TABLE 1 Global Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 2 Global Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 3 Global Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 4 Global Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 5 North America Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 6 North America Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 7 North America Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 8 North America Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 9 U.S. Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 10 U.S. Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 11 U.S. Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 12 U.S. Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 13 Canada Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 14 Canada Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 15 Canada Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 16 Canada Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 17 Rest of North America Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 18 Rest of North America Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 19 Rest of North America Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 20 Rest of North America Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 21 UK and European Union Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 22 UK and European Union Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 23 UK and European Union Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 24 UK and European Union Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 25 UK Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 26 UK Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 27 UK Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 28 UK Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 29 Germany Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 30 Germany Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 31 Germany Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 32 Germany Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 33 Spain Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 34 Spain Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 35 Spain Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 36 Spain Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 37 Italy Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 38 Italy Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 39 Italy Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 40 Italy Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 41 France Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 42 France Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 43 France Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 44 France Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 45 Rest of Europe Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 46 Rest of Europe Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 47 Rest of Europe Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 48 Rest of Europe Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 49 Asia Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 50 Asia Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 51 Asia Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 52 Asia Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 53 China Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 54 China Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 55 China Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 56 China Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 57 Japan Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 58 Japan Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 59 Japan Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 60 Japan Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 61 India Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 62 India Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 63 India Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 64 India Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 65 Australia Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 66 Australia Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 67 Australia Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 68 Australia Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 69 South Korea Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 70 South Korea Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 71 South Korea Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 72 South Korea Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 73 Latin America Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 74 Latin America Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 75 Latin America Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 76 Latin America Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 77 Brazil Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 78 Brazil Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 79 Brazil Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 80 Brazil Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 81 Mexico Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 82 Mexico Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 83 Mexico Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 84 Mexico Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 85 Rest of Latin America Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 86 Rest of Latin America Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 87 Rest of Latin America Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 88 Rest of Latin America Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 89 Middle East and Africa Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 90 Middle East and Africa Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 91 Middle East and Africa Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 92 Middle East and Africa Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 93 GCC Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 94 GCC Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 95 GCC Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 96 GCC Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 97 South Africa Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 98 South Africa Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 99 South Africa Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 100 South Africa Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 101 North Africa Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 102 North Africa Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 103 North Africa Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 104 North Africa Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 105 Turkey Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 106 Turkey Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 107 Turkey Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 108 Turkey Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

TABLE 109 Rest of Middle East and Africa Force Gauge Market By Type, 2022-2032, USD (Million)

TABLE 110 Rest of Middle East and Africa Force Gauge Market By Capacity, 2022-2032, USD (Million)

TABLE 111 Rest of Middle East and Africa Force Gauge Market By Form Factor, 2022-2032, USD (Million)

TABLE 112 Rest of Middle East and Africa Force Gauge Market By Industry Vertical, 2022-2032, USD (Million)

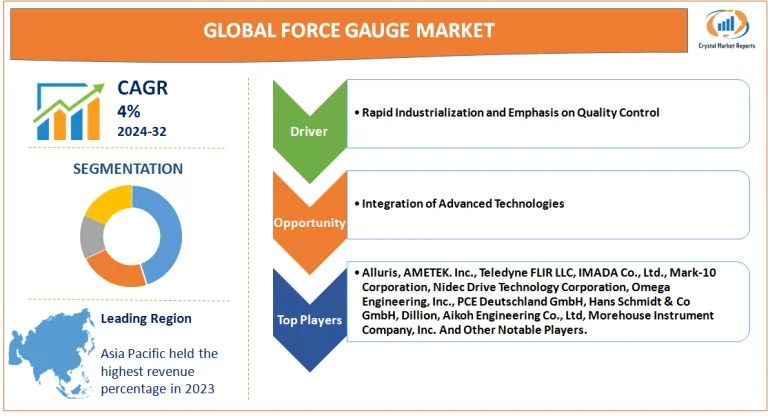

Market Overview

A force gauge is a compact measuring instrument used to gauge force or load. It finds application in a range of sectors, including research, product testing, and quality assurance, to ensure that products comply with respective industry standards. The force gauge market is estimated to grow at a CAGR of 4% from 2024 to 2032.

Force Gauge Market Dynamics

Driver: Rapid Industrialization and Emphasis on Quality Control

In recent years, the rapid pace of industrialization has dramatically impacted the demand for force gauge instruments. As manufacturing processes become more sophisticated, the need for precision in product testing and quality assurance escalates. Evidently, according to the World Bank, the manufacturing value added globally grew at an average of approximately 2% from 2010 to 2020. This uptick in industrial output has directly proportionated with the force gauge market's growth trajectory. Additionally, with consumers becoming more discerning and regulatory bodies imposing stricter quality standards, manufacturers are investing in high-quality force gauges to ensure product reliability. Companies are focusing on ensuring that products, whether they be automotive components or electronic devices, withstand varying forces, thereby cementing the importance of these devices in modern manufacturing units.

