Market Overview

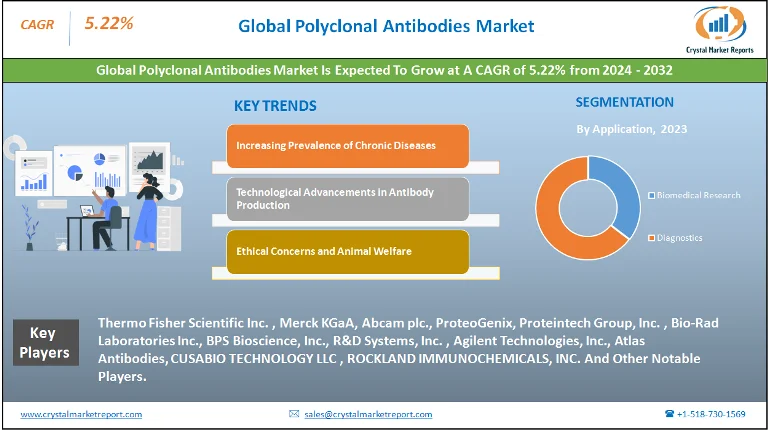

Polyclonal antibodies (pAbs) are a mixture of heterogeneous molecules produced by different B cell populations in the body. Derived from multiple immune cells, these antibodies recognize and can bind to many different epitopes of a single antigen, making them an invaluable tool in various research, diagnostic, and therapeutic applications. The polyclonal antibodies market is estimated to grow at a CAGR of 5.22% from 2024 to 2032. The Polyclonal Antibodies Market has witnessed substantial growth over the past few years. They have been extensively used in molecular biology applications, including enzyme-linked immunosorbent assays (ELISA), immunoprecipitation, immunohistochemistry, and western blotting. Their wide range of recognition and binding capabilities has driven their demand in varied sectors of biomedicine and research.

Polyclonal Antibodies Market Dynamics

Driver: Increasing Prevalence of Chronic Diseases

Chronic diseases, such as cancer, diabetes, and autoimmune disorders, have been on the rise globally. Polyclonal antibodies play a critical role in understanding the pathology of these diseases, aiding in early detection and treatment strategies. The Global Burden of Disease Study reported a sharp rise in chronic diseases, especially in developing nations. This increase, in turn, has ramped up the need for research tools, where pAbs serve as a cornerstone for innovative diagnostics and therapeutic approaches. A study published in "The Lancet" highlighted the escalating prevalence of chronic conditions, especially in low and middle-income countries. As these nations become more industrialized and urbanized, lifestyle changes have led to an increased incidence of diseases like cancer and heart disorders. This surge in chronic illnesses necessitates more robust research and diagnostics tools, underpinning the crucial role of polyclonal antibodies in the medical realm.

Opportunity: Technological Advancements in Antibody Production

The evolving landscape of biotechnology has presented new methodologies for the production and purification of antibodies. Enhanced techniques like recombinant antibody technology offer precise and rapid production of pAbs. The modernization of these processes not only ensures higher yields but also guarantees better specificity and reduced batch-to-batch variability. A review in the "Journal of Immunological Methods" discussed the leaps in technological advancements in polyclonal antibody production. Techniques like phage display and hybridoma technology have streamlined the production, reducing costs and enhancing the efficacy of the resultant antibodies.

Restraint: Ethical Concerns and Animal Welfare

The production of polyclonal antibodies traditionally involves the immunization of animals. Concerns regarding animal welfare, coupled with stringent regulations, might impede the growth of the pAbs market. Animal rights activists and organizations have been increasingly vocal about the ethical considerations of using animals for antibody production. A report by the World Health Organization (WHO) touched upon the ethical implications of using animals in research, specifically pointing out the need for humane treatment and the exploration of alternatives to animal-derived antibodies. The report emphasized the "Three Rs" - Replacement, Reduction, and Refinement, pushing for methods that reduce animal use in scientific research.

Challenge: Batch-to-Batch Variability

One of the inherent challenges with polyclonal antibodies is the variability between batches. Since they are produced by different B cell populations, the resultant antibody mixture can differ from one batch to another. This variability can affect the reproducibility of research results and diagnostics, making it imperative for researchers to account for these differences. An article in "Nature Methods" underscored the issue of reproducibility in research due to the batch-to-batch variability of polyclonal antibodies. The article highlighted the need for better quality control and standardization in pAbs production to ensure consistent results across different experiments and applications.

Market Segmentation by Product

In 2023, Primary Antibodies garnered the highest revenue. Their direct interaction with specific target antigens in various applications makes them indispensable. Moreover, they're fundamental for any immunodetection process, resulting in their widespread adoption in laboratories and research institutions. Secondary Antibodies, on the other hand, displayed the Highest CAGR. Their ability to bind to primary antibodies enhances signal detection in numerous applications, making them pivotal in assays like ELISA and western blotting. As researchers continually seek amplified and accurate results, the demand for secondary antibodies, especially those conjugated with enzymes or fluorescent dyes, surged. Hence, while Primary Antibodies led in terms of revenue due to their foundational role, the flexibility and enhancing ability of Secondary Antibodies fuelled their growth rate.

Market Segmentation by Application

Diagnostics emerged as the segment with the highest revenue in 2023. Given the surge in chronic illnesses and the pressing need for early disease detection, polyclonal antibodies became crucial in diagnostic setups, from hospitals to point-of-care centers. Their pivotal role in ELISAs, a popular diagnostic tool, further buttressed their standing. Biomedical Research, however, is poised to grow at the highest CAGR from 2024 to 2032. With burgeoning investments in drug discovery and the increasing complexity of biomedical research, polyclonal antibodies, known for their multipoint recognition, are expected to be in greater demand. Their versatility offers researchers a broader spectrum of analysis, making them invaluable in experimental setups.

Market Segmentation by Region

In terms of geography, North America was the frontrunner in 2023 in both revenue generation and research advancements. The region's robust healthcare infrastructure, coupled with its thriving biomedical research community, underpinned its dominance. Europe followed closely, buoyed by its stringent regulatory framework that demands high-quality diagnostic tools, where pAbs play a key role. However, the Asia-Pacific region is anticipated to witness the highest CAGR from 2024 to 2032. With emerging economies, increasing healthcare expenditure, and the rapid expansion of research institutions, the demand for polyclonal antibodies in this region is expected to skyrocket. While North America and Europe have established strongholds, Asia-Pacific is the market to watch for the highest growth trajectory in the coming decade.

Competitive Trends

Major players in 2023 included companies like Thermo Fisher Scientific Inc. , Merck KGaA, Abcam plc., ProteoGenix, Proteintech Group, Inc. , Bio-Rad Laboratories Inc., BPS Bioscience, Inc., R&D Systems, Inc. , Agilent Technologies, Inc., Atlas Antibodies, CUSABIO TECHNOLOGY LLC , and ROCKLAND IMMUNOCHEMICALS, INC.. Their strategies revolved around aggressive R&D investments, especially in recombinant antibody technologies, aiming for better specificity and reduced batch variability. Collaborations and mergers were also rampant, as companies sought to consolidate their market positions and expand their product portfolios. Moving forward, from 2024 to 2032, it's expected that players will lean more into technological innovations, seeking alternatives to animal-derived antibodies and embracing technologies that promise consistency across batches. Companies are also likely to penetrate deeper into emerging markets, capitalizing on the untapped potential, especially in the Asia-Pacific region.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.