Market Overview

The FMCW (Frequency Modulated Continuous Wave) millimeter-wave radar market refers to the segment of the radar technology industry that specializes in radar systems operating in the millimeter-wave spectrum using frequency-modulated continuous waves. This technology is distinguished by its ability to measure distance, velocity, and angle of objects with high precision and accuracy. A brief overview of this market indicates its diverse applications across various sectors. Primarily used in automotive and aerospace industries, FMCW millimeter-wave radars are crucial for advanced driver-assistance systems (ADAS) and autonomous vehicles. They provide critical data for functions like collision avoidance, lane change assistance, and adaptive cruise control. In aerospace, these radars play a vital role in navigation, terrain mapping, and obstacle detection. The market for FMCW millimeter wave radar is anticipated to experience substantial revenue growth and a notable CAGR during the forecast period from 2024 to 2032.The adoption of FMCW millimeter-wave radar technology has been growing due to its advantages over traditional radar systems. These include better resolution, smaller size, and the ability to detect both stationary and moving objects with high accuracy. This makes them highly suitable for crowded urban environments where precise detection and measurement are crucial.

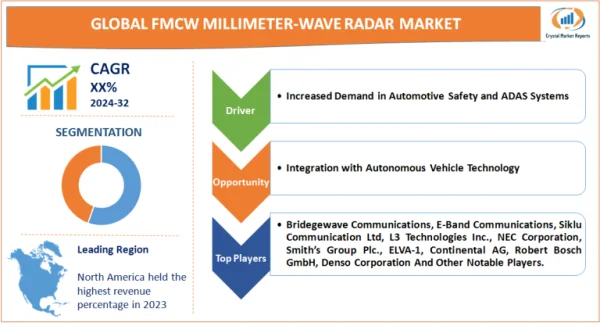

Driver: Increased Demand in Automotive Safety and ADAS Systems

The FMCW millimeter-wave radar market is significantly driven by the increased demand for automotive safety and Advanced Driver Assistance Systems (ADAS). This surge is primarily due to heightened safety regulations and consumer demand for safer vehicles. For instance, the European New Car Assessment Programme (Euro NCAP) has set stringent safety standards, mandating the inclusion of ADAS features for higher safety ratings. These systems rely heavily on radar technologies, including FMCW millimeter-wave radars, for functions like collision avoidance, blind-spot detection, and adaptive cruise control. In the United States, the National Highway Traffic Safety Administration (NHTSA) has been instrumental in advocating for the integration of ADAS in modern vehicles. This regulatory push, combined with consumer awareness about vehicle safety, has propelled the adoption of FMCW millimeter-wave radars in the automotive sector.

Opportunity: Integration with Autonomous Vehicle Technology

Autonomous vehicle technology presents a significant opportunity for the FMCW millimeter-wave radar market. As companies like Tesla, Waymo, and others advance towards full autonomy, the need for reliable, high-resolution radar systems becomes critical. These radars provide essential data for obstacle detection and navigation, especially in complex environments with pedestrians, other vehicles, and various obstacles. The ongoing research and development in autonomous vehicle technology, with an emphasis on improving safety and efficiency, are likely to increase the demand for sophisticated radar systems, offering a substantial opportunity for market growth.

Restraint: High Development Costs

One of the primary restraints in the FMCW millimeter-wave radar market is the high cost associated with the development and implementation of these systems. The production of millimeter-wave radar involves advanced materials and complex manufacturing processes, leading to higher costs compared to traditional radar systems. Additionally, the need for continuous research and development to enhance accuracy and reliability further escalates the expenses. This high cost of development and production can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) and in markets where cost sensitivity is a major factor.

Challenge: Technological Complexity and Integration Issues

A major challenge facing the FMCW millimeter-wave radar market is the technological complexity associated with these systems. The integration of millimeter-wave radar into existing systems, such as vehicles or aerospace platforms, requires intricate design and compatibility considerations. This complexity not only extends to the physical integration but also to the software aspects, where advanced algorithms are needed to process and interpret the radar data accurately. Ensuring seamless integration without interference with other systems, and maintaining performance in diverse environmental conditions, adds layers of complexity to the development and deployment of these radar systems. This challenge is particularly pronounced as the technology continues to evolve rapidly, requiring ongoing adaptation and upgrades.

