TABLE 1 Global Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 2 Global Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 3 Global Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 4 North America Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 5 North America Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 6 North America Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 7 U.S. Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 8 U.S. Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 9 U.S. Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 10 Canada Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 11 Canada Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 12 Canada Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 13 Rest of North America Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 14 Rest of North America Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 15 Rest of North America Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 16 UK and European Union Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 17 UK and European Union Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 18 UK and European Union Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 19 UK Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 20 UK Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 21 UK Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 22 Germany Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 23 Germany Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 24 Germany Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 25 Spain Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 26 Spain Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 27 Spain Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 28 Italy Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 29 Italy Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 30 Italy Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 31 France Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 32 France Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 33 France Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 37 Asia Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 38 Asia Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 39 Asia Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 40 China Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 41 China Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 42 China Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 43 Japan Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 44 Japan Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 45 Japan Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 46 India Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 47 India Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 48 India Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 49 Australia Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 50 Australia Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 51 Australia Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 52 South Korea Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 53 South Korea Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 54 South Korea Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 55 Latin America Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 56 Latin America Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 57 Latin America Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 58 Brazil Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 59 Brazil Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 60 Brazil Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 61 Mexico Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 62 Mexico Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 63 Mexico Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 70 GCC Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 71 GCC Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 72 GCC Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 73 South Africa Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 74 South Africa Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 75 South Africa Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 76 North Africa Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 77 North Africa Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 78 North Africa Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 79 Turkey Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 80 Turkey Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 81 Turkey Microtube Box Market By Capacity, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Microtube Box Market By Material, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Microtube Box Market By Plastic, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Microtube Box Market By Capacity, 2022-2032, USD (Million)

Market Overview

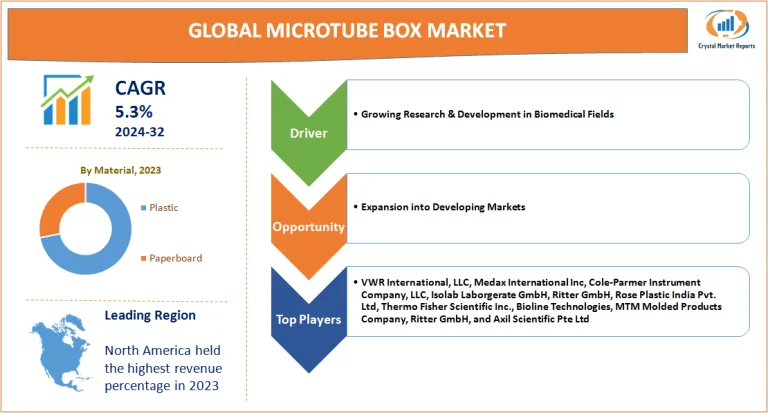

The microtube box market is a specialized sector dedicated to providing storage solutions for microtubes, which are essentially small vials used primarily in laboratories for storing samples. These boxes are quintessential in various fields such as biology, chemistry, and medical research. The microtube box market is estimated to grow at a CAGR of 5.3% from 2024 to 2032.

Microtube Box Market Dynamics

Driver: Growing Research & Development in Biomedical Fields

One significant driver for the microtube box market is the escalated growth in research and development activities in biomedical fields. The last decade has witnessed a surge in studies related to genetics, molecular biology, and medical diagnosis. This uptick has necessitated increased sample collection, subsequently driving demand for storage solutions like microtube boxes. For instance, during the development of vaccines for recent global health threats, extensive research was conducted requiring the collection and storage of countless samples. With the onset of the global health crisis in 2019-2020, many countries dramatically increased their funding for biomedical research. This influx of funds, aiming to improve health outcomes, inadvertently propelled the demand for microtube boxes.

Opportunity: Expansion into Developing Markets

A significant opportunity lies in expanding the microtube box market into developing countries. Over recent years, nations like India, Brazil, and South Africa have significantly increased their investments in scientific research and healthcare infrastructures. This expansion is indicative of the latent demand in these countries. For example, India, in its 2020 budget, increased its health expenditure by about 5%, a portion of which is allocated to biomedical research. Such moves by governments create a favorable environment for the microtube box industry to establish a strong foothold.

