TABLE 1 Global ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 2 Global ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 3 Global ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 4 North America ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 5 North America ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 6 North America ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 7 U.S. ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 8 U.S. ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 9 U.S. ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 10 Canada ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 11 Canada ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 12 Canada ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 13 Rest of North America ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 14 Rest of North America ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 15 Rest of North America ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 16 UK and European Union ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 17 UK and European Union ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 18 UK and European Union ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 19 UK ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 20 UK ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 21 UK ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 22 Germany ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 23 Germany ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 24 Germany ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 25 Spain ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 26 Spain ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 27 Spain ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 28 Italy ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 29 Italy ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 30 Italy ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 31 France ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 32 France ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 33 France ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 34 Rest of Europe ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 35 Rest of Europe ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 36 Rest of Europe ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 37 Asia ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 38 Asia ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 39 Asia ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 40 China ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 41 China ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 42 China ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 43 Japan ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 44 Japan ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 45 Japan ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 46 India ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 47 India ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 48 India ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 49 Australia ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 50 Australia ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 51 Australia ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 52 South Korea ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 53 South Korea ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 54 South Korea ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 55 Latin America ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 56 Latin America ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 57 Latin America ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 58 Brazil ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 59 Brazil ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 60 Brazil ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 61 Mexico ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 62 Mexico ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 63 Mexico ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 70 GCC ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 71 GCC ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 72 GCC ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 73 South Africa ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 74 South Africa ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 75 South Africa ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 76 North Africa ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 77 North Africa ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 78 North Africa ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 79 Turkey ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 80 Turkey ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 81 Turkey ICP-MS System Market By Application, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa ICP-MS System Market By Product, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa ICP-MS System Market By Modality, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa ICP-MS System Market By Application, 2022-2032, USD (Million)

Market Overview

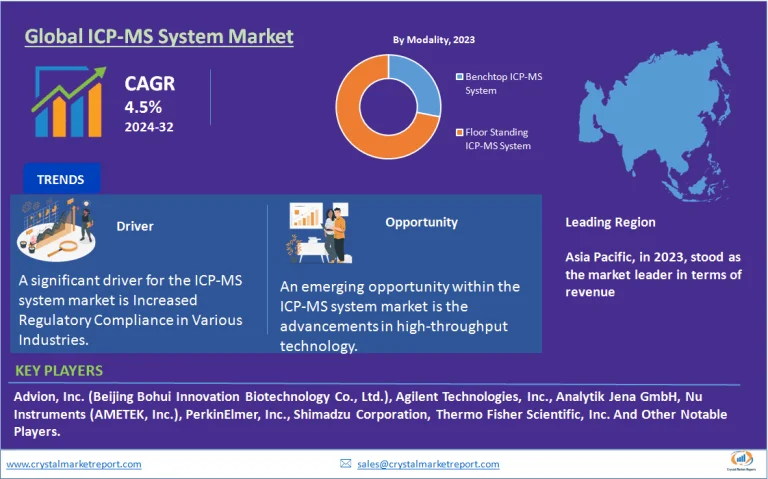

The ICP-MS (Inductively Coupled Plasma Mass Spectrometry) system market refers to the segment of the analytical instrumentation industry that specializes in the development, production, and distribution of ICP-MS systems. ICP-MS is an analytical technique used for the detection and quantification of trace elements in various types of samples. It combines a high-temperature plasma source with mass spectrometry to ionize and measure elements at very low concentrations, often in parts per billion or parts per trillion. The ICP-MS system market is estimated to grow at a CAGR of 4.5% from 2024 to 2032. The ICP-MS system market is a crucial component of the broader scientific and laboratory equipment industry. It plays a significant role in various fields including environmental testing, pharmaceuticals, mining, food and beverage testing, and clinical research, among others. The market is driven by the need for precise and accurate trace element analysis in these industries.

ICP-MS System Market Dynamics

Driver: Increased Regulatory Compliance in Various Industries

A significant driver for the ICP-MS system market is the heightened regulatory compliance in various industries. In sectors such as environmental testing, pharmaceuticals, and food safety, stringent regulations mandate precise and accurate trace element analysis. ICP-MS systems, known for their high sensitivity and accuracy, are increasingly used to meet these regulatory requirements. For instance, in the pharmaceutical industry, regulatory bodies like the FDA enforce strict guidelines on elemental impurities in drugs, leading to a higher adoption of ICP-MS for compliance. Similarly, environmental regulations concerning the monitoring of heavy metals in water and soil have bolstered the use of ICP-MS in environmental laboratories.

Opportunity: Advancements in High-Throughput Technology

An emerging opportunity within the ICP-MS system market is the advancements in high-throughput technology. The development of new ICP-MS systems that offer faster analysis and higher sample throughput addresses the need for efficient, large-scale testing in various sectors. This is particularly beneficial in industries where large numbers of samples require rapid and accurate analysis, such as in environmental monitoring and mass-scale food testing. The integration of automation and improved data management systems in ICP-MS technology also presents significant growth potential, enabling laboratories to enhance productivity and data accuracy.

