Market Overview

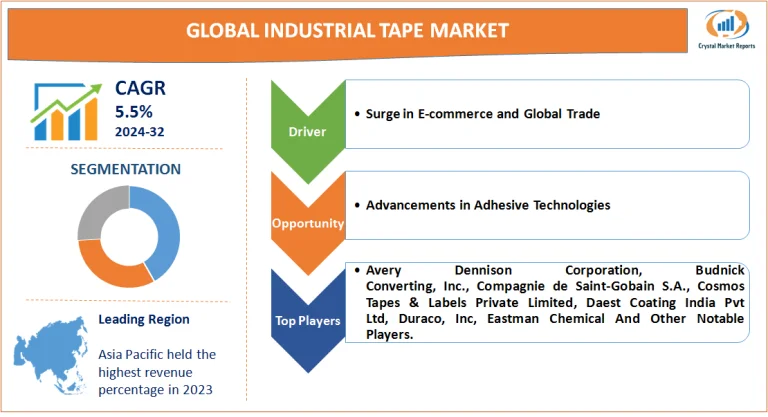

The industrial tape market refers to the business ecosystem surrounding the production, distribution, and application of tapes designed for industrial use. These tapes typically exhibit enhanced adhesive properties, resistance to environmental factors, and durability, making them apt for a myriad of applications across industries. From securing packages in logistics to aiding in construction and automotive repairs, industrial tapes are integral to seamless operations in numerous sectors. The industrial tape market is estimated to grow at a CAGR of 5.5% from 2024 to 2032.

Industrial Tape Market Dynamics

Driver: Surge in E-commerce and Global Trade

One of the most robust drivers propelling the industrial tape market forward is the meteoric rise of e-commerce and the resulting explosion in global trade. With online shopping becoming a staple for consumers worldwide, businesses are shipping more products than ever before. As reported by the United Nations Conference on Trade and Development (UNCTAD), e-commerce sales hit $4.28 trillion in 2020, a number that has been on an upward trajectory. Industrial tapes, being pivotal in the packaging and secure transportation of these goods, have seen a direct uptick in demand. These tapes ensure the packages are tamper-proof, protecting the product inside and providing assurance to both sellers and buyers. The undeniable link between growing e-commerce trends and industrial tape demand showcases how modern consumption patterns significantly influence traditional industrial markets.

Opportunity: Advancements in Adhesive Technologies

The continual evolution of adhesive technologies presents a golden opportunity for the industrial tape market. With industries becoming more specialized, there's a growing demand for tapes that cater to niche requirements - whether it's resistance to high temperatures in automotive applications or bio-degradable tapes for sustainable packaging. For instance, a report by the Journal of Adhesion Science and Technology detailed how nano-technological advancements are enhancing adhesive properties, allowing for tapes that bond better and resist external pressures more efficiently. Manufacturers who invest in R&D to harness these innovations can position themselves as market leaders, catering to a clientele that seeks the latest and most efficient in adhesive solutions.

Restraint: Environmental Concerns and Regulations

However, the industrial tape market isn't without its challenges. A significant restraint is the increasing scrutiny on the environmental impact of these tapes, especially those made from non-biodegradable materials. Numerous governments and environmental bodies have highlighted the detrimental effects of waste from these tapes. For instance, the European Union's Waste Framework Directive aims to promote waste prevention, and products like non-recyclable industrial tapes fall under its purview. Such regulations push manufacturers to rethink their products, potentially driving up costs or necessitating a pivot to sustainable materials, which might not always align with the tape's required industrial properties.

Challenge: Fluctuating Raw Material Prices

On the challenge front, fluctuating raw material prices play a significant role. Industrial tapes require various raw materials, such as polymers, resins, and adhesives. Any disruption in the supply chain, whether due to geopolitical tensions, trade wars, or natural disasters, can lead to price volatilities. An example can be drawn from the price spikes observed in the polymer industry post-2017 due to supply chain disruptions caused by environmental regulations in China, as reported by Financial Times. Such unpredictabilities make it challenging for manufacturers to maintain consistent pricing, potentially affecting their market position and profitability.

Market Segmentation by Product

Analyzing the revenue generation, Adhesive Transfer Tapes were the leaders in 2023, finding wide applications across industries, primarily due to their versatility. They're essential in areas requiring clear finishes, like glass installations. Yet, in terms of CAGR, Duct Tapes are expected to lead from 2024 to 2032. Their increasing use in quick repairs, both domestically and industrially, combined with ongoing innovations in enhancing their adhesive qualities, contributes to this growth. Simultaneously, Aluminum Tapes, best known for their temperature resistance, also accounted for a significant market share in 2023, predominantly in the HVAC sector. Filament Tapes, with their fiberglass strands, gave robust competition, primarily in the packaging sector, ensuring box closures are secure. Other products, including specialty tapes, continue to cater to niche markets, with steady demand across specific sectors.

Market Segmentation by Material

In the material segment, Polypropylene stood out in 2023, contributing the most to revenue. This can be attributed to its durability and cost-effectiveness, making it a favorite among manufacturers. However, in terms of CAGR, Paper Tapes are poised to showcase remarkable growth from 2024 to 2032. The sustainability drive, combined with easy tear properties, boosts their demand. Polyvinyl Chloride (PVC), with its flame-resistant properties, saw significant use in electrical applications, maintaining a steady market share. Other materials, including specialty composites, had their dedicated demand pockets, primarily governed by application-specific requirements.

Market Segmentation by Region

Geographically, the Asia-Pacific (APAC) region was the crown jewel in 2023, bringing in the highest revenue. Rapid industrialization, coupled with infrastructural developments in countries like China, India, and Vietnam, drove this trend. The region is also home to numerous tape manufacturers, further cementing its dominant position. However, in terms of CAGR, Latin America is predicted to show the most significant growth between 2024 and 2032, primarily driven by increasing industrial activities in countries like Brazil and Mexico and the expanding e-commerce sector necessitating packaging solutions.

Competitive Trends

In the competitive landscape, giants like Avery Dennison Corporation, Budnick Converting, Inc., Compagnie de Saint-Gobain S.A., Cosmos Tapes & Labels Private Limited, Daest Coating India Pvt Ltd, Duraco, Inc, and Eastman Chemical Company dominated in 2023. Their strategies ranged from expansive R&D investments, driving product innovation, to mergers and acquisitions, expanding their market footprints. For instance, 3M's consistent focus on producing environmentally friendly products gave them an edge in markets prioritizing sustainability. The forecast period from 2024 to 2032 is expected to witness a rise in collaborations, especially with tech companies, to produce smart tapes equipped with sensors for specialized industrial applications.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.