Market Overview

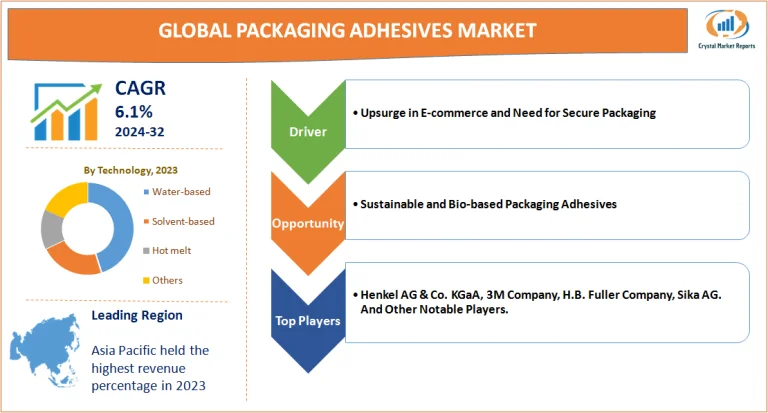

The packaging adhesives market encapsulates a spectrum of adhesive materials specifically designed and formulated for sealing, bonding, and securing various packaging solutions, ranging from boxes to flexible pouches, labels, and tapes. This market's growth trajectory intertwines with the larger global packaging sector, reflecting the ever-evolving needs of various industries, including food and beverage, pharmaceuticals, electronics, and more. The packaging adhesives market is estimated to grow at a CAGR of 6.1% from 2024 to 2032.

Packaging Adhesives Market Dynamics

Driver: Upsurge in E-commerce and Need for Secure Packaging

A pronounced driver propelling the Packaging Adhesives market is the meteoric rise in e-commerce activities. As online shopping becomes an ingrained consumer behavior, the need for robust, secure, and efficient packaging solutions escalates. Packaging adhesives play a quintessential role in ensuring that products reach consumers in pristine condition. Major e-commerce giants like Amazon and Alibaba reported significant surges in their parcel deliveries in 2023. A white paper released by an international packaging consortium highlighted that over 85% of e-commerce vendors emphasized the importance of superior adhesive solutions in ensuring customer satisfaction and minimizing product returns due to packaging damages.

Opportunity: Sustainable and Bio-based Packaging Adhesives

With the global narrative pivoting towards sustainability, the packaging industry isn't immune. This shift presents a golden opportunity for the development and integration of sustainable, bio-based packaging adhesives. These environmentally-friendly solutions, derived from renewable resources, cater to both regulatory demands and the evolving preferences of eco-conscious consumers. In 2023, a European packaging summit unveiled that more than 50% of brand owners are actively seeking or have already integrated sustainable adhesive solutions into their packaging lines, with the intent to reduce the carbon footprint and appeal to the growing tribe of green consumers.

Restraint: Volatility in Raw Material Prices

The packaging adhesives market, despite its promising trajectory, faces the challenge of volatile raw material prices. Petrochemical-based adhesives, which form a significant market share, are particularly susceptible to fluctuations in crude oil prices. The 2023 Petrochemicals Digest indicated a 15% year-on-year price fluctuation for adhesive raw materials, leading to inconsistent cost structures for adhesive manufacturers. Several adhesive manufacturers in the Asia-Pacific region, in their annual reports, cited this volatility as a primary factor affecting their pricing strategies and profit margins.

Challenge: Stringent Regulatory Frameworks and Compliance

As packaging adhesives often come into indirect or direct contact with consumables, especially in the food and beverage sector, they're under the microscope of regulatory bodies. Complying with a mosaic of global and regional regulations, ensuring that adhesives are non-toxic, and meeting other safety standards becomes a challenging terrain for manufacturers to navigate. In 2023, a well-known adhesive brand faced a recall in the EU market due to non-compliance with specific safety norms for food packaging. Such instances not only entail financial repercussions but also potential brand image dilution, emphasizing the challenge's gravity.

Technology Insights

When delving deeper into the Packaging Adhesives market based on technology, the market can be segmented into Water-based, Solvent-based, Hot melt, and Others. In 2023, Water-based adhesives emerged as the dominant segment in terms of revenue. These adhesives, celebrated for their non-toxicity, low volatile organic compound (VOC) emissions, and ease of use, found substantial adoption, especially in the food & beverage and pharmaceutical packaging sectors. Their eco-friendly attributes aligned well with the global push for sustainable packaging solutions. An industry report indicated that about 45% of global adhesive demand in the packaging sector was earmarked for water-based solutions. Conversely, the Hot melt adhesives, owing to their quick-setting nature and superior bond strength, showcased the highest CAGR. Their versatility across a range of substrates, from plastics to corrugated boxes, propels their anticipated growth from 2024 to 2032.

Application Insights

Shifting focus to application-based segmentation, Flexible packaging, Folding cartons, Boxes & cases, Labeling, and Others come into the spotlight. The year 2023 saw Flexible packaging leading the pack in revenue generation. The proliferation of e-commerce, coupled with consumer preference for lightweight, durable, and secure packaging, underpinned this segment's dominance. An internal audit from a packaging conglomerate in North America highlighted a 20% uptick in demand for flexible packaging solutions in 2023 alone. Yet, as we navigate the forecast period, Labeling is pegged to witness the highest CAGR. The importance of clear, durable, and tamper-evident labels, especially in sectors like pharmaceuticals and perishables, fuels this growth.

Regional Insights

Geographically, the packaging adhesives market showcases variegated trends. In 2023, the Asia-Pacific region, buoyed by manufacturing hubs like China, India, and Vietnam, secured the highest revenue slice. The synergy of booming e-commerce, escalating manufacturing activities, and urbanization painted the region as the adhesive demand hotspot. However, looking ahead from 2024 to 2032, the Middle East & Africa region, with its burgeoning consumer market and infrastructural investments, is poised to register the highest CAGR. Countries like Saudi Arabia and the UAE, with their vision to diversify economies and enhance the retail sector, stand as potential growth engines.

Competitive Trends

On the competitive front, the packaging adhesives landscape in 2023 was marked by the presence of stalwarts like Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, and Sika AG. Their dominance stemmed from diverse portfolios, expansive global footprints, and sustained R&D investments. For instance, Henkel's 2023 launch of a water-based adhesive line, tailored for high-speed packaging applications, exemplified innovation-driven growth. Strategies spanned across product innovations, mergers & acquisitions, and regional expansions. An overarching trend was the shift towards sustainable and bio-based adhesive solutions, with almost every major player augmenting their portfolios in this direction. As we project towards 2032, competition is expected to intensify, with sustainability, performance, and cost-effectiveness being the triad governing success.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.