TABLE 1 Global Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 2 Global Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 3 Global Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 4 North America Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 5 North America Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 6 North America Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 7 U.S. Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 8 U.S. Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 9 U.S. Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 10 Canada Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 11 Canada Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 12 Canada Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 13 Rest of North America Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 14 Rest of North America Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 15 Rest of North America Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 16 UK and European Union Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 17 UK and European Union Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 18 UK and European Union Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 19 UK Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 20 UK Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 21 UK Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 22 Germany Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 23 Germany Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 24 Germany Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 25 Spain Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 26 Spain Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 27 Spain Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 28 Italy Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 29 Italy Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 30 Italy Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 31 France Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 32 France Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 33 France Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 37 Asia Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 38 Asia Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 39 Asia Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 40 China Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 41 China Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 42 China Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 43 Japan Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 44 Japan Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 45 Japan Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 46 India Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 47 India Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 48 India Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 49 Australia Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 50 Australia Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 51 Australia Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 52 South Korea Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 53 South Korea Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 54 South Korea Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 55 Latin America Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 56 Latin America Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 57 Latin America Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 58 Brazil Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 59 Brazil Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 60 Brazil Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 61 Mexico Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 62 Mexico Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 63 Mexico Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 70 GCC Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 71 GCC Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 72 GCC Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 73 South Africa Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 74 South Africa Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 75 South Africa Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 76 North Africa Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 77 North Africa Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 78 North Africa Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 79 Turkey Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 80 Turkey Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 81 Turkey Rail Gangway Market By Train Type, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Rail Gangway Market By Product, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Rail Gangway Market By Material Type, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Rail Gangway Market By Train Type, 2022-2032, USD (Million)

Market Overview

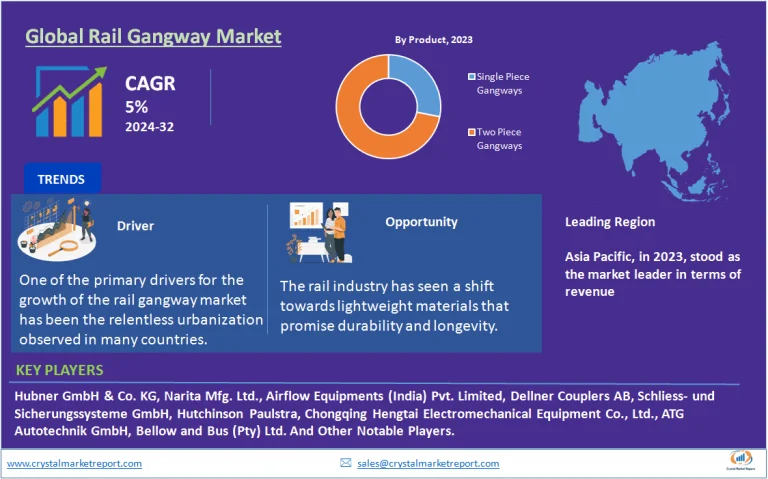

The rail gangway market refers to the global industry associated with the production, distribution, and application of gangways that connect two rail cars, allowing for safe movement of passengers or transit personnel. These gangways, pivotal for inter-car mobility, often serve as critical components for ensuring safety and operational flexibility in rail transportation. As urbanization intensifies and public transportation systems expand, the demand for reliable rail gangway systems has escalated. The rail gangway market is estimated to grow at a CAGR of 5% from 2024 to 2032.

Rail gangway market Dynamics

Driver: Urbanization and Expanding Metro Networks

One of the primary drivers for the growth of the rail gangway market has been the relentless urbanization observed in many countries. According to the United Nations' records, 55% of the world's population resided in urban areas in 2018. This figure was expected to climb to 68% by 2050. As cities grow and become more densely populated, the need for efficient public transport systems becomes evident.In response to this urban influx, numerous cities worldwide have either initiated or expanded their metro rail projects. For instance, Delhi Metro, serving India's capital, saw its inception in the 2000s and has since grown exponentially in terms of its network reach. Such expansion necessitates the procurement of more rail cars and, consequently, rail gangways.Governments and transportation authorities, in recognizing the potential hazards of rail transit, have imposed stringent safety regulations on train operators. These regulations often mandate the inclusion of high-quality gangways to minimize risks associated with inter-car transitions.

