Market Overview

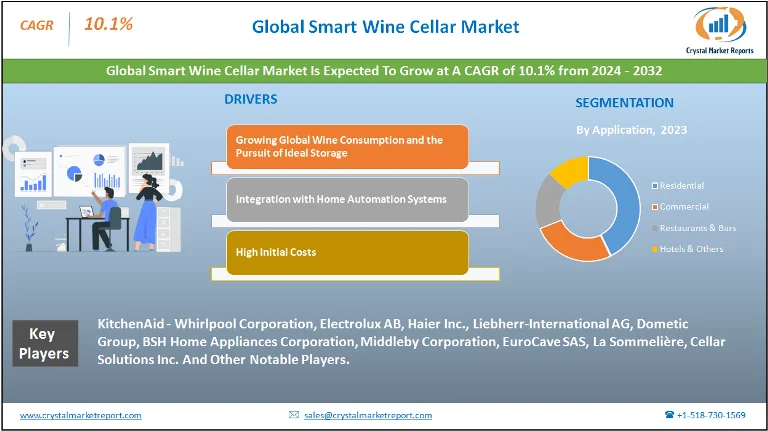

The smart wine cellar market encompasses technologically-advanced wine storage solutions designed to offer optimal storage conditions through automation, thereby ensuring the preservation of flavor, aroma, and quality of wines. These cellars are integrated with IoT capabilities and come equipped with sensors, allowing users to monitor and adjust settings via smartphones or tablets. The smart wine cellar market is estimated to grow at a CAGR of 10.1% from 2024 to 2032.

Smart Wine Cellar Market Dynamics

Driver: Growing Global Wine Consumption and the Pursuit of Ideal Storage

A significant driver for the smart wine cellar market has been the rising global wine consumption. Wine, being a cherished beverage, has seen steady growth in consumption, with countries like China, the US, and UK leading the charge. The trend of collecting and investing in premium wines has been more evident in the last decade. For such investments to be meaningful, the storage conditions of these wines become paramount. Storing wines at the wrong temperature or in fluctuating conditions can degrade their quality. Enter smart wine cellars. They not only maintain the optimal conditions but also allow users to track and control these conditions remotely. Evidence of this driver can be seen in the growth of wine imports. For instance, China's wine imports grew by about 6.9% in the first half of 2019, as reported by the General Administration of Customs.

Opportunity: Integration with Home Automation Systems

One of the most substantial opportunities in the smart wine cellar market lies in the integration with broader home automation systems. As modern homes become "smarter," with integrated IoT devices controlling everything from lighting to security, integrating wine cellars into this ecosystem is a logical progression. Users could manage their wine collection alongside other household operations seamlessly. There's already evidence of this integration. For example, several modern luxury homes listed in the US in 2021 mentioned integrated smart wine cellars as a part of their comprehensive smart home systems.

Restraint: High Initial Costs

However, like many technological innovations, the smart wine cellar market faces its set of challenges. A major restraint has been the high initial costs associated with these advanced cellars. When compared to traditional wine racks or basic coolers, smart wine cellars are considerably pricier. This price barrier has been evident in emerging markets where the middle-class populace, although increasingly interested in wine, find the costs of smart wine cellars prohibitive. A survey in 2020 revealed that while 65% of respondents in India were interested in purchasing wine storage solutions, only about 15% were willing to invest in high-end solutions like smart wine cellars.

Challenge: Dependence on Stable Internet Connectivity

The very advantage of smart wine cellars - their connectivity - is also a challenge in areas with unstable internet. Being IoT devices, their "smart" functionalities rely heavily on uninterrupted internet connectivity. In regions or locales where internet services are erratic, the full range of functionalities of these cellars might not be exploited, rendering them as just expensive wine storage units. Anecdotal evidence comes from users in rural France, a wine-loving region, where internet connectivity can be spotty. Many users reported dissatisfaction as they couldn't fully utilize the smart features of their wine cellars.

Market Segmentation by Capacity

When dissecting the smart wine cellar market, segmenting by capacity provides an insight into consumer preferences and usage patterns. Capacity is a paramount factor, especially for avid wine collectors and commercial establishments. In 2023, the segment for up to 500 bottles held the highest revenue. This prevalence can be attributed to the growing number of urban consumers looking to integrate compact wine storage solutions in their modern homes, without compromising on the technological edge. Furthermore, the more than 1500 bottles segment is anticipated to witness the highest CAGR from 2024 to 2032. The reason behind this trend is likely the expanding hospitality sector, especially luxury hotels and upscale restaurants looking to house extensive wine collections, ensuring their premium guests have a wide range to select from. Additionally, as wine investment becomes more mainstream, serious collectors are expected to require larger storage capacities.

Market Segmentation by Application

Moving on to the Application segmentation, residential applications dominated in terms of revenue generation in 2023. The proliferation of smart homes and the integration of IoT devices in residential settings have considerably boosted this segment. It wasn't surprising, considering the convenience of having a personally curated wine collection at one's fingertips, coupled with the added assurance of optimal storage conditions. However, the segment expected to have the fastest growth, in terms of CAGR from 2024 to 2032, is hotels. With the travel and tourism sector projected to bounce back robustly post-pandemic, luxury hotels are gearing up to enhance their offerings, and a sophisticated wine experience tops the list.

Market Segmentation by Region

From a Geographic perspective, North America, buoyed by the US, led the charts in revenue in 2023. A confluence of factors, from a rise in disposable income, heightened wine appreciation, to a robust hospitality industry, contributed to this lead. However, Asia-Pacific is poised to exhibit the highest CAGR from 2024 to 2032. This can be attributed to the burgeoning middle class, especially in countries like China and India, which have shown an accelerated interest in wine consumption and collection. Furthermore, the expanding hospitality sector across APAC, coupled with increased urbanization and Western lifestyle adoption, is anticipated to fuel this growth.

Competitive Trends

Several players are at the forefront of the smart wine cellar market. Companies like KitchenAid - Whirlpool Corporation, Electrolux AB, Haier Inc., Liebherr-International AG, Dometic Group, BSH Home Appliances Corporation, Middleby Corporation, EuroCave SAS, La Sommelière, and Cellar Solutions Inc. stood out in 2023 in terms of revenue and market share. Their strategies revolved around product innovation, with features such as advanced humidity control, UV protection, and even predictive maintenance using AI. Collaborations and partnerships were also a part of their playbook, especially with smart home solution providers, enhancing the seamlessness of their products in a smart home ecosystem. As we move forward into the forecast period of 2024 to 2032, companies are expected to further integrate AI and machine learning, not just for maintenance but also for features such as wine recommendation based on user preferences or even external factors like weather.