Market Overview

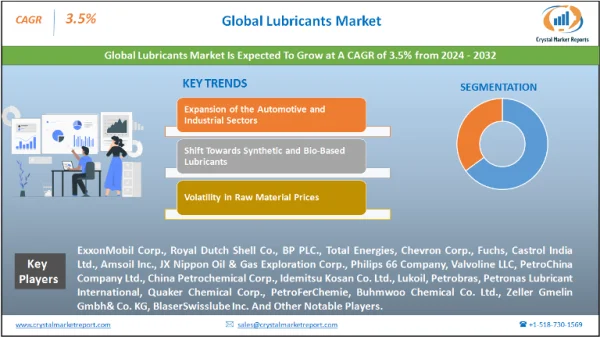

The lubricants market encompasses the production, distribution, and sale of substances used to reduce friction and wear between surfaces in mutual contact, which ultimately reduces the heat generated when the surfaces move. Lubricants are primarily used to protect machinery and equipment, ensuring smooth operational functionality and extending their lifespan. They find application across various sectors, including automotive, industrial, marine, and aviation. The lubricants market is estimated to grow at a CAGR of 3.5% from 2024 to 2032. The lubricants market is driven by factors such as the growing automotive industry, industrial expansion, and advancements in technology leading to the development of high-performance lubricants. The increasing focus on sustainability and environmental regulations is also influencing market trends, particularly boosting the demand for bio-based lubricants. The market's growth is further influenced by the rising need for energy-efficient solutions in various sectors, as well as the ongoing research and development activities aimed at improving lubricant efficiency and reducing environmental impact.

Lubricants Market Dynamics

Expansion of the Automotive and Industrial Sectors

A primary driver of the lubricants market is the expansion of the automotive and industrial sectors. The global rise in vehicle production and sales, fueled by growing economies and increasing consumer purchasing power, directly impacts the demand for automotive lubricants. For instance, the increase in automobile production in countries like China and India, where the automotive sector has seen rapid growth, leads to a corresponding rise in the need for lubricants. Additionally, the industrial sector's growth, particularly in emerging economies, contributes significantly to the lubricants market. The use of lubricants in heavy machinery, manufacturing equipment, and industrial processes is essential for the smooth operation and maintenance of machinery, driving the demand in this sector. As industries expand and modernize, the need for efficient and high-performance lubricants grows, further propelling the market.

Shift Towards Synthetic and Bio-Based Lubricants

An opportunity within the lubricants market is the shift towards synthetic and bio-based lubricants. As environmental concerns become more prominent, and regulations regarding emissions and sustainability tighten, there is a growing demand for environmentally friendly lubricants. Synthetic lubricants, known for their superior performance in extreme conditions and better environmental profiles compared to mineral oil-based lubricants, are gaining traction. Bio-based lubricants, derived from renewable resources, are witnessing increased interest due to their biodegradability and lower ecological impact. This shift presents significant opportunities for manufacturers to innovate and expand their portfolios with sustainable lubricant solutions.

Volatility in Raw Material Prices

A major restraint in the lubricants market is the volatility in raw material prices. Lubricants, particularly those derived from petroleum, are subject to fluctuations in crude oil prices. These price instabilities can significantly impact the cost of production, affecting the profitability of lubricant manufacturers. For instance, a sudden increase in oil prices can lead to higher production costs, which may not always be passed on to consumers, squeezing the manufacturers' margins. This volatility makes it challenging for companies to maintain consistent pricing and profitability, affecting market growth.

Adapting to Technological Advancements and Regulations

The lubricants market faces the challenge of adapting to rapid technological advancements and stringent regulations. As machinery and engines become more advanced, they require high-performance lubricants that can meet specific technical specifications. Keeping pace with these technological changes demands continuous research and development from lubricant manufacturers. Furthermore, the industry is subject to stringent environmental regulations aimed at reducing pollution and promoting sustainability. Complying with these evolving regulations, particularly in different regions with varying standards, requires constant adaptation and innovation, posing a significant challenge to the market.

Application Insights

In the lubricants market, segmentation by application showcases varied growth and revenue dynamics across different sectors. The automotive sector has historically been the largest contributor in terms of revenue, driven by the global increase in vehicle production and ownership. This sector's demand for lubricants stems from the need for engine oils, transmission fluids, and greases essential for vehicle maintenance and performance. The consistent growth in automotive sales, particularly in emerging economies, has sustained the high demand for automotive lubricants. On the other hand, the industrial application segment is expected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is attributable to the rapid industrialization in developing countries, where there is an increasing demand for lubricants in various industries, including manufacturing, construction, and energy. Industrial lubricants are crucial for the smooth operation of heavy machinery and equipment, and the ongoing expansion of these sectors necessitates a growing supply of these products.

Regional Insights

In the geographic segmentation of the lubricants market, distinct trends are observable across different regions. As of 2023, the Asia-Pacific region led in terms of revenue, primarily driven by rapid industrialization and growth in the automotive sector in emerging economies like China and India. The region's vast manufacturing base, coupled with increasing vehicle ownership and industrial activities, contributed significantly to the demand for lubricants. However, from 2024 to 2032, the Middle East and Africa (MEA) region is expected to exhibit the highest Compound Annual Growth Rate (CAGR). This anticipated growth can be attributed to the expanding industrial and construction activities in these regions, alongside the development of the automotive sector in countries like Saudi Arabia and the United Arab Emirates.

Competitive Landscape

In the competitive landscape, the lubricants market in 2023 was dominated by major players such as ExxonMobil Corp., Royal Dutch Shell Co., BP PLC., Total Energies, Chevron Corp., Fuchs, Castrol India Ltd., Amsoil Inc., JX Nippon Oil & Gas Exploration Corp., Philips 66 Company, Valvoline LLC, PetroChina Company Ltd., China Petrochemical Corp., Idemitsu Kosan Co. Ltd., Lukoil, Petrobras, Petronas Lubricant International, Quaker Chemical Corp., PetroFerChemie, Buhmwoo Chemical Co. Ltd., Zeller Gmelin Gmbh& Co. KG, BlaserSwisslube Inc. These companies led the market with their extensive product portfolios, strong global distribution networks, and significant investments in research and development. Their success was primarily driven by continuous innovations in lubricant technology, strategic partnerships, and expansion into emerging markets. Looking forward from 2024 to 2032, these companies are expected to maintain their dominance by focusing on the production of high-performance and environmentally friendly lubricants. This shift aligns with the global trend towards sustainability and the increasing regulatory pressures to reduce environmental impact. Additionally, these companies are likely to explore new growth opportunities in emerging markets by establishing local production and distribution facilities.