of the market revenue in 2023. The region, with its expanding middle class, urbanization, and growing number of retail chains, has become a hotspot for stand-up zipper pouch adoption. Furthermore, countries like India and China, with their burgeoning food and beverage industries, have immensely contributed to this growth. However, as we gaze into the future, Latin America is expected to showcase the highest CAGR between 2024 and 2032. The region, in its bid to modernize its retail and consumer goods sector, is gradually shifting towards flexible packaging solutions, with stand-up zipper pouches at the forefront.

Competitive Trends

From a competitive standpoint, the stand-up zipper pouch market has witnessed innovations and strategic partnerships. Key players, including Pouch Direct Pty. Ltd., Alpha Packaging, Mondi Plc, Grab&Go Pouch, Snack&Go Pouch, and Zipper Pouch, to name a few, have invested heavily in R&D in 2023, aiming to introduce pouches that cater to specific industry needs. For instance, there's a push towards introducing zipper pouches that can withstand high temperatures, specifically targeting the ready-to-eat meals segment. Moreover, mergers and acquisitions have been rampant, with companies looking to expand their global footprint and leverage the expertise of regional players. As we progress from 2024 to 2032, it's expected that these market leaders, along with emerging players, will focus on sustainability, aiming to introduce pouches made from recycled or upcycled materials.