TABLE 1 Global Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 2 Global Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 3 Global Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 4 North America Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 5 North America Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 6 North America Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 7 U.S. Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 8 U.S. Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 9 U.S. Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 10 Canada Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 11 Canada Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 12 Canada Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 13 Rest of North America Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 14 Rest of North America Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 15 Rest of North America Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 16 UK and European Union Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 17 UK and European Union Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 18 UK and European Union Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 19 UK Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 20 UK Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 21 UK Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 22 Germany Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 23 Germany Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 24 Germany Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 25 Spain Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 26 Spain Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 27 Spain Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 28 Italy Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 29 Italy Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 30 Italy Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 31 France Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 32 France Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 33 France Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 37 Asia Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 38 Asia Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 39 Asia Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 40 China Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 41 China Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 42 China Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 43 Japan Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 44 Japan Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 45 Japan Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 46 India Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 47 India Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 48 India Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 49 Australia Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 50 Australia Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 51 Australia Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 52 South Korea Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 53 South Korea Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 54 South Korea Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 55 Latin America Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 56 Latin America Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 57 Latin America Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 58 Brazil Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 59 Brazil Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 60 Brazil Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 61 Mexico Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 62 Mexico Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 63 Mexico Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 70 GCC Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 71 GCC Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 72 GCC Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 73 South Africa Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 74 South Africa Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 75 South Africa Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 76 North Africa Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 77 North Africa Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 78 North Africa Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 79 Turkey Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 80 Turkey Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 81 Turkey Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Internet Sports Betting Market By Game Type, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Internet Sports Betting Market By Cybersports, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Internet Sports Betting Market By Device Type, 2022-2032, USD (Million)

Market Overview

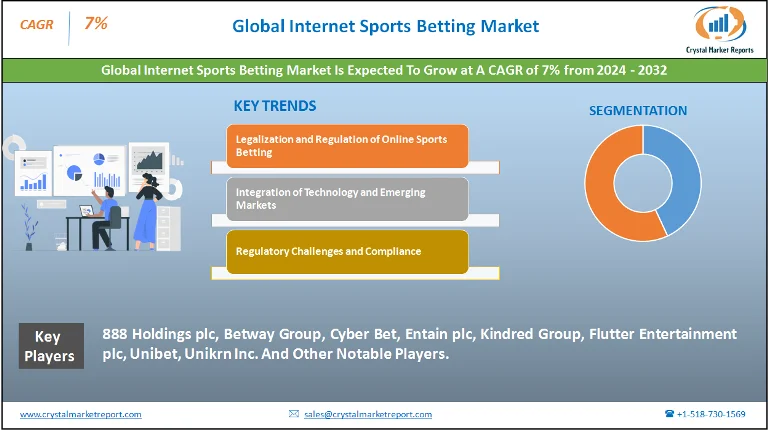

The internet sports betting market encompasses the sector that offers online sports betting services. Sports betting refers to the activity of placing wagers on the outcomes of various sports events, such as football, basketball, baseball, horse racing, and more. Internet sports betting, a form of online gambling, allows users to bet on these sports events through websites and mobile applications. This market includes the companies that operate online sports betting platforms and the technology and services that support these activities. The internet sports betting market is estimated to grow at a CAGR of 7% from 2024 to 2032. The internet sports betting market has been growing rapidly, driven by the increasing accessibility of internet services, the proliferation of smartphones, and the convenience of placing bets online. The market's expansion is also fueled by the growing legalization and regulation of sports betting in various countries, which has opened new markets and opportunities for online betting platforms.

Internet Sports Betting Market Dynamics

Driver: Legalization and Regulation of Online Sports Betting

A primary driver of the internet sports betting market is the ongoing legalization and regulation of online sports betting across various countries. This trend is largely driven by governments recognizing the potential for substantial tax revenue and the desire to curb illegal betting activities. For example, in the United States, the 2018 Supreme Court decision to overturn the Professional and Amateur Sports Protection Act has led to a wave of individual states legalizing and regulating sports betting. In Europe, countries like the UK have long-established regulated markets, while others are following suit, recognizing the economic benefits and the need to protect consumers. The shift towards legalization and regulation is creating a more secure and structured environment for bettors and operators, encouraging more users to participate in online sports betting activities and driving market growth.

Opportunity: Integration of Technology and Emerging Markets

An emerging opportunity within the internet sports betting market lies in the integration of advanced technologies and the exploration of new geographic markets. The adoption of technologies like artificial intelligence, blockchain, and big data analytics is enhancing the user experience, improving security, and offering personalized betting options. Furthermore, the expanding internet penetration and smartphone usage in emerging economies present significant opportunities for market expansion. Regions like Asia, Africa, and Latin America, with their growing middle-class populations and increasing digital connectivity, offer untapped potential for online sports betting operators.

