Market Overview

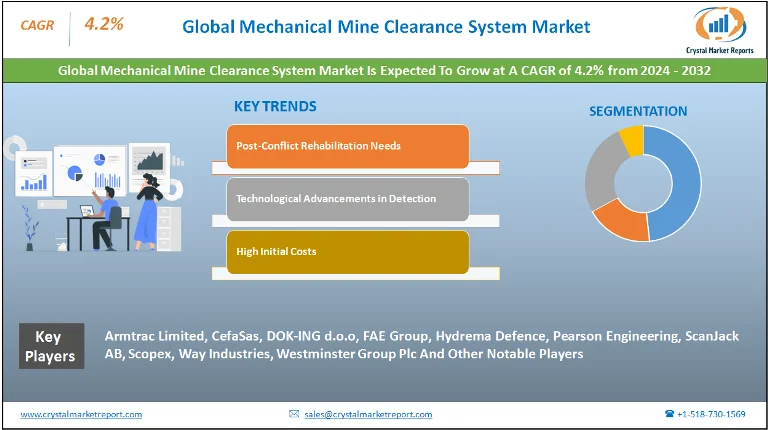

The mechanical mine clearance system market refers to the sector focusing on machinery and equipment developed to detect and clear land mines. Mechanical mine clearance systems are critical in ensuring the safety of civilians in areas previously embroiled in conflict, and they play a pivotal role in the rehabilitation of war-torn regions, allowing them to return to economic productivity. The mechanical mine clearance system market is estimated to grow at a CAGR of 4.2% from 2024 to 2032.

Mechanical Mine Clearance System Market Dynamics

Driver: Post-Conflict Rehabilitation Needs

One of the primary drivers for the growth of the mechanical mine clearance system market is the urgent need for post-conflict rehabilitation. Regions emerging from wars or internal strife often have vast tracts of land rendered unusable due to the presence of mines. The clearance of these mines is not just a safety concern but also an economic one. Farmlands, infrastructure projects, and housing areas remain inaccessible until these mines are cleared. For instance, countries like Angola and Cambodia, which have faced prolonged periods of conflict, have significant portions of their arable land still riddled with landmines. The adoption of mechanical mine clearance systems in such areas not only ensures faster rehabilitation but also reduces the risk of manual deminers facing accidents.

Opportunity: Technological Advancements in Detection

There's an emerging opportunity in the realm of technological advancements related to mine detection. With the integration of AI and machine learning, these systems can potentially become more accurate in detecting mines. Moreover, the use of drones equipped with infrared sensors and ground-penetrating radars might revolutionize the way mines are detected. An evidence of this trend is seen in the increasing investments in defense and tech startups focusing on innovative mine detection and clearance solutions. Countries and NGOs are recognizing that investing in technology will not only expedite the clearance process but also minimize human risks.

Restraint: High Initial Costs

However, a significant restraint in the market is the high initial investment required for these mechanical systems. For many countries emerging from conflict, their economies are often in shambles, and prioritizing expenditure on mine clearance, despite its evident importance, becomes challenging. These machines, being specialized, also come with maintenance costs. There have been instances where nations have had to rely on international aid or NGO support to afford these systems. The recent case of Syria, with vast territories affected by mines, showcased how dependent nations can be on external financial aid to address the mine menace.

Challenge: Varied Terrain and Mine Types

A significant challenge that persists in the market is the varied terrain and types of mines that these mechanical systems have to detect and clear. Mines are not standard; their designs, triggering mechanisms, and materials can vary, making detection a challenge. Additionally, terrains can range from dense forests, deserts, to marshy lands. Adapting machinery to such varied conditions while ensuring efficiency is a persistent challenge. For instance, in the rugged terrains of Afghanistan, many traditional mechanical mine clearance systems face operational challenges, necessitating a combination of manual and mechanical clearance methods.

Market Segmentation by Product

In 2023, the mechanical mine clearance system market witnessed robust trends across various product segments. Among products such as Flails, Rollers, Millers & Tillers, Dozers, and Others (including sifters and graders), Flails secured the highest revenue. This dominance can be attributed to the efficiency and speed of Flails in mine clearance processes, coupled with their ability to reduce the risks associated with manual mine detection. These rotating chains, when propelled, strike the ground, detonating hidden mines, thus making large areas safe within short time frames. On the other hand, the segment projected with the Highest CAGR for the forecast period of 2024 to 2032 was Millers & Tillers. These products are expected to gain prominence due to their adaptability in various terrains and their thoroughness in unearthing and detonating mines.

Market Segmentation by Category

When analyzing by Category, in 2023, the Remote Control/Robotic System held the lion's share in revenue generation. These systems, given their reduced risk to human operators and increased efficiency, have been the preferred choice for many nations and NGOs. Their ability to operate in dangerous terrains without endangering human lives has made them invaluable assets in mine clearance operations. However, from 2024 to 2032, the Manually Operated System is expected to record a higher CAGR. This rise is anticipated because of its cost-effectiveness and the increasing expertise of manual operators, especially in regions where the allocation of financial resources to acquire advanced robotic systems remains a challenge.

Market Segmentation by Region

Geographically, in 2023, the Middle East and North Africa (MENA) region contributed the highest revenue percentage in the mechanical mine clearance system market, primarily due to the prolonged conflicts in countries like Syria, Iraq, and Libya. These regions, marred by warfare, have extensive mine-laden areas that need rehabilitation. However, it is expected that from 2024 to 2032, the African region, particularly nations like Angola, Sudan, and Mozambique, will display the highest CAGR. As these nations inch towards stability and focus on economic recovery, mine clearance will be paramount, thus boosting the demand for mechanical mine clearance systems.

Competitive Trends

In terms of competitive trends, 2023 observed intense competition among leading players in the mechanical mine clearance system market. Key strategies employed by these industry titans included technological innovation, partnerships with governments and NGOs, and robust after-sales support services. Companies like Armtrac Limited, CefaSas, DOK-ING d.o.o, FAE Group, Hydrema Defence, Pearson Engineering, ScanJack AB, Scopex, Way Industries, and Westminster Group Plc, dominated the scene with their state-of-the-art products and global outreach. The emphasis was not just on product sales but also on training personnel in the operation and maintenance of these systems. Moving forward, from 2024 to 2032, it's expected that these players will further invest in R&D, seeking to introduce AI and other advanced technologies into their offerings, enhancing efficiency and safety metrics.