Market Overview

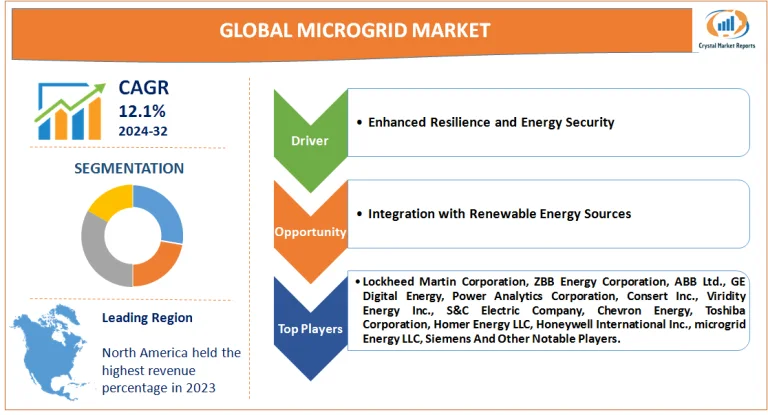

The microgrid market, a pivotal component of the broader energy industry, encapsulates systems that ensure localized energy generation and distribution, typically operating autonomously and parallelly with conventional grids. As the modern energy sector evolves rapidly, driven by technological advancements and the urgency of sustainability, the implications and opportunities in the microgrid market become profound. However, like any developing domain, it faces its unique set of challenges and constraints. The microgrid market is estimated to grow at a CAGR of 12.1% from 2024 to 2032.

Microgrid Market Dynamics

Driver: Enhanced Resilience and Energy Security

One of the most compelling drivers for the growth of the microgrid market is the demand for enhanced resilience and energy security. As climate change poses unpredictable challenges, resulting in extreme weather conditions, there have been reported instances of major blackouts in large metropolitan areas due to grid failures. A classic case in point is the blackout experienced by New York City in 2019, which left thousands without power. Microgrids, by design, offer localized energy solutions, reducing the dependence on extensive transmission networks and hence minimizing vulnerability. This decentralization not only bolsters resilience against environmental adversities but also counteracts potential infrastructural or cyber-attacks on the power grid. Given the increasing frequency of these incidents, the appeal of Microgrids has only grown more pronounced.

Opportunity: Integration with Renewable Energy Sources

The worldwide shift towards sustainability has positioned renewable energy sources like solar and wind as primary power generation methods. The microgrid market stands to benefit enormously from this transition. The decentralized nature of Microgrids means they can easily integrate with localized renewable energy setups. A small town in Texas, for instance, was reported to have successfully integrated their solar farms into a community microgrid, allowing them to not only be energy self-sufficient but also to contribute excess power back to the main grid. Such cases underscore the potential of combining microgrids with renewables, presenting a significant opportunity for market expansion.

Restraint: High Initial Investment Cost

However, the microgrid market isn't without its limitations. A major restraint facing its widespread adoption is the high initial investment cost. Setting up a microgrid involves substantial infrastructure, sophisticated control systems, and advanced software for seamless operation. A small community in Alaska aiming to establish a localized grid found the initial capital requirements to be a major hurdle, even when the long-term benefits were evident. Such significant upfront costs might deter communities, especially in economically disadvantaged regions, from investing in microgrid systems.

Challenge: Regulatory and Standardization Hurdles

The dynamic realm of the microgrid market also presents specific challenges, prominent among which are regulatory and standardization hurdles. Given the nascent nature of this industry, standardized policies and regulations are often lacking, leading to potential inefficiencies and conflicts. For instance, a community in California aiming to integrate its microgrid with the main grid faced numerous bureaucratic obstacles due to unclear regulations, delaying the project by years. Without a streamlined regulatory framework, the microgrid market might find its growth trajectory impeded.

Market Segmentation by Verticals

In 2023, the microgrid market saw diverse applications spanning across various verticals, such as the Public Sector, Healthcare, Telecom, and Manufacturing. Each of these verticals recognized the inherent benefits of Microgrids and adopted them according to their specific needs. The Public Sector, traditionally seen as the foundation of civic infrastructure, led the charge in revenue, with municipalities adopting Microgrids to ensure consistent power to critical civic utilities, thus minimizing disruptions during grid failures. Conversely, the Telecom sector, while not leading in revenue, showcased the highest Compound Annual Growth Rate (CAGR). Given the critical nature of uninterrupted telecommunication services, businesses have been investing heavily in Microgrids to prevent network downtimes, emphasizing the shift towards decentralized energy solutions.

Market Segmentation by microgrid infrastructure

Shifting our focus to the microgrid infrastructure, the market is segmented into Hardware, Software, and Services. In 2023, the Hardware segment dominated in terms of revenue. The tangible aspects of microgrid systems, including controllers, switches, and storage solutions, required substantial investment. However, the Software segment, which ensures the seamless integration and operation of Microgrids, is projected to witness the highest CAGR from 2024 to 2032. As Microgrids proliferate, there's an anticipated demand for sophisticated software solutions that can optimize power distribution, incorporate AI-driven analytics, and ensure cybersecurity.

Market SegmentationGeography

Geographically, North America, buoyed by the technological prowess of the U.S. and the drive for sustainable solutions in Canada, contributed the highest revenue percentage in 2023. With mature markets and a robust energy infrastructure, this region has been quick to integrate Microgrids into its framework. However, the Asia-Pacific region, with countries like India and China at its helm, is expected to showcase the highest CAGR between 2024 and 2032. Rapid urbanization, coupled with increasing industrial demands and a pressing need for resilient energy solutions, is set to drive the growth of Microgrids in this region.

Competitive Trends

On the competitive front, the microgrid market is graced by several key players, each with its strategic blueprint. In 2023, companies like Lockheed Martin Corporation, ZBB Energy Corporation, ABB Ltd., GE Digital Energy, Power Analytics Corporation, Consert Inc., Viridity Energy Inc., S&C Electric Company, Chevron Energy, Toshiba Corporation, Homer Energy LLC, Honeywell International Inc., microgrid Energy LLC, and Siemens were at the forefront, championing innovations in microgrid solutions. Their strategies revolved around rigorous R&D initiatives, mergers, and acquisitions, and expanding their global footprints. For instance, Siemens' acquisition of a microgrid software startup in late 2023 underlined the growing importance of software solutions in this domain. Moving forward, from 2024 to 2032, the competitive landscape is expected to be shaped by not just innovations but also collaborations. As the demand for integrated, multi-faceted microgrid systems rises, companies are expected to engage in cross-vertical collaborations, pooling expertise to cater to the diverse demands of the market.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.