Opportunity: Integration of Advanced Technologies

The digital transformation wave offers a significant opportunity for the force gauge market. As IoT (Internet of Things) and AI (Artificial Intelligence) become more mainstream, there's a pronounced trend of these technologies making their way into force gauges. For instance, force gauges now come with features that allow real-time data transfer to cloud platforms, enabling remote monitoring. Also, some modern force gauges are equipped with predictive analytics, allowing users to predict potential wear and tear, thereby enhancing the device's lifespan. The application of such advanced technologies not only enhances the instrument's efficiency but also makes it more user-friendly, presenting a significant opportunity for manufacturers in the force gauge sector.

Restraint: High Cost of Advanced force gauges

One major restraining factor for the force gauge market's growth is the high cost associated with advanced force gauges. While basic models are affordable for small-scale industries, the advanced ones embedded with modern technologies come at a premium. Small and medium enterprises (SMEs), which contribute significantly to global industrial output, often find it challenging to allocate budgets for these premium force gauges. As a testament to this, the World Trade Organization (WTO) noted in one of its reports that SMEs constitute about 90% of businesses globally and more than 50% of employment. The budget constraints of these businesses can hinder the overall market growth.

Challenge: Requirement for Regular Calibration and Maintenance

Another challenge that the force gauge market faces is the need for regular calibration and maintenance. These instruments, especially when used in high-frequency industrial environments, are prone to wear and tear. Regular calibration ensures the device's accuracy, but it also means added costs and downtime, which can affect manufacturing timelines. An article published in the 'Journal of Physics: Conference Series' highlighted the challenges associated with the calibration of force measuring instruments, emphasizing the nuances that can lead to inaccuracies if not addressed appropriately.

Market Segmentation by Type

In 2023, the Digital force gauge segment demonstrated higher revenue generation, predominantly due to the global shift towards digitalization, where industries are more inclined to utilize digital measurement tools for enhanced accuracy and efficiency. Furthermore, the digital force gauge's user-friendly nature, coupled with features like digital displays and real-time data monitoring, made it a preferred choice across various sectors. On the other hand, the Analog (Mechanical) force gauge, which has been a staple in several industries for decades, exhibited the highest CAGR. This could be attributed to their reliability and preference in regions where industries are still transitioning to newer technologies.

Market Segmentation by Industry Verticals

Electronics & Semiconductor emerged as the highest revenue-generating sector in 2023. The meticulous nature of electronics manufacturing and the need for precision has driven the demand for force gauges in this segment. However, the Sports & Recreation segment is anticipated to showcase the highest CAGR from 2024 to 2032. This projection stems from the increasing use of force gauges in sports equipment testing and the growing emphasis on ensuring athletes' safety through equipment quality.

Market Segmentation by Region

From a geographic standpoint, Asia-Pacific dominated the market in terms of revenue in 2023. With manufacturing hubs like China, India, and South Korea concentrating on sectors ranging from electronics to automotive, the demand for force gauges has surged. Additionally, rapid industrialization and initiatives to boost manufacturing sectors in these regions have furthered the demand. Nevertheless, the Middle East & Africa region is expected to register the highest CAGR from 2024 to 2032, owing to burgeoning investments in sectors like Oil & Gas, coupled with the region's diversification efforts to incorporate more industries.

Competitive Trends

The Force gauge market is moderately fragmented with several global and regional players vying for market dominance. In 2023, major players Alluris, AMETEK. Inc., Teledyne FLIR LLC, IMADA Co., Ltd., Mark-10 Corporation, Nidec Drive Technology Corporation, Omega Engineering, Inc., PCE Deutschland GmbH, Hans Schmidt & Co GmbH, Dillion, Aikoh Engineering Co., Ltd, and Morehouse Instrument Company, Inc. held significant market shares, each bringing distinct strategies to the fore. Key strategies adopted by these top players included technological innovations, mergers and acquisitions, and expansion into untapped markets. For instance, the integration of IoT and AI in force gauges has been a focal point for innovation, allowing users to remotely monitor and predict wear and tear. Moreover, the leading players have been investing heavily in R&D to offer more advanced and efficient products, catering to the ever-evolving needs of modern industries. As the market continues its trajectory from 2024 to 2032, companies are expected to further intensify their R&D efforts, foster strategic collaborations, and expand geographically to tap into the potential of emerging markets.