TABLE 1 Global Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 2 Global Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 3 Global Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 4 Global Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 5 Global Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 6 North America Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 7 North America Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 8 North America Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 9 North America Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 10 North America Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 11 U.S. Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 12 U.S. Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 13 U.S. Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 14 U.S. Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 15 U.S. Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 16 Canada Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 17 Canada Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 18 Canada Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 19 Canada Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 20 Canada Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 21 Rest of North America Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 22 Rest of North America Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 23 Rest of North America Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 24 Rest of North America Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 25 Rest of North America Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 26 UK and European Union Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 27 UK and European Union Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 28 UK and European Union Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 29 UK and European Union Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 30 UK and European Union Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 31 UK Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 32 UK Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 33 UK Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 34 UK Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 35 UK Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 36 Germany Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 37 Germany Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 38 Germany Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 39 Germany Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 40 Germany Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 41 Spain Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 42 Spain Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 43 Spain Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 44 Spain Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 45 Spain Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 46 Italy Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 47 Italy Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 48 Italy Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 49 Italy Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 50 Italy Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 51 France Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 52 France Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 53 France Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 54 France Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 55 France Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 56 Rest of Europe Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 57 Rest of Europe Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 58 Rest of Europe Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 59 Rest of Europe Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 60 Rest of Europe Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 61 Asia Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 62 Asia Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 63 Asia Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 64 Asia Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 65 Asia Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 66 China Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 67 China Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 68 China Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 69 China Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 70 China Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 71 Japan Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 72 Japan Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 73 Japan Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 74 Japan Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 75 Japan Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 76 India Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 77 India Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 78 India Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 79 India Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 80 India Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 81 Australia Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 82 Australia Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 83 Australia Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 84 Australia Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 85 Australia Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 86 South Korea Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 87 South Korea Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 88 South Korea Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 89 South Korea Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 90 South Korea Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 91 Latin America Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 92 Latin America Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 93 Latin America Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 94 Latin America Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 95 Latin America Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 96 Brazil Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 97 Brazil Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 98 Brazil Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 99 Brazil Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 100 Brazil Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 101 Mexico Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 102 Mexico Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 103 Mexico Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 104 Mexico Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 105 Mexico Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 106 Rest of Latin America Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 107 Rest of Latin America Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 108 Rest of Latin America Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 109 Rest of Latin America Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 110 Rest of Latin America Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 111 Middle East and Africa Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 112 Middle East and Africa Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 113 Middle East and Africa Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 114 Middle East and Africa Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 115 Middle East and Africa Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 116 GCC Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 117 GCC Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 118 GCC Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 119 GCC Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 120 GCC Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 121 South Africa Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 122 South Africa Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 123 South Africa Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 124 South Africa Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 125 South Africa Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 126 North Africa Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 127 North Africa Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 128 North Africa Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 129 North Africa Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 130 North Africa Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 131 Turkey Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 132 Turkey Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 133 Turkey Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 134 Turkey Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 135 Turkey Flame Retardant Market By End-Use, 2022-2032, USD (Million)

TABLE 136 Rest of Middle East and Africa Flame Retardant Market By Product, 2022-2032, USD (Million)

TABLE 137 Rest of Middle East and Africa Flame Retardant Market By Halogenated, 2022-2032, USD (Million)

TABLE 138 Rest of Middle East and Africa Flame Retardant Market By Non-Halogenated, 2022-2032, USD (Million)

TABLE 139 Rest of Middle East and Africa Flame Retardant Market By Application, 2022-2032, USD (Million)

TABLE 140 Rest of Middle East and Africa Flame Retardant Market By End-Use, 2022-2032, USD (Million)