Restraint: High Cost of Equipment and Operational Complexity

However, a major restraint in the market is the high cost of ICP-MS systems and their operational complexity. The initial investment for ICP-MS equipment is substantial, which can be a barrier for smaller laboratories or institutions with limited budgets. Additionally, the operation of ICP-MS systems requires skilled personnel, as the technology is sophisticated and involves complex sample preparation and analysis procedures. This need for specialized training and expertise can limit the accessibility and widespread adoption of ICP-MS in certain sectors.

Challenge: Maintaining Technological Advancements and User Training

A critical challenge in the ICP-MS system market is keeping pace with rapid technological advancements and ensuring adequate user training. As ICP-MS technology evolves, manufacturers must continually innovate and upgrade their systems to stay competitive. This rapid evolution requires users to be regularly trained on the latest equipment and software, adding to the operational challenges. Balancing the introduction of advanced features with user-friendly operation and providing comprehensive training and support are essential for the successful implementation and utilization of ICP-MS systems in various analytical settings.

Market Segmentation by Product Type

In the ICP-MS system market, segmentation by product type includes Single Quadrupole ICP-MS, Triple Quadrupole ICP-MS, Multi-quadrupole ICP-MS, High Resolution ICP-MS, Multi-collector ICP-MS, and Others. The Triple Quadrupole ICP-MS segment is anticipated to experience the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032. This growth can be attributed to the advanced capabilities of triple quadrupole ICP-MS in providing enhanced sensitivity, precision, and lower detection limits, making it ideal for complex and demanding applications like pharmaceuticals and environmental testing. The ability of these systems to handle interferences effectively and provide reliable quantification of trace elements is driving their increased adoption. Despite the rapid growth of the Triple Quadrupole ICP-MS segment, in 2023, the highest revenue was generated by the Single Quadrupole ICP-MS. Its dominance in the market is due to its widespread use across various industries, affordability, and suitability for a broad range of applications, making it a popular choice for many laboratories.

Market Segmentation by Modality

Regarding market segmentation by modality, the categories include Benchtop ICP-MS system and Floor Standing ICP-MS system. The Benchtop ICP-MS system segment is expected to witness the highest CAGR from 2024 to 2032. This growth is driven by the increasing demand for compact, user-friendly, and cost-effective systems that are suitable for laboratories with limited space and resources. Benchtop systems offer the advantage of a smaller footprint while still providing robust analytical capabilities. However, in 2023, the highest revenue was observed in the Floor Standing ICP-MS system segment. These systems are typically more powerful and have higher throughput capabilities, making them ideal for high-volume testing environments such as large commercial laboratories and research institutions.

These trends in product type and modality segmentation reflect the diverse requirements and technological advancements in the ICP-MS system market, highlighting the demand for systems that offer accuracy, efficiency, and adaptability to various analytical needs.

Market Segmentation by Region

In the ICP-MS system market, geographic segmentation reveals distinct growth trends across various regions. The Asia-Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032, driven by rapid industrialization, increasing investment in research and development, and the growth of sectors like pharmaceuticals and environmental testing in countries such as China, India, and Japan. The region's expanding manufacturing base and rising emphasis on regulatory compliance and quality control in various industries contribute to this growth. In contrast, in 2023, North America accounted for the highest revenue in the ICP-MS system market. This can be attributed to the well-established pharmaceutical and environmental testing industries, along with substantial investments in research and technological advancements in the United States and Canada. The strong presence of leading industry players and advanced healthcare infrastructure have been central to its revenue dominance.

Competitive Trends

Regarding competitive trends and key players in the market, 2023 saw companies like Advion, Inc. (Beijing Bohui Innovation Biotechnology Co., Ltd.), Agilent Technologies, Inc., Analytik Jena GmbH, Nu Instruments (AMETEK, Inc.), PerkinElmer, Inc., Shimadzu Corporation, and Thermo Fisher Scientific, Inc. leading the market. These companies have maintained their market dominance through continuous innovation, strategic partnerships, and a focus on expanding their product portfolios. Agilent Technologies, for example, has been at the forefront of offering advanced ICP-MS systems, focusing on technology-driven solutions and customer-centric approaches. Thermo Fisher Scientific has emphasized on integrating automation and high-throughput capabilities in its ICP-MS systems, catering to the growing demand for efficient and accurate analysis. PerkinElmer has focused on developing user-friendly and reliable ICP-MS systems, enhancing their accessibility to a broader range of laboratories. From 2024 to 2032, these players are expected to continue their focus on innovation, particularly in developing systems that offer greater sensitivity, accuracy, and ease of use. Their strategies are likely to include further investments in R&D, exploring new applications in emerging markets, and adapting to the evolving needs of the scientific and industrial communities. The combined revenue of these companies in 2023 reflects their significant role in the market, and their ongoing strategies are anticipated to significantly shape the market dynamics over the forecast period. This competitive landscape highlights a market driven by technological advancements, the growing need for precise elemental analysis, and the adaptation to a rapidly evolving analytical and regulatory environment.