TABLE 1 Global Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 2 Global Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 3 Global Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 4 Global Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 5 North America Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 6 North America Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 7 North America Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 8 North America Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 9 U.S. Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 10 U.S. Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 11 U.S. Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 12 U.S. Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 13 Canada Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 14 Canada Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 15 Canada Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 16 Canada Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 17 Rest of North America Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 18 Rest of North America Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 19 Rest of North America Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 20 Rest of North America Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 21 UK and European Union Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 22 UK and European Union Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 23 UK and European Union Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 24 UK and European Union Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 25 UK Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 26 UK Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 27 UK Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 28 UK Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 29 Germany Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 30 Germany Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 31 Germany Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 32 Germany Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 33 Spain Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 34 Spain Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 35 Spain Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 36 Spain Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 37 Italy Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 38 Italy Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 39 Italy Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 40 Italy Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 41 France Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 42 France Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 43 France Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 44 France Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 45 Rest of Europe Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 46 Rest of Europe Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 47 Rest of Europe Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 48 Rest of Europe Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 49 Asia Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 50 Asia Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 51 Asia Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 52 Asia Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 53 China Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 54 China Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 55 China Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 56 China Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 57 Japan Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 58 Japan Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 59 Japan Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 60 Japan Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 61 India Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 62 India Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 63 India Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 64 India Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 65 Australia Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 66 Australia Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 67 Australia Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 68 Australia Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 69 South Korea Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 70 South Korea Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 71 South Korea Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 72 South Korea Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 73 Latin America Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 74 Latin America Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 75 Latin America Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 76 Latin America Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 77 Brazil Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 78 Brazil Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 79 Brazil Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 80 Brazil Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 81 Mexico Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 82 Mexico Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 83 Mexico Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 84 Mexico Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 85 Rest of Latin America Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 86 Rest of Latin America Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 87 Rest of Latin America Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 88 Rest of Latin America Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 89 Middle East and Africa Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 90 Middle East and Africa Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 91 Middle East and Africa Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 92 Middle East and Africa Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 93 GCC Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 94 GCC Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 95 GCC Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 96 GCC Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 97 South Africa Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 98 South Africa Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 99 South Africa Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 100 South Africa Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 101 North Africa Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 102 North Africa Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 103 North Africa Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 104 North Africa Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 105 Turkey Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 106 Turkey Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 107 Turkey Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 108 Turkey Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

TABLE 109 Rest of Middle East and Africa Refillable Deodorants Market By Type, 2022-2032, USD (Million)

TABLE 110 Rest of Middle East and Africa Refillable Deodorants Market By Packaging, 2022-2032, USD (Million)

TABLE 111 Rest of Middle East and Africa Refillable Deodorants Market By Distribution Channel, 2022-2032, USD (Million)

TABLE 112 Rest of Middle East and Africa Refillable Deodorants Market By Offline, 2022-2032, USD (Million)

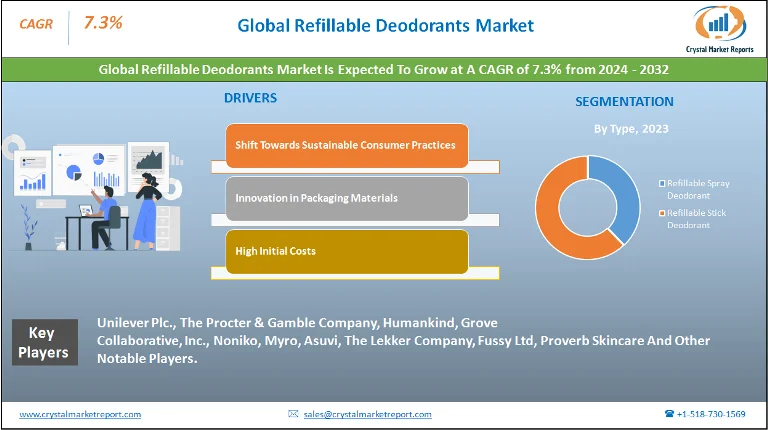

Market Overview

The refillable deodorants market encapsulates a paradigm shift from traditional single-use deodorants to more sustainable, environmentally-friendly alternatives. In essence, refillable deodorants are reusable containers where consumers can replace the deodorant stick once exhausted, rather than discarding the entire package. This reduces plastic waste and promotes circular economy principles. The refillable deodorants market is estimated to grow at a CAGR of 7.3% from 2024 to 2032.

Refillable Deodorants Market Dynamics

Driver: Shift Towards Sustainable Consumer Practices

A potent driver propelling the refillable deodorants market is the intensifying consumer demand for sustainable products. An increasing percentage of the global populace is becoming more environmentally conscious, leading them to opt for eco-friendly products. This behavioral shift stems from an escalating awareness about the detrimental environmental impacts of single-use plastics. Several oceanic expeditions, captured by mainstream media, have highlighted islands of plastic waste affecting marine life. Moreover, reports from non-profit environmental organizations have amplified the discourse around plastic pollution. This wealth of information, readily available on digital platforms, has galvanized consumers into prioritizing sustainability. For instance, in 2020, a study by the Environmental Journal revealed that approximately 90% of sampled sea water contained microplastic particles, a consequence of plastic waste degradation. Such concrete evidence underpins consumers' desire for sustainable deodorant solutions.