Restraint: Environmental Concerns and Sustainable Packaging

On the flip side, a significant restraint faced by the microtube box market is the rising environmental concerns related to plastic use. A majority of microtube boxes are made from plastic due to its durability and cost-effectiveness. However, as global awareness about plastic pollution increases, there's pressure on industries to reduce plastic usage. Notably, in 2019, the European Union passed legislation aiming to curb single-use plastics, signaling a potential challenge for markets dependent on plastic products. Such legislations could influence labs and research institutions to seek alternative storage solutions or push manufacturers to explore sustainable materials.

Challenge: Need for Advanced Storage Solutions in Cryogenic Conditions

A rising challenge in the sector is the evolving need for advanced storage solutions compatible with cryogenic conditions. As genetic and cellular research advances, the demand for storing samples at ultra-low temperatures escalates. Traditional microtube boxes might not always be optimal for these extreme conditions. This was evident during the rapid development of mRNA-based vaccines, which required storage at temperatures as low as -70°C. Such specific requirements present challenges for manufacturers to innovate and ensure their products remain relevant and functional.

Market Segmentation by Material

The market is predominantly bifurcated into Plastic and Paperboard. Historically, in 2023, Plastic held the lion’s share in terms of revenue. This dominance can be attributed to plastic's durability, cost-effectiveness, and ability to handle a broad range of temperatures, making it an ideal choice for most laboratories. On the other hand, while the paperboard segment didn't match the revenue prowess of its plastic counterpart, it registered the Highest CAGR. This surge can be linked to the increasing environmental awareness and the push towards sustainable solutions. With institutions looking to reduce their carbon footprint, paperboard-based microtube boxes are gaining traction. Innovations in paperboard materials ensuring moisture resistance and durability further fuel this growth.

Market Segmentation by Capacity

When segmented by Capacity, the categories span from Storing Up to 50 Tubes, 51 to 100 Tubes, 100 to 150 Tubes, to Storing Above 150 Tubes. Revenue-wise, the Storing 51 to 100 Tubes segment led the pack in 2023. This size is popular as it strikes a balance between compactness and storage utility, catering to a broad spectrum of laboratory needs. However, as per growth rates, the segment of Storing Above 150 Tubes is expected to witness the highest CAGR from 2024 to 2032. The rationale behind this is the burgeoning demands of large-scale research projects and commercial labs that handle massive sample sizes and prefer storage solutions maximizing capacity.

Market Segmentation by Region

Geographically, North America held the highest revenue percentage in 2023, backed by a robust research infrastructure, well-funded universities, and a plethora of private labs. Europe followed closely, buoyed by its strong pharmaceutical and biomedical research sector. However, Asia-Pacific is anticipated to register the highest CAGR from 2024 to 2032. This can be credited to the swift expansion of research facilities, rising healthcare investments, and growing academic-industry collaborations in countries like India, China, and South Korea.

Competitive Trends

In 2023, key players like VWR International, LLC, Medax International Inc, Cole-Parmer Instrument Company, LLC, Isolab Laborgerate GmbH, Ritter GmbH, Rose Plastic India Pvt. Ltd, Thermo Fisher Scientific Inc., Bioline Technologies, MTM Molded Products Company, Ritter GmbH, and Axil Scientific Pte Ltd held significant market shares, primarily owing to their advanced product offerings and extensive distribution networks. Their strategies often revolved around launching technologically advanced products and expanding their geographical footprint. As the forecast period progresses, the industry is expected to witness collaborations between manufacturers and tech firms to integrate smart features into microtube boxes. Furthermore, companies are anticipated to focus on eco-friendly materials, responding to global calls for sustainability. The rise of local manufacturers, especially in emerging economies, will further intensify competition, prompting global giants to innovate and diversify their product portfolios.