Market Overview

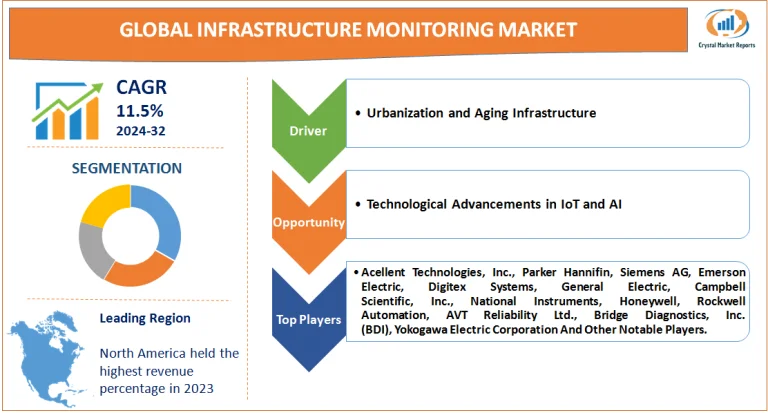

The infrastructure monitoring market pertains to systems and solutions that evaluate and monitor the health and durability of key infrastructure elements like bridges, tunnels, dams, railways, and buildings. These solutions ensure safety, extend the lifespan of infrastructure, and reduce maintenance costs by detecting defects early. The infrastructure monitoring market is estimated to grow at a CAGR of 11.5% from 2024 to 2032.

Infrastructure Monitoring Market Dynamics

Driver: Urbanization and Aging Infrastructure

One primary driver propelling the Infrastructure Monitoring Market is the rapid pace of urbanization coupled with aging infrastructure. As urban areas grow, so does the demand for infrastructure, and concurrently, the need to monitor the same. For instance, many of the bridges and tunnels in metropolitan cities worldwide were built decades ago and are approaching, if not already exceeding, their intended lifespan. Early signs of wear and tear or damage, if not detected, can lead to catastrophic events. For instance, the unfortunate collapse of the Morandi Bridge in Genoa, Italy, in 2018, which resulted in 43 fatalities, is a somber testament to the need for thorough and regular infrastructure monitoring. Furthermore, the American Society of Civil Engineers reported in its Infrastructure Report Card that 9.1% of bridges in the U.S. are structurally deficient, emphasizing the urgency of the situation.

Opportunity: Technological Advancements in IoT and AI

With the advancement of technology, particularly in the realms of the Internet of Things (IoT) and Artificial Intelligence (AI), there's a significant opportunity for the Infrastructure Monitoring Market. Sensors are becoming cheaper, more durable, and more efficient. When these sensors are integrated with infrastructure elements and paired with advanced data analytics, it provide real-time, actionable insights. For example, in a recent project, sensors were embedded in concrete to monitor and report its health in real-time, thus preventing any potential mishaps. The rise of smart cities, where infrastructure communicates with central databases to provide updates on its health, represents another lucrative avenue. Cities like Singapore and Barcelona have already begun integrating these advanced monitoring systems into their infrastructure networks.

Restraint: High Initial Costs

Despite the clear benefits of infrastructure monitoring, the high initial costs associated with implementing these systems can be a considerable restraint for many countries, especially those in the developing world. The costs are not just restricted to the physical sensors but also encompass data storage solutions, analytics software, and personnel training. Consider, for instance, a small town with limited budget allocations. For such localities, prioritizing infrastructure monitoring can be challenging when weighed against other immediate needs. This has been evidenced by numerous small municipalities opting out of implementing these systems due to budgetary constraints.

Challenge: Data Privacy and Security Concerns

In the age of digitalization, data privacy and security stand as formidable challenges. Infrastructure monitoring systems collect a plethora of data, and ensuring this data doesn't fall into the wrong hands or is not misused is crucial. A notable incident that underlines this challenge was when a cyber-attack on Ukraine's power grid in 2015 left over 200,000 residents without power in the heart of winter. Such vulnerabilities highlight the pressing need to secure infrastructure monitoring systems from potential cyber threats.

Market Segmentation by Component

In 2023, the hardware segment held the highest revenue share. This isn't surprising, given that physical sensors and monitoring devices, which are essential for collecting real-time data from infrastructure, fall under this category. On the other hand, the software segment, encompassing advanced data analytics and predictive modeling tools, is projected to grow at the highest CAGR from 2024 to 2032. As the IoT and AI-driven monitoring systems gain traction, the reliance on sophisticated software to decipher complex data patterns and provide actionable insights is anticipated to surge. Meanwhile, services, including consulting, maintenance, and training, are expected to observe consistent growth, as the implementation of monitoring systems often requires expertise and ongoing support.

Market Segmentation by Application

By 2023, crack detection dominated in terms of revenue, primarily because of the acute need to monitor the structural health of aging infrastructure components, ensuring that no critical damage goes undetected. However, the forecast for 2024 to 2032 sees multimodal sensing, which amalgamates various monitoring methodologies into a singular system, boasting the highest CAGR. The appeal lies in its comprehensive monitoring capability, providing a holistic view of the infrastructure's health.

Market Segmentation by Region

In the past year, 2023, North America led the Infrastructure Monitoring Market in revenue, largely driven by the U.S.'s considerable investments in revamping its aging infrastructure and its early adoption of advanced technologies. However, the Asia-Pacific region, led by countries such as China and India, is expected to experience the highest CAGR from 2024 to 2032. The combination of rapid urbanization, expansive infrastructure projects, and a growing emphasis on safety standards contributes to this predicted surge.

Competitive Trends

By the close of 2023, several key players had established dominance in the Infrastructure Monitoring Market. Companies like Acellent Technologies, Inc., Parker Hannifin, Siemens AG, Emerson Electric, Digitex Systems, General Electric, Campbell Scientific, Inc., National Instruments, Honeywell, Rockwell Automation, AVT Reliability Ltd., Bridge Diagnostics, Inc. (BDI), and Yokogawa Electric Corporation were not just recognized for their innovative solutions but also for their strategic endeavors in expanding their global footprint and diversifying their offerings. A common strategy among top players was collaboration—with tech firms for enhancing data analytics capabilities and with local governments for better implementation of monitoring systems. As we look ahead from 2024 to 2032, it's expected that these collaborations will intensify. Additionally, a trend worth noting is the increasing investment in R&D, with companies vying to introduce the next groundbreaking solution in infrastructure monitoring. This competitive yet collaborative landscape is anticipated to drive the market to new heights in the coming decade.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.