TABLE 1 Global Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 2 Global Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 3 Global Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 4 North America Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 5 North America Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 6 North America Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 7 U.S. Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 8 U.S. Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 9 U.S. Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 10 Canada Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 11 Canada Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 12 Canada Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 13 Rest of North America Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 14 Rest of North America Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 15 Rest of North America Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 16 UK and European Union Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 17 UK and European Union Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 18 UK and European Union Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 19 UK Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 20 UK Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 21 UK Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 22 Germany Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 23 Germany Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 24 Germany Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 25 Spain Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 26 Spain Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 27 Spain Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 28 Italy Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 29 Italy Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 30 Italy Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 31 France Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 32 France Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 33 France Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 37 Asia Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 38 Asia Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 39 Asia Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 40 China Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 41 China Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 42 China Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 43 Japan Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 44 Japan Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 45 Japan Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 46 India Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 47 India Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 48 India Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 49 Australia Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 50 Australia Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 51 Australia Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 52 South Korea Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 53 South Korea Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 54 South Korea Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 55 Latin America Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 56 Latin America Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 57 Latin America Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 58 Brazil Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 59 Brazil Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 60 Brazil Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 61 Mexico Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 62 Mexico Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 63 Mexico Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 70 GCC Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 71 GCC Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 72 GCC Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 73 South Africa Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 74 South Africa Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 75 South Africa Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 76 North Africa Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 77 North Africa Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 78 North Africa Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 79 Turkey Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 80 Turkey Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 81 Turkey Plating On Plastics Market By Application, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Plating On Plastics Market By Plating Type, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Plating On Plastics Market By Base Material, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Plating On Plastics Market By Application, 2022-2032, USD (Million)

Market Overview

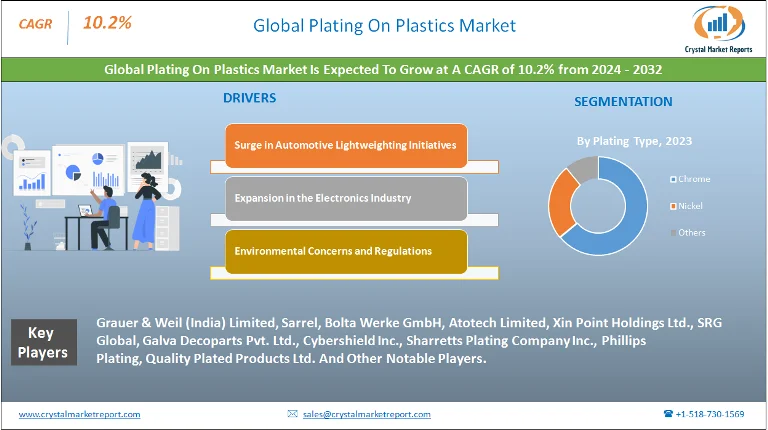

The plating on plastics (PoP) market signifies the process wherein metal coatings are applied to plastic substrates to improve their aesthetic appeal, surface conductivity, wear resistance, and corrosion protection. Over recent years, this process has gained remarkable attention, predominantly in industries like automotive, electronics, and consumer goods. The plating on plastics market is estimated to grow at a CAGR of 10.2% from 2024 to 2032. As industries continue to seek durable, lightweight, and cost-efficient solutions, the adoption of plated plastics has risen significantly.

Plating On Plastics Market Dynamics

Driver: Surge in Automotive Lightweighting Initiatives

The automotive sector, in its quest to enhance fuel efficiency and reduce carbon emissions, has been shifting towards lightweight materials. Metal components traditionally utilized are being substituted by plastic components, which are then plated for improved resilience and aesthetics. An article in "Automotive World" highlighted the positive correlation between vehicle weight reduction and fuel efficiency. The article pointed out that for every 10% reduction in weight, there's a 5-7% increase in fuel efficiency. With global carbon emission standards becoming more stringent, the automotive sector's dependency on lightweight materials, like plated plastics, is evident.

