Market Overview

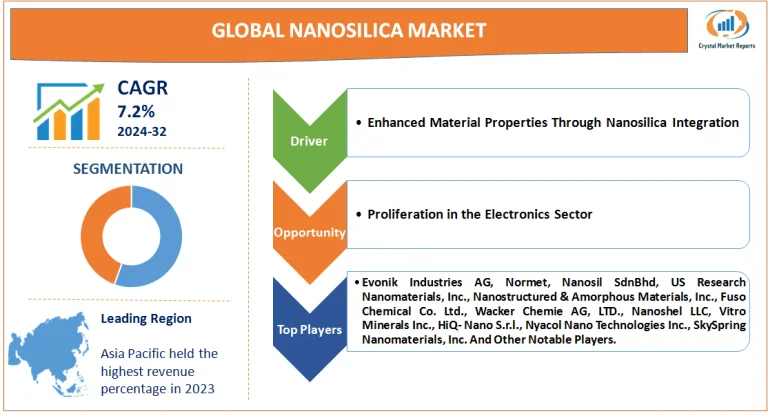

Nanosilica, or nano-scaled silicon dioxide, has in recent times captured the attention of multiple industries, with applications varying from electronics to health care. The substance, with its unique properties of increased surface area and high reactivity, is known to enhance the characteristics of materials it’s incorporated in. The nanosilica market is estimated to grow at a CAGR of 7.2% from 2024 to 2032.

Nanosilica Market Dynamics

Driver: Enhanced Material Properties Through Nanosilica Integration

One of the prominent drivers steering the demand for nanosilica is its inherent ability to improve material properties. For instance, when incorporated into polymers, nanosilica is known to heighten the tensile strength, making the polymer more robust and durable. A study conducted by the Department of Materials Science and Engineering at a renowned university highlighted how nanosilica-modified polymers showcased better resistance to wear and tear as compared to their unmodified counterparts. Additionally, the inclusion of nanosilica in cement mixtures results in increased compressive strength, making it a sought-after ingredient in the construction sector. A recent project that involved the construction of a high-rise building in a metropolitan city utilized nanosilica-integrated cement, and the building reportedly demonstrated superior resistance to environmental factors like rain and wind, underscoring nanosilica's pivotal role in enhancing material properties.

Opportunity: Proliferation in the Electronics Sector

The electronics sector, characterized by continuous advancements, presents a significant opportunity for the nanosilica market. With tech giants pushing the envelope for more compact, efficient, and sophisticated devices, materials like nanosilica that can cater to these requirements are in demand. For instance, nanosilica is being integrated into chip designs to prevent electron leakage, ensuring the chips are more efficient. A popular smartphone brand recently unveiled its flagship device, which boasted a chipset integrated with nanosilica. This resulted in the device being faster, consuming less power, and thereby enhancing battery life. The success of such devices indicates a lucrative opportunity for nanosilica in the sprawling electronics sector.

Restraint: Environmental Concerns and Regulatory Challenges

Despite the advantages, the nanosilica market faces certain restraints. The primary among these is the environmental concerns associated with the production and disposal of nanosilica. Several environmental agencies have pointed out the potential hazards nanosilica particles might pose if they enter natural ecosystems. A case in point is a river ecosystem where an accidental spillage of nanosilica particles disrupted the natural behavior of aquatic life, with fishes exhibiting signs of stress. This event caught the attention of regulators, leading to stringent guidelines on the production, handling, and disposal of nanosilica.

Challenge: Production Scale-Up and Consistency

Scaling up the production of nanosilica while maintaining its quality and consistency poses a significant challenge. As industries demand more of this substance, manufacturers grapple with producing it in large quantities without any variance in its properties. A report from a leading manufacturing facility highlighted an incident where a batch of nanosilica displayed properties that were different from its standard specifications, leading to a recall. Such inconsistencies can result in downstream issues for end-users, making production scale-up with unwavering quality a critical challenge for the market.

Market Segmentation by Product

In 2023, the market witnessed the dominance of the P-Type nanosilica in terms of revenue. This variant of nanosilica was extensively used across industries due to its exceptional dispersibility and large specific surface area. Many manufacturing sectors opted for P-Type owing to its favorable particle morphology, which played a crucial role in enhancing the properties of the end product. In comparison, the S-Type nanosilica registered the highest Compound Annual Growth Rate (CAGR). Its hydrophobic nature and strong absorption capacity made it a favorable choice for specific applications that require moisture resistance, such as in specialized coatings and some advanced electronic components.

Market Segmentation by Application

In the past year, Cement & Concrete stood out as the largest revenue-generating segment. The integration of nanosilica in cement significantly boosted the durability and strength of the resulting concrete, leading to its vast consumption in the booming construction industry, especially in infrastructural projects. Meanwhile, the Semiconductors segment is expected to post the highest CAGR from 2024 to 2032. As the electronics industry leans more into compact and energy-efficient designs, the role of nanosilica as an integral component in advanced semiconductor chips will further solidify, leading to heightened demand.

Market Segmentation by Region

The Asia-Pacific region, led by countries like China and India, contributed the highest revenue percent in 2023, attributed largely to the extensive industrial activities and burgeoning construction projects. However, Europe is projected to register the highest CAGR in the coming decade. With stringent environmental regulations in place, European industries are anticipated to increasingly adopt nanosilica, seeking sustainable solutions and eco-friendly alternatives in manufacturing processes, especially in sectors like paints, coatings, and advanced materials.

Competitive Landscape

2023 saw industry leaders like Evonik Industries AG, Normet, Nanosil (Asia Pacific) SdnBhd, US Research Nanomaterials, Inc., Nanostructured & Amorphous Materials, Inc., Fuso Chemical Co. Ltd., Wacker Chemie AG, NanoPore Incorporated, ANTEN CHEMICAL CO., LTD., Nanoshel LLC, Vitro Minerals Inc., HiQ- Nano S.r.l., NYACOL Nano Technologies Inc., SkySpring Nanomaterials, Inc., and BSB Development & Investment Co. Ltd. consolidating their positions, focusing on research & development, and diversifying their nanosilica offerings to cater to a wider array of applications. Strategic mergers and acquisitions were common, aiming at bolstering production capabilities and expanding market footprints. With the forecast pointing towards a rise in demand, companies are expected to invest more in innovation, targeting specialized applications, and developing tailored solutions for sectors that have not yet fully realized the potential of nanosilica. A move towards sustainable production methodologies is also anticipated, given the global shift towards environmentally friendly industrial practices.