TABLE 1 Global Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 2 Global Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 3 Global Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 4 North America Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 5 North America Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 6 North America Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 7 U.S. Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 8 U.S. Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 9 U.S. Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 10 Canada Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 11 Canada Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 12 Canada Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 13 Rest of North America Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 14 Rest of North America Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 15 Rest of North America Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 16 UK and European Union Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 17 UK and European Union Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 18 UK and European Union Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 19 UK Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 20 UK Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 21 UK Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 22 Germany Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 23 Germany Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 24 Germany Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 25 Spain Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 26 Spain Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 27 Spain Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 28 Italy Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 29 Italy Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 30 Italy Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 31 France Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 32 France Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 33 France Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 37 Asia Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 38 Asia Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 39 Asia Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 40 China Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 41 China Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 42 China Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 43 Japan Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 44 Japan Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 45 Japan Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 46 India Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 47 India Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 48 India Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 49 Australia Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 50 Australia Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 51 Australia Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 52 South Korea Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 53 South Korea Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 54 South Korea Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 55 Latin America Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 56 Latin America Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 57 Latin America Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 58 Brazil Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 59 Brazil Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 60 Brazil Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 61 Mexico Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 62 Mexico Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 63 Mexico Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 70 GCC Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 71 GCC Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 72 GCC Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 73 South Africa Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 74 South Africa Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 75 South Africa Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 76 North Africa Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 77 North Africa Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 78 North Africa Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 79 Turkey Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 80 Turkey Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 81 Turkey Integrated Systems Market By End Use, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Integrated Systems Market By Product, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Integrated Systems Market By Service, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Integrated Systems Market By End Use, 2022-2032, USD (Million)

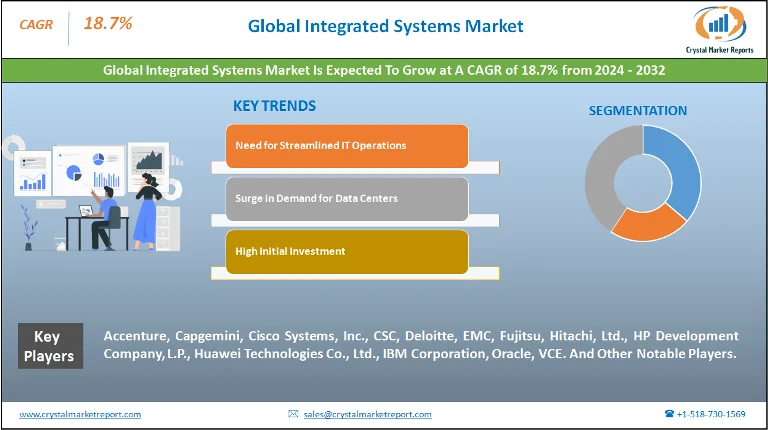

Market Overview

The integrated systems market primarily revolves around the concept of integrating different IT components, including servers, storage devices, and network infrastructures into a single unit. This amalgamation facilitates streamlined operations, easier management, and a unified framework for businesses to address diverse computing requirements. The integrated systems market is estimated to grow at a CAGR of 18.7% from 2024 to 2032.

Integrated Systems Market Dynamics

Driving Force: Need for Streamlined IT Operations

Organizations in the modern era are continually seeking methods to optimize their IT operations, aiming to achieve higher efficiencies and reduce complexities. Integrated systems offer a solution to this by providing a unified infrastructure that combines multiple IT components. This not only minimizes compatibility issues but also enhances operational efficiency. For instance, a multinational corporation successfully streamlined its scattered IT operations across continents by deploying an integrated system, resulting in a 40% increase in operational efficiency and a considerable reduction in IT-related complexities.

Opportunity: Surge in Demand for Data Centers

With the exponential growth in data consumption and the transition to cloud computing, there's a rising demand for data centers globally. Integrated systems, with their consolidated framework, are ideally suited for these environments. They allow for better scalability, enhanced management capabilities, and reduced footprint. Consider the scenario where a leading e-commerce giant expanded its data centers to cater to its growing user base. Leveraging integrated systems, the company efficiently scaled its operations without substantial infrastructural changes, leading to a 30% cost reduction in IT deployments.

Restraint: High Initial Investment

While the benefits of integrated systems are manifold, their adoption is often hindered by the substantial initial investment required. For many small to mid-sized enterprises (SMEs), this upfront cost poses a significant challenge. A recent survey of SMEs indicated that nearly 60% of the respondents perceived the high initial cost of integrated systems as a deterrent to their adoption, even when they acknowledged the long-term operational benefits.

Challenge: Rapid Technological Advancements

The IT industry is characterized by rapid and continual advancements. This pace poses a challenge for integrated systems. As individual components of IT infrastructure (like servers or storage solutions) evolve, there's a risk that integrated systems may become outdated or incompatible with newer technologies. An illustrative case in this context is a tech firm that invested heavily in integrated systems, only to find some components becoming obsolete within two years due to technological advancements. Such scenarios mandate continuous updates or even overhauls, leading to further investments.

Product Insights

In the realm of the Integrated Systems Market, product segmentation delineates between Integrated Platform/Workload Systems and Integrated Infrastructure Systems. Historically, as of 2023, Integrated Infrastructure Systems had dominated the market, accounting for the highest revenue. These systems were favored due to their flexibility in consolidating various IT components, resulting in more efficient operations and easier management across businesses of all scales. In contrast, Integrated Platform/Workload Systems, which are tailored for specific application workloads, showcased the highest Compound Annual Growth Rate (CAGR). This growth is attributed to the rising demand for specialized solutions that cater to unique business requirements, thereby offering optimized performances for specific tasks.

Service Insights

Drilling down into services, the market segments further into Integration & Installation, Consulting, and Maintenance & Support. In 2023, Integration & Installation services constituted the highest revenue, highlighting the ever-present need for businesses to transition to integrated systems and the requisite expert assistance for their effective deployment. On the other hand, Maintenance & Support services are forecasted to exhibit the highest CAGR from 2024 to 2032. As businesses become more reliant on integrated systems, ensuring their smooth operation and resolving potential issues becomes paramount, driving this segment's growth.

Regional Insights

Geographically, North America had firmly held its position as the highest revenue generator in 2023, with countries like the U.S. and Canada at the forefront of adopting and implementing integrated systems. The robust IT infrastructure, coupled with a large number of enterprises in the region, has fostered this dominance. However, the Asia-Pacific region, led by economies such as India, China, and Japan, is anticipated to witness the highest CAGR from 2024 to 2032. Rapid industrialization, expanding IT sectors, and a surge in the number of startups necessitating efficient IT operations propel this growth trajectory.

Competitive Trends

On the competitive frontier, 2023 had witnessed fierce competition among top players like Accenture, Capgemini, Cisco Systems, Inc., CSC, Deloitte, EMC, Fujitsu, Hitachi, Ltd., HP Development Company, L.P., Huawei Technologies Co., Ltd., IBM Corporation, Oracle, and VCE. These market leaders had primarily banked on strategies like mergers & acquisitions, innovative product launches, and strategic partnerships to consolidate their market positions. For instance, Cisco's acquisition of certain tech entities positioned them to offer more comprehensive solutions, while IBM's continuous innovation in its integrated system products kept them relevant and competitive. As we venture into the decade leading up to 2032, it's expected that these companies, among others, will delve deeper into R&D, exploring the realms of AI and machine learning to further enhance the capabilities of integrated systems.