Opportunity: Expansion in the Electronics Industry

The consumer electronics market, with its ever-evolving demand for sleek designs combined with functionality, presents a burgeoning opportunity for PoP. Mobile devices, laptops, and wearables are continually being innovated to be slimmer yet robust. A report from the "Consumer Electronics Association" stated that the demand for consumer electronics is projected to grow by 7% annually, with devices becoming more compact and integrated. This uptick is directly proportional to the need for lightweight components, like plated plastics, which not only enhance the product's aesthetic but also its performance.

Restraint: Environmental Concerns and Regulations

While PoP offers multiple advantages, it also brings forth environmental concerns. The plating process often utilizes chemicals like hexavalent chromium, nickel, and cyanide, which are harmful to the environment. In Europe, the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulations have imposed restrictions on the use of certain chemicals in plating processes. The U.S. Environmental Protection Agency (EPA) also has guidelines concerning the discharge of pollutants from plating operations. These regulations, while necessary for environmental protection, act as a restraint for the PoP market, pushing companies to seek eco-friendly alternatives or face compliance challenges.

Challenge: Adhesion Issues on Plastic Substrates

One of the primary technical challenges faced in the PoP market is ensuring proper adhesion of the metal layer to the plastic substrate. Factors like the type of plastic, surface treatment, and plating process all play crucial roles in determining the quality of adhesion. Any oversight can lead to peeling or delamination, thereby compromising the component's integrity. "Plastics Technology Magazine" highlighted a case study where a major electronics brand faced recalls due to poor adhesion in its plated plastic components, leading to functionality issues. Such incidents underscore the need for rigorous quality control and R&D in the PoP process.

Market Segmentation by Plating Type

In terms of plating type, the market is segmented into Chrome, Nickel, and Others. Chrome plating historically dominated the revenue charts, given its widespread application, especially in the automotive sector for decorative purposes and corrosion resistance. In 2023, the Chrome segment constituted the highest revenue in the PoP market, thanks to its aesthetic appeal and durability. However, the Nickel plating segment is witnessing the highest Compound Annual Growth Rate (CAGR). This surge can be attributed to its increasing adoption due to its non-corrosive nature, and the fact that it's often used as a base layer for chrome plating to enhance adhesion. Other plating types, including copper and zinc, have also seen traction, especially in niche applications, but their market share remains comparatively lower.

Market Segmentation by Application

By application, the market comprises Automotive, Building & Construction, Electrical & Electronics, and Others. The automotive sector held the lion's share of revenue in 2023. The reasons for this dominance stem from the industry's consistent demand for aesthetically appealing, lightweight, and corrosion-resistant components, especially in luxury vehicles. Nevertheless, the Electrical & Electronics sector is projected to grow at the most rapid CAGR from 2024 to 2032. This growth is forecasted because of the surging demand for compact, durable, and efficient electronics, including smartphones, wearables, and IoT devices.

Market Segmentation by Region

From a geographic standpoint, the Asia-Pacific region held the highest revenue percentage in 2023. This domination is credited to the booming automotive and electronics industries, particularly in economies like China, Japan, and South Korea. Rapid industrialization, coupled with a vast consumer base, further cements the region's leading position. However, Europe is anticipated to register the highest CAGR in the forecast period, driven by stringent environmental regulations promoting the adoption of safer and eco-friendly plating alternatives.

Competitive Landscape

The PoP market in 2023 was marked by several strategic moves by top players. Companies such as Grauer & Weil (India) Limited, Sarrel, Bolta Werke GmbH, Atotech Limited, Xin Point Holdings Ltd., SRG Global, Galva Decoparts Pvt. Ltd., Cybershield Inc., Sharretts Plating Company Inc., Phillips Plating, and Quality Plated Products Ltd. had a significant market presence. They often engaged in mergers, acquisitions, and R&D initiatives to enhance their market position. For instance, in 2023, Atotech introduced an eco-friendly chrome plating alternative, aligning with European regulations. As we gaze into the forecast period from 2024 to 2032, we expect top players to increasingly invest in sustainable solutions, tap into emerging markets, and strengthen their global supply chains.