Market Segmentation by Type

The FMCW millimeter-wave radar market, segmented by type, comprises mainly of the 24GHz, 77GHz, and other frequency bands. Among these, the 77GHz radar segment is experiencing the highest Compound Annual Growth Rate (CAGR) and is also anticipated to generate the highest revenue. This trend is attributed to the superior benefits of the 77GHz frequency band, such as higher resolution, longer range, and better accuracy in object detection compared to the 24GHz band. These attributes make the 77GHz radar more suitable for advanced applications in autonomous driving and ADAS, where precision is paramount. The shift from 24GHz to 77GHz is also driven by regulatory changes in various regions, phasing out the use of 24GHz for automotive radars due to spectrum regulations. Despite this shift, the 24GHz band continues to be used in certain applications due to its lower cost and sufficiency for basic radar functions. The ‘Others’ category, which includes other emerging frequency bands, is also gaining traction, though it is not yet a major contributor to market revenue or growth.

Market Segmentation by Application

In terms of application, the market is segmented into passenger cars and commercial vehicles. The passenger cars segment holds the distinction of having the highest revenue and CAGR within the FMCW millimeter-wave radar market. This dominance is largely due to the increasing incorporation of ADAS features in passenger vehicles, driven by consumer demand and stringent safety regulations. The growing trend towards autonomous vehicles further bolsters this segment, as these vehicles require multiple radar units for comprehensive environmental sensing. On the other hand, the commercial vehicles segment is also experiencing substantial growth. This growth is fueled by the rising emphasis on safety and efficiency in the logistics and transportation sectors, leading to the adoption of radar-based safety systems in trucks, buses, and other commercial vehicles. However, the penetration rate in commercial vehicles is comparatively lower than in passenger cars, due partly to the higher costs and the longer replacement cycle of commercial vehicles. Nevertheless, as safety standards for commercial vehicles tighten and as autonomous technology in this sector advances, this segment is expected to witness accelerated growth in the coming years.

Market Segmentation by Region

In the geographic segmentation of the FMCW millimeter-wave radar market, notable trends indicate variances across different regions, with Asia-Pacific emerging as the region with the highest Compound Annual Growth Rate (CAGR) and North America generating the highest revenue percentage as of 2023. The growth in Asia-Pacific is largely fueled by the rapid expansion of the automotive industry, particularly in China and India, coupled with increasing investments in smart city projects and autonomous vehicle technology. This region is expected to continue its growth trajectory from 2024 to 2032, driven by ongoing industrial advancements and supportive government policies. North America, on the other hand, has been leading in terms of revenue generation, attributed to the early adoption of advanced radar technologies, significant presence of key players, and stringent safety regulations in the automotive sector. The European market also holds a substantial share, underpinned by robust automotive manufacturing capabilities and proactive adoption of safety regulations. From 2024 to 2032, Europe is expected to maintain steady growth, with a focus on incorporating radar technology in autonomous and electric vehicles.

Competitive Trends

In terms of competitive trends and key strategies, the FMCW millimeter-wave radar market is characterized by the presence of major players like Robert Bosch GmbH, Continental AG, Denso Corporation, Infineon Technologies AG, and NXP Semiconductors. In 2023, these companies demonstrated a strong emphasis on research and development, strategic collaborations, and expansion of product portfolios to enhance their market position. Bosch, for instance, has been pivotal in advancing radar technology for automotive applications, leading in both innovation and market share. Continental AG has focused on expanding its global footprint and enhancing its radar product lines, catering to both passenger and commercial vehicles. Denso and Infineon have invested significantly in R&D to develop cutting-edge radar solutions, aligning with the evolving demands of autonomous driving. NXP Semiconductors, known for its semiconductor solutions, has been integral in providing the necessary components for radar systems. From 2024 to 2032, these companies are expected to continue their strategic shifts, focusing on innovation, partnerships, and geographical expansion to capitalize on emerging opportunities in autonomous vehicles, smart cities, and ADAS. The competitive landscape is anticipated to become more dynamic with the entry of new players and the adoption of advanced technologies like AI and machine learning in radar systems, further driving market growth and transformation.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.