TABLE 1 Global Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 2 Global Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 3 Global Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 4 North America Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 5 North America Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 6 North America Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 7 U.S. Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 8 U.S. Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 9 U.S. Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 10 Canada Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 11 Canada Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 12 Canada Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 13 Rest of North America Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 14 Rest of North America Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 15 Rest of North America Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 16 UK and European Union Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 17 UK and European Union Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 18 UK and European Union Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 19 UK Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 20 UK Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 21 UK Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 22 Germany Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 23 Germany Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 24 Germany Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 25 Spain Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 26 Spain Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 27 Spain Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 28 Italy Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 29 Italy Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 30 Italy Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 31 France Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 32 France Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 33 France Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 37 Asia Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 38 Asia Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 39 Asia Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 40 China Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 41 China Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 42 China Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 43 Japan Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 44 Japan Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 45 Japan Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 46 India Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 47 India Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 48 India Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 49 Australia Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 50 Australia Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 51 Australia Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 52 South Korea Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 53 South Korea Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 54 South Korea Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 55 Latin America Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 56 Latin America Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 57 Latin America Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 58 Brazil Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 59 Brazil Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 60 Brazil Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 61 Mexico Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 62 Mexico Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 63 Mexico Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 70 GCC Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 71 GCC Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 72 GCC Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 73 South Africa Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 74 South Africa Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 75 South Africa Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 76 North Africa Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 77 North Africa Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 78 North Africa Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 79 Turkey Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 80 Turkey Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 81 Turkey Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Handheld Ultrasound Devices Market By Technology, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Handheld Ultrasound Devices Market By Application, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Handheld Ultrasound Devices Market By End-Use, 2022-2032, USD (Million)

Market Overview

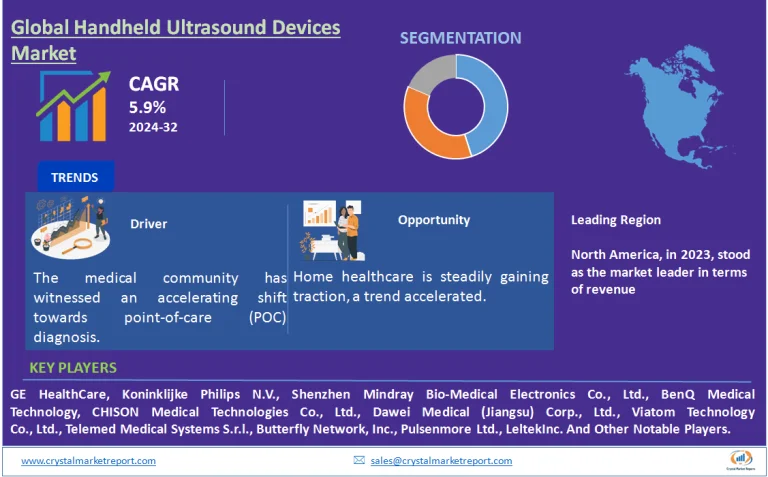

The handheld ultrasound devices market, which primarily revolves around compact, portable ultrasound devices that can be easily operated by medical professionals, has been pivotal in transforming the landscape of diagnostics. These devices provide quick, real-time imaging and are becoming an invaluable tool, particularly in point-of-care settings. The handheld ultrasound devices market is estimated to grow at a CAGR of 5.9% from 2024 to 2032.

Handheld Ultrasound Devices Market Dynamics

Market Driver: The Rising Need for Point-of-Care Diagnosis

In recent years, the medical community has witnessed an accelerating shift towards point-of-care (POC) diagnosis. Handheld ultrasound devices, due to their portability and ease of use, are perfectly aligned with this trend. They enable physicians to make immediate, informed decisions, especially in emergency situations, thereby potentially saving lives. For example, in trauma centers, where quick decision-making is crucial, the ability to rapidly assess internal bleeding can make the difference between life and death. An article published in the Journal of Emergency Medicine highlighted that with the introduction of handheld ultrasound devices, the time taken for bedside imaging reduced dramatically, enhancing the efficiency of care. Moreover, in primary care settings or in remote areas with limited access to sophisticated diagnostic infrastructure, these devices prove invaluable. They bridge the gap between sophisticated ultrasound machines and immediate patient needs, ensuring that quality care isn't compromised.