Opportunity: Innovation in Packaging Materials

An immense opportunity lies in innovating packaging materials. As the refillable deodorants market grows, brands are increasingly looking for materials that are not only durable but also environmentally benign. A trend that's gathering momentum is the utilization of bioplastics or plant-derived polymers. An article published in the Material Science Review in 2021 showcased a case study of a startup leveraging algae-based polymers for deodorant containers, which not only ensures durability but is also compostable. This fusion of innovative material science with sustainability offers avenues for brands to differentiate themselves and capture market share.

Restraint: High Initial Costs

On the restraint front, the higher initial cost associated with refillable deodorants can be a deterring factor for some consumers. Producing sturdy, long-lasting containers demands better quality materials, intricate design, and sometimes, advanced manufacturing processes. This can translate to elevated costs when compared to traditional deodorants. In developing nations, where purchasing power is limited, consumers might prioritize affordability over sustainability. A report in the Economic Times in late 2021 highlighted this very dichotomy, where, in a surveyed group of consumers in Southeast Asia, nearly 60% expressed reluctance to invest in refillable deodorants citing cost concerns.

Challenge: Consumer Adaptation and Behavior

One significant challenge confronting the refillable deodorants market is the inertia associated with consumer behavior. For decades, single-use deodorants have been the norm, and a vast majority of consumers are habituated to this mode of consumption. Transitioning consumers to a refill-based model demands not only educating them about environmental benefits but also ensuring convenience. A feature in Consumer Behavior Weekly in 2023 discussed the psychological barriers to adopting sustainable practices, emphasizing the role of habit and the perceived inconvenience of refills.

Market Segmentation by Type

In 2023, Refillable Stick Deodorant reigned supreme in terms of revenue, attributable to its widespread acceptance and application across various demographics. Historically, stick deodorants have been favored by consumers for their ease of application and less wet texture compared to sprays. An article from Cosmetic Weekly in 2023 highlighted that approximately 65% of the global sales in the refillable deodorant market were captured by the stick variant. Conversely, Refillable Spray Deodorant is poised to witness the highest CAGR from 2024 to 2032. The anticipated growth is underpinned by the increasing demand for convenient and quick-drying solutions, especially in tropical and humid regions where swift evaporation of the deodorant is beneficial.

Market Segmentation by Packaging

When dissected by packaging, Metal and Plastic containers were the forerunners in terms of revenue in 2023. Metal, with its premium appeal, durability, and recyclability, was a favored choice for many premium brands. Eco Packaging Digest in 2023 reported that nearly 45% of refillable deodorants were encased in metal containers. However, Plastic, especially bio-derived and recycled variants, is projected to see the highest CAGR through the forecast period. The growth is a testimony to continuous innovation in sustainable plastic solutions that marry durability with environmental responsibility. Glass, Paper, and other niche materials like Recycled Paper and Recycled Plastic did find their niche, especially in the artisanal and indie brand segment, but their overall market share was modest in comparison.

Market Segmentation by Region

Geographically, Europe was the stalwart in 2023, accounting for the highest revenue percentage in the refillable deodorants market. The European consumer's heightened environmental awareness, stringent regulations around packaging waste, and a robust presence of sustainable brands contributed to this dominance. An article in the European Retail Gazette in late 2023 elucidated on this trend, noting that 40% of European consumers actively sought out refillable personal care solutions. However, the Asia-Pacific region, with burgeoning economies and an evolving consumer base, is expected to manifest the highest CAGR from 2024 to 2032. The rapid urbanization, increasing disposable incomes, and a surge in eco-consciousness among millennials and Gen Z are the catalysts for this anticipated growth.

Competitive Trends

On the competitive front, 2023 witnessed a tapestry of brands, both legacy and startups, vying for a piece of the refillable deodorant pie. Renowned players like Unilever Plc., The Procter & Gamble Company, Humankind, Grove Collaborative, Inc., Noniko, Myro, Asuvi, The Lekker Company, Fussy Ltd, and Proverb Skincare, leveraging their extensive distribution networks and brand equity, were pivotal in mainstreaming the refillable deodorant narrative. However, indie brands and startups, with their nimbleness, innovative formulations, and avant-garde packaging solutions, provided stiff competition. A predominant strategy observed was collaboration with eco-activists and influencers to bolster brand authenticity and resonance. Another recurrent theme was investment in R&D, especially around sustainable materials and long-lasting deodorant formulations.