TABLE 1 Global High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 2 Global High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 3 Global High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 4 North America High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 5 North America High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 6 North America High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 7 U.S. High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 8 U.S. High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 9 U.S. High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 10 Canada High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 11 Canada High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 12 Canada High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 13 Rest of North America High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 14 Rest of North America High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 15 Rest of North America High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 16 UK and European Union High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 17 UK and European Union High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 18 UK and European Union High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 19 UK High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 20 UK High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 21 UK High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 22 Germany High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 23 Germany High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 24 Germany High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 25 Spain High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 26 Spain High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 27 Spain High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 28 Italy High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 29 Italy High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 30 Italy High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 31 France High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 32 France High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 33 France High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 34 Rest of Europe High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 35 Rest of Europe High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 36 Rest of Europe High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 37 Asia High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 38 Asia High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 39 Asia High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 40 China High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 41 China High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 42 China High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 43 Japan High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 44 Japan High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 45 Japan High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 46 India High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 47 India High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 48 India High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 49 Australia High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 50 Australia High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 51 Australia High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 52 South Korea High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 53 South Korea High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 54 South Korea High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 55 Latin America High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 56 Latin America High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 57 Latin America High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 58 Brazil High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 59 Brazil High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 60 Brazil High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 61 Mexico High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 62 Mexico High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 63 Mexico High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 70 GCC High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 71 GCC High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 72 GCC High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 73 South Africa High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 74 South Africa High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 75 South Africa High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 76 North Africa High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 77 North Africa High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 78 North Africa High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 79 Turkey High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 80 Turkey High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 81 Turkey High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa High Barrier Lidding Film Market By Product, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa High Barrier Lidding Film Market By Material, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa High Barrier Lidding Film Market By End Use, 2022-2032, USD (Million)

Market Overview

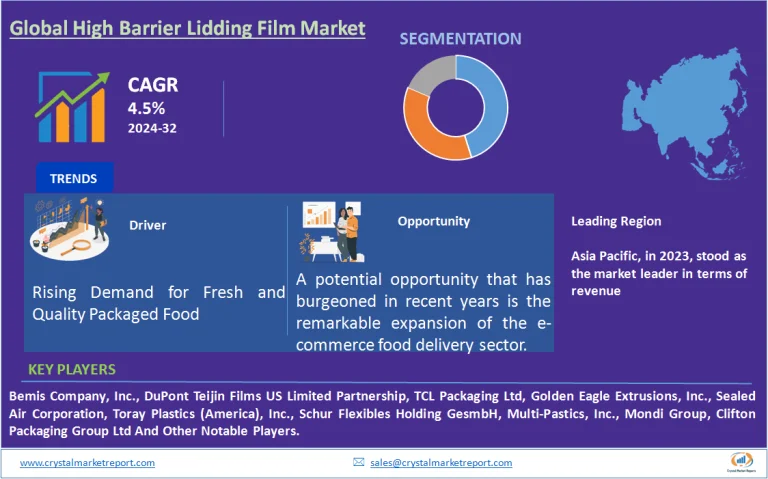

The high barrier lidding film market primarily revolves around the production and distribution of lidding films that offer advanced protection against external contaminants, ensuring the prolonged freshness and shelf life of the packaged products. These films, typically used in the food and pharmaceutical industries, stand out due to their high barrier properties against moisture, oxygen, and light. The high barrier lidding film market is estimated to grow at a CAGR of 4.5% from 2024 to 2032.

High Barrier Lidding Film Market Dynamics

Driver: Rising Demand for Fresh and Quality Packaged Food

One of the most significant drivers for the high barrier lidding film market is the escalating consumer demand for fresh and quality packaged food. As the global populace becomes increasingly health-conscious, there's a notable tilt towards packaged foods that guarantee freshness without compromising on nutritional value. Evidently, urban centers worldwide have observed a surge in the number of retail chains and supermarkets, which predominantly stock packaged food items. A 2023 report by the World Retail Congress highlighted that over 65% of urban consumers prefer buying packaged dairy, meat, and ready-to-eat meals. The high barrier lidding films play an instrumental role in ensuring these products remain uncontaminated and fresh over extended periods.