Restraint: Regulatory Challenges and Compliance

A major restraint in the market is the complexity of regulatory challenges and the need for compliance across different jurisdictions. Online sports betting operators must navigate varying legal landscapes, where regulations can differ significantly from one region to another. This regulatory complexity requires operators to invest in legal expertise and compliance measures, adding to operational costs. Ensuring adherence to different regulatory standards, especially in areas related to consumer protection and anti-money laundering, remains a critical and ongoing challenge for companies in the market.

Challenge: Responsible Gambling and Ethical Concerns

A critical challenge facing the internet sports betting market is addressing responsible gambling and ethical concerns. As online sports betting becomes more accessible, there is an increased risk of gambling-related harm, such as addiction. Operators are under pressure to implement effective responsible gambling measures and to promote ethical betting practices. This includes offering tools for self-exclusion, setting betting limits, and providing support for problem gambling. Balancing commercial objectives with social responsibility is a delicate task, requiring a commitment to ethical practices and the well-being of customers. Failure to address these concerns adequately can lead to reputational damage and regulatory penalties, presenting a significant challenge for operators in the market.

Market Segmentation by Game Type

In the internet sports betting market, segmentation by game type includes Cybersports, Table Tennis, Football, Basketball, Baseball, Hockey, Cricket, Boxing, among Others. The Football segment is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032. This growth is largely due to football's global popularity and the extensive fan base, which translates into significant betting activity, especially during major events like the FIFA World Cup and European Championships. Football betting offers a wide range of markets and bet types, attracting a diverse group of bettors. Despite the rapid growth of the Football segment, in 2023, the highest revenue was generated by the Cybersports (esports) segment. The rising popularity of competitive gaming, with large-scale tournaments and a growing fan base, has propelled the esports betting market. The appeal of esports betting lies in its dynamic nature and the range of games and events available for betting, making it a lucrative segment.

Market Segmentation by Device Type

Regarding market segmentation by device type, the categories include Desktops & Laptops and Tablets & Mobiles. The Tablets & Mobiles segment is expected to witness the highest CAGR from 2024 to 2032, driven by the increasing use of mobile devices and the convenience they offer for online betting. The proliferation of smartphones, along with the development of dedicated betting apps and mobile-friendly websites, has made it easier for users to place bets on-the-go. However, in 2023, the highest revenue was observed in the Desktops & Laptops segment. This can be attributed to the preference of many users for the larger screens and more robust user experience that desktops and laptops provide, especially for detailed analysis and live streaming of sports events.

Market Segmentation by Region

In the internet sports betting market, geographic segmentation shows diverse growth patterns and potentials across different regions. The Asia-Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032, driven by the increasing internet penetration, rising popularity of sports betting, and gradual relaxation of betting regulations in countries like Japan and the Philippines. This region's large population base and growing interest in sports, including both traditional sports and esports, contribute significantly to the market's expansion. In contrast, in 2023, Europe accounted for the highest revenue in the internet sports betting market. The region's dominance can be attributed to its well-established betting culture, the presence of numerous major sports betting companies, and the widespread legalization and regulation of online betting. Countries like the UK, Italy, and Spain have a long history of sports betting, coupled with advanced technological infrastructure, making Europe a mature and lucrative market.

Competitive Trends

Regarding competitive trends and key players in the market, 2023 saw companies such as 888 Holdings plc, Betway Group, Cyber Bet, Entain plc, Kindred Group, Flutter Entertainment plc, Unibet, and Unikrn Inc. leading the market. These companies have maintained their market dominance through a combination of extensive betting markets, strong brand presence, and continuous technological innovation. Bet365, for instance, is known for its comprehensive betting options and user-friendly platform. William Hill has capitalized on its brand strength and extensive retail betting operations, while GVC Holdings (now Entain plc) has focused on digital expansion and diversifying its portfolio. From 2024 to 2032, these players are expected to continue focusing on technological advancements, particularly in mobile betting and live streaming services. Their strategies will likely include further investments in user experience enhancement, geographical expansion, and adapting to evolving regulatory landscapes. The integration of responsible gambling practices and the emphasis on customer protection will also be pivotal in their operational strategies. The combined revenue of these companies in 2023 reflects their significant role in the market, and their ongoing strategies are anticipated to significantly shape the market dynamics over the forecast period. This competitive landscape highlights a market driven by digital innovation, regulatory compliance, and the growing global interest in sports and esports betting.