Market Overview

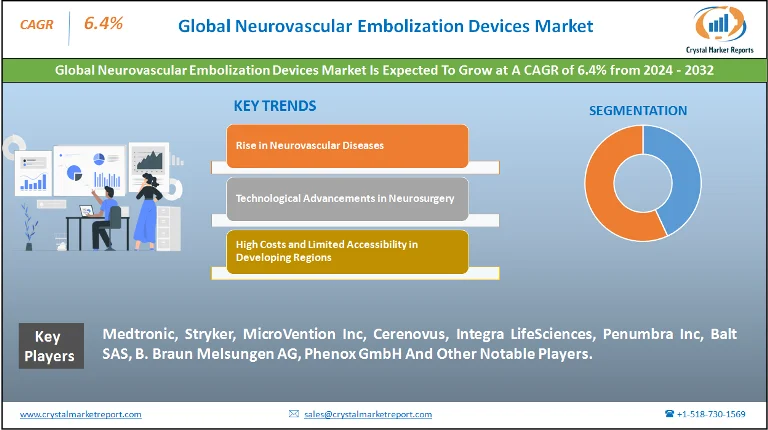

The neurovascular embolization devices market is primarily focused on specialized medical equipment used in endovascular surgeries to treat neurovascular diseases like aneurysms and arteriovenous malformations. These devices play a pivotal role in blocking blood flow to a particular area of the brain, helping reduce the risk of rupture and subsequent strokes. With an aging global population and increasing rates of neurovascular diseases, the demand for these advanced medical devices has surged. The neurovascular embolization devices market is estimated to grow at a CAGR of 6.4% from 2024 to 2032.

Neurovascular Embolization Devices Market Dynamics

Driving Force: Rise in Neurovascular Diseases

A prominent force steering the growth of the neurovascular embolization devices market is the alarming rise in neurovascular diseases globally. According to the World Health Organization, cerebrovascular diseases, which encompass conditions like strokes and aneurysms, account for 6.5 million deaths each year, making them the second leading cause of death and the third leading cause of disability. With the world witnessing an uptick in lifestyle-related diseases such as hypertension and diabetes, the incidence of neurovascular disorders has escalated. Besides, the geriatric population, naturally more susceptible to such conditions, is growing steadily. As per the United Nations, by 2050, one in six people in the world will be over age 65, up from one in 11 in 2019. This demographic shift, coupled with the increasing incidence of neurovascular diseases, underscores the dire need for effective neurovascular embolization devices.

Opportunity: Technological Advancements in Neurosurgery

Technological innovations present a lucrative opportunity in this market. As surgeries become more complex, there's a burgeoning demand for devices that offer greater precision, reduced invasiveness, and better patient outcomes. For instance, advancements in materials used for devices have enabled the creation of flexible, biocompatible coils and stents that can be more easily navigated through the intricate neurovascular system. Additionally, the integration of AI and real-time imaging has allowed for better visualization and more precise placement of these devices. Hospitals and healthcare institutions are increasingly recognizing these benefits, and there's a notable trend of them investing in cutting-edge neurosurgical equipment to bolster patient care and improve surgical success rates.

Restraint: High Costs and Limited Accessibility in Developing Regions

However, the neurovascular embolization devices market isn't without its constraints. A primary restraint is the high cost associated with these devices, and the subsequent surgeries. These advanced devices, often utilizing state-of-the-art materials and technologies, come with a hefty price tag. Furthermore, the surgeries involving these devices require specialized training and equipment, adding to the overall costs. Such expenses make these treatments inaccessible to a vast majority in low and middle-income countries. Even in developed nations, the high costs can deter individuals without comprehensive health insurance from opting for these treatments, thus limiting the market's growth potential.

Challenge: Need for Specialized Training and Risk of Complications

A significant challenge facing this market is the requisite specialized training for healthcare professionals. Utilizing neurovascular embolization devices is intricate and demands a high skill level. A slight misstep can lead to severe complications such as hemorrhage, thrombosis, or even death. While many leading medical institutions and manufacturers offer training programs, the steep learning curve remains a concern. Furthermore, post-surgical complications like coil migration or stent displacement pose risks. Although rare, when such complications arise, they can be life-threatening and significantly impact a patient's quality of life.

Market Segmentation by Product

As of 2023, Embolic Coils held a dominant share in terms of revenue. Primarily used in endovascular coiling, these devices are preferred for their minimally invasive nature, thereby reducing recovery times and hospital stays. Flow Diversion Devices, with their unique design to divert blood flow away from an aneurysm, followed closely in revenue generation. They have gained popularity due to their efficacy in treating large or giant neck aneurysms, which are often challenging to manage with traditional methods. However, Liquid Embolic Agents are anticipated to witness the highest CAGR from 2024 to 2032. These agents, when introduced into the bloodstream, solidify and block abnormal blood vessels, and their increasing applicability in a range of neurovascular conditions is driving their market demand. Aneurysm Clips, although essential in treating ruptured aneurysms, have seen a slower growth due to the surge in preference for less invasive treatments.

Market Segmentation by End-Use

Delineating the market based on end-use, Hospitals, given their infrastructure and accessibility, constituted the highest revenue share in 2023. They are often the primary choice for critical procedures due to the availability of specialized equipment and skilled professionals. Specialty Clinics, focusing on targeted treatments, are predicted to register the highest CAGR in the decade leading to 2032. Their rise can be attributed to the personalized care they offer and the rapid adoption of advanced technologies. Other facilities, including outpatient centers, held a minor market share but remain essential, especially in regions where hospital infrastructure might be sparse.

Market Segmentation by Region

From a geographical standpoint, North America, in 2023, dominated the market revenue for neurovascular embolization devices. Factors such as advanced healthcare facilities, increased awareness, and higher expenditure on healthcare played a pivotal role. However, the Asia-Pacific region is expected to outpace others in CAGR from 2024 to 2032. This expected surge is due to the amalgamation of an aging population, increasing healthcare infrastructure, and rising awareness about neurovascular diseases in countries like China and India. Europe, with its robust healthcare system, will continue to be a significant player, whereas Latin America and the Middle East & Africa, though holding smaller shares, present potential growth avenues, especially with increasing investments in healthcare.

Competitive Trends

In terms of competitive trends, the neurovascular embolization devices market, in 2023, saw a few major players steering its trajectory. Companies like Medtronic, Stryker, MicroVention Inc, Cerenovus, Integra LifeSciences, Penumbra Inc, Balt SAS, B. Braun Melsungen AG, and Phenox GmbH had set deep roots with their innovative product lines and expansive distribution networks. Their strategies often entailed research and development spurts, aiming at product innovation, and collaborations or acquisitions to expand their global footprint. As we peer into the horizon from 2024 to 2032, it's expected that these conglomerates will delve deeper into technological integration, possibly harnessing AI and real-time data analytics, to make devices more efficient and patient-friendly. Emerging players, on the other hand, will try to carve niches by addressing specific market gaps or by introducing cost-effective solutions for developing regions.