Opportunity: Technological Advancements in Gangway Systems

The rail industry has seen a shift towards lightweight materials that promise durability and longevity. Aluminum and reinforced composites, known for their strength-to-weight ratios, have become popular choices for gangway construction. The adoption of such materials not only enhances the operational life of gangways but also contributes to energy savings due to reduced train weights. Modern train designs prioritize aesthetics and functionality. Gangway manufacturers are exploring designs that integrate seamlessly with train exteriors, offering not only safe passage but also a visual continuity that's appealing to the eye.

Restraint: High Initial Investment

While rail networks present long-term solutions to urban transit challenges, their initial setup and expansion costs are considerable. Gangways, being specialized components, contribute to this financial burden. Especially for developing economies, where budget constraints are pronounced, the high costs associated with state-of-the-art gangway systems can deter their adoption.

Challenge: Maintaining Operational Efficiency in Diverse Conditions

Rail systems often traverse varied terrains and climates. From the icy conditions of Moscow to the tropical humidity of Singapore, gangways must withstand diverse environmental challenges. Ensuring their operational efficiency and safety in such varied conditions is a significant challenge for manufacturers. Given that these gangways are in constant motion when the train is operational, wear and tear are inevitable. Ensuring that these gangways remain functional and safe amidst this constant use is an ongoing challenge.

Market Segmentation by Product

In 2023, Single Piece Gangways dominated in terms of revenue, driven by their widespread application in many metropolitan rail systems owing to their inherent structural simplicity and ease of maintenance. However, during the forecast period of 2024 to 2032, Two Piece Gangways are expected to exhibit a higher CAGR. This can be attributed to the increasing demand for flexibility in rail systems, especially for longer trains, where the need for advanced mobility and flexibility between rail cars becomes crucial. With modern train designs aiming to provide more passenger space and less restrictive movement, Two Piece Gangways are positioned to see a surge in adoption.

Market Segmentation by Material Type

Diving into the materials employed in gangway manufacturing, Steel has been traditionally preferred, and in 2023, it accounted for the highest revenue share in the market. Renowned for its durability and strength, steel provides the robustness required for the safety-intensive application of gangways. Nevertheless, as environmental concerns and energy efficiency become central to rail operation considerations, Aluminum and Composites are gaining traction. Expected to manifest the highest CAGR between 2024 and 2032, Aluminum, with its lightweight properties, promises fuel efficiency. Similarly, Composites, known for their resistance to environmental factors and reduced weight, are also witnessing increasing adoption. Alloys, while still in the game, are navigating a competitive landscape where the balance between weight, durability, and cost is pivotal.

Market Segmentation by Region

Geographically, the Asia-Pacific region emerged as the highest revenue-contributing segment in 2023. With sprawling urban centers and massive investments in public transport systems, countries like China, India, and Japan have been significant demand drivers. Europe, with its established rail networks, followed closely. However, looking ahead from 2024 to 2032, Africa is poised to record the highest CAGR. African nations, with expanding urban centers and growing investments in public transport infrastructure, present lucrative opportunities for the rail gangway market. Yet, in terms of revenue, the Asia-Pacific region is anticipated to maintain its dominance, fueled by continuous expansion projects and upgrades in existing rail systems.

Competitive Landscape

2023 witnessed a few key players, such as Hubner GmbH & Co. KG, Narita Mfg. Ltd., Airflow Equipments (India) Pvt. Limited, Dellner Couplers AB, Schliess- und Sicherungssysteme GmbH, Hutchinson Paulstra, Chongqing Hengtai Electromechanical Equipment Co., Ltd., ATG Autotechnik GmbH, and Bellow and Bus (Pty) Ltd. market. Strategies embraced by these front-runners included mergers, acquisitions, and collaborations to expand their footprints and research and development to introduce innovative, more efficient gangway systems. The trend of collaboration and consolidation, with companies aiming to harness complementary strengths, is expected to remain prevalent from 2024 to 2032. Furthermore, as sustainability becomes a dominant theme, companies investing in green technologies and materials that reduce the environmental footprint of rail systems will likely gain a competitive edge.