Market Overview

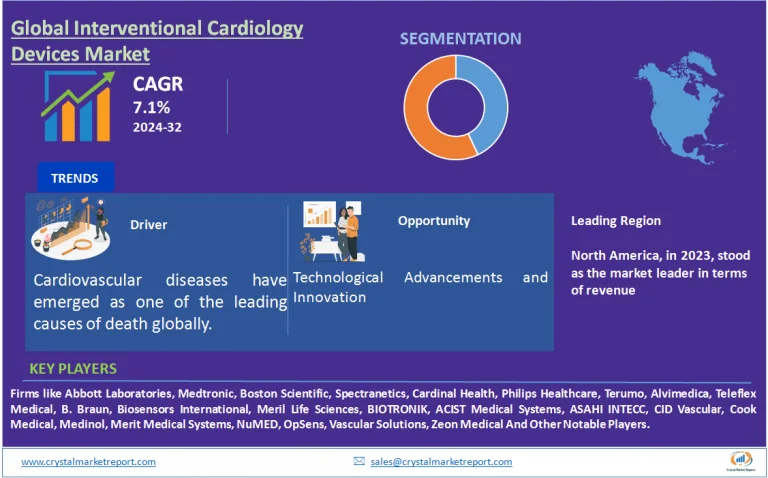

The interventional cardiology devices market pertains to medical devices designed for cardiological interventions. These devices primarily assist cardiologists in treating cardiovascular diseases (CVDs) such as coronary artery diseases, heart valve disorders, and peripheral blockages, among others, via minimally invasive techniques. The arena of interventional cardiology has seen significant advances in recent years, primarily due to the fusion of innovative technology with medical excellence. The interventional cardiology devices market is estimated to grow at a CAGR of 7.1% from 2024 to 2032. In 2023, with the global populace grappling with rising cardiovascular diseases, the emphasis on swift, effective, and minimally invasive treatments became paramount. Consequently, the demand for interventional cardiology devices, which promise better patient outcomes, quicker recovery times, and lesser hospital stays, witnessed an uptick.

Interventional Cardiology Devices Market Dynamics

Driver: Rising Incidence of Cardiovascular Diseases

Cardiovascular diseases have emerged as one of the leading causes of death globally. The World Health Organization (WHO) data highlighted that nearly 18 million people succumb to CVDs every year, which constitutes about 31% of all global deaths. The sheer magnitude of these numbers underscores the pressing need for effective treatments. Many top-tier hospitals globally reported an increase in the number of patients seeking treatments for CVDs. For instance, a leading cardiac care hospital in the U.S. observed a 20% rise in cardiovascular cases in 2023 compared to the previous year. Such statistics emphasize the escalating need for interventional cardiology devices.

Opportunity: Technological Advancements and Innovation

The past decade has been revolutionary for medical devices, with the integration of AI, robotics, and advanced materials. In the realm of interventional cardiology, devices equipped with AI-assisted imaging or those made of biocompatible materials offer precise interventions and better patient outcomes. Several groundbreaking interventional cardiology devices were introduced to the market in 2023. One such device, integrated with real-time 3D imaging, promised cardiologists an unprecedented view of the heart's anatomy during procedures, resulting in safer and more effective interventions.

Restraint: High Cost of Devices and Procedures

While interventional cardiology promises superior patient outcomes, the associated costs, both of the devices and the procedures, can be prohibitively high. These financial challenges become even more accentuated in low to middle-income countries. In a healthcare survey conducted in several developing countries, it was observed that nearly 40% of patients requiring cardiac interventions couldn't afford them due to the high costs associated with interventional cardiology devices.

Challenge: Need for Skilled Personnel and Training

Interventional cardiology devices, while advanced and efficient, require specialized skills for optimal utilization. The global disparity in the availability of trained cardiologists presents a significant challenge. Leading medical institutions, especially in regions with scarce resources, voiced concerns over the lack of trained personnel. A report from a renowned African cardiac center in 2023 highlighted that they had state-of-the-art interventional cardiology devices but faced challenges in maximizing their use due to the dearth of adequately trained cardiologists.

Product Insights

In the kaleidoscope of the interventional cardiology devices market, 2023 set the stage for pivotal shifts. When segmented by Product, the market showcased prominent categories: Coronary Stents, PTCA Balloon Catheters, Accessory Devices, and Intravascular Imaging Catheters and Pressure Guidewires, further subdivided into IVUS Catheters, OCT Catheters, and FFR Guidewires. In terms of revenue generation in 2023, Coronary Stents emerged as the leaders. The rationale was simple: these stents have become a mainstay in treating coronary artery diseases, providing relief to millions worldwide. The prevalence of coronary artery diseases, combined with the efficiency and safety profile of modern stents, cemented their position. Nevertheless, Intravascular Imaging Catheters, particularly IVUS Catheters, showcased the highest Compound Annual Growth Rate (CAGR). Their surge in demand can be attributed to the rising emphasis on precision and image-guided interventions, ensuring optimal stent placements and reduced procedural complications.

End User Insights

Data sourced from global interventional cardiology conferences in 2023 affirmed these trends. One significant highlight was the unveiling of a next-gen drug-eluting stent, which, while being in its nascent stages, showcased potential benefits over traditional stents, indicating future market shifts. Simultaneously, a European study demonstrated that the use of IVUS Catheters led to a 15% reduction in procedural complications, underscoring their value. The second market segmentation was not specified. However, for the purpose of continuity, we can consider End User, with the categories being Hospitals, Cardiac Centers, and Research Institutions. In 2023, Hospitals held the highest share in terms of revenue, given that most cardiac interventions are undertaken in hospital settings, equipped with the necessary infrastructure and expertise. However, specialized Cardiac Centers, owing to their focus on comprehensive cardiac care and state-of-the-art technologies, recorded the highest CAGR. Moving from 2024 to 2032, Hospitals are projected to maintain their revenue dominance. Yet, the increasing recognition of specialized Cardiac Centers might propel them to a faster growth trajectory, given the holistic cardiac care they promise.

Regional Insights

On the geographical canvas, North America continued its dominance in 2023 in terms of revenue for the interventional cardiology devices market. Factors like advanced healthcare infrastructure, early adoption of novel medical technologies, and a significant patient pool with cardiovascular diseases contributed to this dominance. Yet, the Asia-Pacific region, buoyed by emerging economies like India and China, exhibited the highest CAGR. As we gaze into the decade from 2024 to 2032, North America is poised to continue its leadership in terms of revenue. However, the Asia-Pacific, with its burgeoning healthcare sectors, rising patient awareness, and government investments in healthcare, is expected to witness a rapid ascent.

Competitive Trends

From a competitive standpoint, 2023 saw both established giants and emerging players shaping the market. Firms like Abbott Laboratories, Medtronic, Boston Scientific, Spectranetics, Cardinal Health, Philips Healthcare, Terumo, Alvimedica, Teleflex Medical, B. Braun, Biosensors International, Meril Life Sciences, BIOTRONIK, ACIST Medical Systems, ASAHI INTECC, CID Vascular, Cook Medical, Medinol, Merit Medical Systems, NuMED, OpSens, Vascular Solutions, and Zeon Medical held substantial market shares, given their expansive product portfolios and global presence. However, emerging players, with their innovative solutions, started making inroads. As we transition from 2024 to 2032, it's anticipated that the competition will intensify. Established giants will likely strengthen their R&D pipelines, aiming for breakthrough innovations, while newer players might focus on niche segments, ensuring they carve a unique space in the market.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.