Opportunity: Expansion in the E-commerce Food Delivery Sector

A potential opportunity that has burgeoned in recent years is the remarkable expansion of the e-commerce food delivery sector. As more people resort to online shopping, especially for groceries and ready-to-eat meals, there's an amplified need for packaging that ensures the product remains intact and fresh during transit. A 2023 survey from the International E-commerce Association revealed that nearly 70% of respondents had ordered perishable food items online at least once, and 85% of them expressed satisfaction only when the delivered product maintained its freshness. Thus, the high barrier lidding film manufacturers have an ample avenue to tap into, catering to the packaging needs of e-commerce giants and budding online grocery startups alike.

Restraint: Environmental Concerns and Regulations

However, the road isn't without bumps. A significant restraint faced by the industry is the environmental concern associated with the use of plastics and the consequent stringent regulations. Governments and environmental bodies globally are pushing industries to adopt sustainable practices. The European Union, for instance, announced in 2023 a set of guidelines aiming to reduce single-use plastics. Such regulations force manufacturers to rethink their strategies and could potentially increase the production costs if they decide to pivot towards more eco-friendly alternatives.

Challenge: Technological Advancements in Alternative Packaging

The market also faces challenges from technological advancements in alternative packaging methods. The rise of smart packaging, which uses sensors and IoT to monitor food quality in real-time, offers stiff competition. A case in point is a European tech startup that introduced smart packaging for dairy products in early 2023, which garnered significant attention from dairy giants. These innovations, while still in nascent stages, could pose a significant threat if they become mainstream, owing to their dual advantage of ensuring freshness and reducing plastic usage.

Product Insights

In the high barrier lidding film Market, products play a vital role in determining consumer preferences and market growth. Specifically, in 2023, the Cup segment of the product category showed the highest revenue, primarily owing to the increasing demand for single-serve beverages and food products in urban centers. Moreover, Cups are widely preferred due to their portability and convenience. On the other hand, the Tray segment, closely following Cups, is projected to have the highest CAGR from 2024 to 2032. This can be attributed to the surge in ready-to-eat meals and the consumers' preference for organized and portioned food servings. Trays provide an ideal solution for packaging pre-cooked and frozen meals. The Top-Web segment also found significant usage, particularly in fresh produce and meat packaging.

Material Insights

Diving into the materials used for these products, Polyethylene (PE) dominated the 2023 market in terms of revenue. Its popularity rests on its flexibility, clarity, and excellent barrier properties. However, forecasts from 2024 to 2032 indicate that Polypropylene (PP) is expected to have the highest CAGR. The reasons for this include PP's high-temperature resistance, making it apt for hot-filling processes, and its cost-effectiveness. Polyethylene Terephthalate (PET) continues to be favored for its clarity and strength, especially in beverage packaging, while Polyvinyl Chloride (PVC) is gradually seeing a decline due to environmental concerns, even though it's prized for its flexibility.

Regional Insights

On the geographical front, Asia-Pacific, with its booming population and escalating urbanization, accounted for the lion's share in 2023's revenue for the high barrier lidding film Market. Rapid urban growth, increased disposable income, and shifts in food consumption patterns make this region a hotbed for market growth. However, the forecast from 2024 to 2032 indicates that Europe is poised to show the highest CAGR, buoyed by stringent food safety regulations and the region's significant tilt towards ready-to-eat and packaged meals. North America, with its advanced food processing industry, also remains a significant stakeholder in the market.

Competitive Trends

Competitively, the high barrier lidding film Market has seen innovations and strategic partnerships among its key players. In 2023, companies like Bemis Company, Inc., DuPont Teijin Films US Limited Partnership, TCL Packaging Ltd, Golden Eagle Extrusions, Inc., Sealed Air Corporation, Toray Plastics (America), Inc., Schur Flexibles Holding GesmbH, Multi-Pastics, Inc., Mondi Group, and Clifton Packaging Group Ltd led in revenue generation, primarily due to their extensive distribution networks and diverse product portfolios. However, with sustainability becoming a massive trend, companies are expected to invest more in R&D to develop eco-friendly lidding films from 2024 onwards. Furthermore, mergers, acquisitions, and collaborations will remain popular strategies, as companies aim to expand their global footprints and capitalize on the emerging trends in the market.