Market Opportunity: Expanding into Home Healthcare

Home healthcare is steadily gaining traction, a trend accelerated by the recent global events such as the COVID-19 pandemic. With more patients preferring at-home treatments and monitoring to avoid hospital visits, there's a burgeoning demand for devices that support this mode of healthcare. Handheld ultrasound devices fit seamlessly into this narrative. They can be used by patients under the guidance of healthcare professionals, providing regular updates on health metrics without necessitating frequent hospital visits. A case in point is the monitoring of chronic cardiac patients. A study in the American Journal of Cardiology highlighted that patients using handheld ultrasound devices for at-home monitoring experienced better health outcomes and reduced hospital readmissions compared to those relying solely on periodic hospital-based check-ups.

Market Restraint: Limitations in Imaging Capability

While handheld ultrasound devices offer numerous advantages, they aren't without limitations. Their imaging capability, when compared to traditional, full-sized ultrasound machines, can be somewhat restricted. They might not always provide the detailed imaging required for certain intricate diagnostics. A report in the Radiology Journal emphasized that while handheld devices are exceptional for quick scans and immediate assessments, they might not be the ideal choice for detailed, layered imaging required for complex diagnoses. For instance, when assessing intricate structures of the heart or vascular system, the clarity and depth of traditional devices might be preferred.

Market Challenge: Ensuring Adequate Training for Professionals

The compactness and user-friendly nature of handheld ultrasound devices, paradoxically, also present a challenge. As these devices make their way into various medical settings, ensuring that every healthcare professional is adept at using them becomes a task. Misinterpretations or over-reliance without adequate training could lead to diagnostic errors. An article in the British Medical Journal underscored this, pointing out instances where handheld devices, when used by untrained personnel, led to misdiagnoses, especially in the context of cardiac assessments.

Market Segmentation by Application

The market's segmentation by application comprises Obstetrics/Gynecology, Cardiovascular, Urology, Gastroenterology, Musculoskeletal, Trauma, among others. Obstetrics/Gynecology held the highest revenue in 2023. This segment's dominance can be attributed to the pressing need for real-time imaging during pregnancies and the increasing adoption of these devices in maternal health monitoring. Cardiovascular applications, on the other hand, are expected to register the highest CAGR from 2024 to 2032. The rapid prevalence of cardiovascular diseases worldwide necessitates immediate diagnostics, and handheld devices play a crucial role in immediate assessments, especially during emergencies. Urology and Gastroenterology sectors also witnessed a growing adoption rate, given their demand in outpatient settings and the benefits of quick scans provided by these devices.

Market Segmentation by End-Use

Analyzing the end-use categories, Hospitals, Primary Clinics, and Others (like private practitioners and home healthcare) emerged as key segments. In 2023, Hospitals generated the highest revenue, primarily due to the large volume of patients and the need for immediate imaging in critical care scenarios. However, Primary Clinics are expected to experience the highest CAGR between 2024 and 2032. This can be ascribed to the growing shift towards decentralized healthcare and the increasing number of primary healthcare centers worldwide.

Market Segmentation by Region

From a geographic standpoint, North America held the highest revenue percentage in 2023. Factors like advanced healthcare infrastructure, rapid technological adoption, and the presence of key market players contributed to this dominance. The Asia-Pacific region, however, is expected to witness the highest CAGR from 2024 to 2032. Factors propelling this growth include rising healthcare expenditure, increasing awareness about point-of-care diagnostics, and government initiatives in countries like India and China promoting healthcare decentralization.

Competitive Trends

The competitive landscape of the Handheld Ultrasound Devices market is marked by innovations and strategic alliances. Key players that dominated in 2023 include brands like GE HealthCare, Koninklijke Philips N.V., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., BenQ Medical Technology, CHISON Medical Technologies Co., Ltd., Dawei Medical (Jiangsu) Corp., Ltd., Viatom Technology Co., Ltd., Telemed Medical Systems S.r.l., Butterfly Network, Inc., Pulsenmore Ltd., and LeltekInc. Their dominance is backed by a strong R&D focus, extensive distribution networks, and continuous product enhancements.Notably, collaborations, mergers, and acquisitions are expected to remain a significant strategy for these top players. For instance, GE Healthcare's strategic partnerships with tech companies aim to integrate AI capabilities into their devices, enhancing their diagnostic precision.