Market Overview

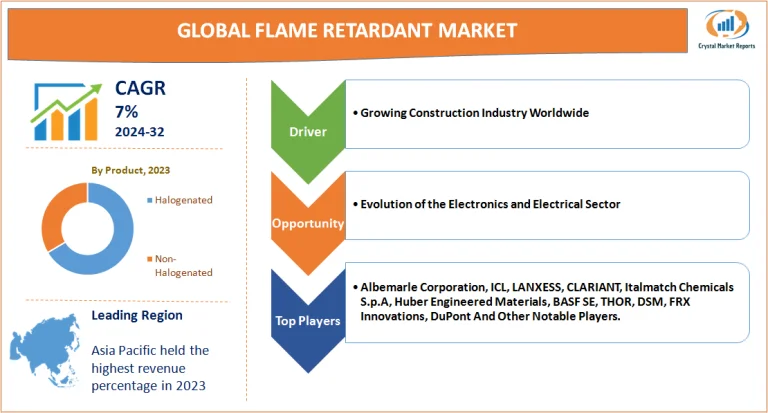

The flame retardant market revolves around substances that are added to potentially combustible materials to prevent, delay, or slow down the process of combustion. These compounds are pivotal in ensuring safety across various sectors, notably in textiles, plastics, and construction materials. As industries expand and modern structures become more intricate, the need for such compounds has only escalated, driving the dynamics of the flame retardant market. The flame retardant market is estimated to grow at a CAGR of 7% from 2024 to 2032.

Flame Retardant Market Dynamics

Driver: Growing Construction Industry Worldwide

One primary driver promoting the growth of the flame retardant market is the burgeoning construction industry across the globe. As urbanization rapidly advances, especially in emerging economies, there is an amplified demand for commercial and residential spaces. This has led to increased construction activities, where flame retardants become essential to ensure the safety of these structures. Safety Regulations: Governments and regulatory bodies worldwide have been stringent in implementing safety standards, requiring the application of flame retardants in building materials. For instance, the International Building Code necessitates specific fire safety criteria that buildings must adhere to, thus mandating the use of flame retardants. Anecdotal evidences, such as the unfortunate Grenfell Tower fire in London, underscore the paramount importance of flame retardants. Such incidents, which resulted in catastrophic loss, have heightened awareness regarding fire safety, compelling builders and contractors to integrate flame retardants comprehensively in their materials.

Opportunity: Evolution of the Electronics and Electrical Sector

The surge in the electronics and electrical sector presents a lucrative opportunity for the flame retardant market. As devices become smaller and more compact, their internal components are closely packed, increasing the risk of overheating and potential fires. flame retardants in these devices ensure they operate safely even under such constraints. With smartphones, laptops, and other gadgets becoming ubiquitous, there's an evident rise in consumer electronics consumption. News stories about phones or chargers catching fire due to faulty components or batteries have made consumers more safety-conscious. Manufacturers, keen on maintaining their brand's reputation, are therefore more inclined to incorporate flame retardants in their products. E-mobility: The push towards electric vehicles also requires flame retardants, especially considering the dense configuration of batteries and the potential risks associated with them.

Restraint: Environmental and Health Concerns

Despite its many applications, the flame retardant market faces significant restraints in the form of environmental and health concerns. Certain flame retardants, when released into the environment, have shown to be persistent and bio-accumulative. They can disrupt aquatic ecosystems, impacting marine life adversely. Studies have indicated that prolonged exposure to specific flame retardants might lead to health issues. For instance, there have been reports suggesting potential links between some flame retardants and hormonal imbalances, leading to concerns about their extensive use. Regulatory Hurdles: Due to the above issues, many governments have started regulating the use of certain flame retardants. The European Union, for example, has restricted the use of particular retardants under its REACH regulations.

Challenge: Need for Innovative and Safe flame retardants

One pressing challenge is the urgent requirement for innovative flame retardants that are both effective and environmentally benign. Manufacturers are grappling with creating retardants that provide optimum fire resistance without compromising on the material's mechanical properties. As safety norms become more stringent and specific, the industry needs retardants that can meet these evolving benchmarks. Sustainability: The modern consumer is environmentally conscious. This awareness has seeped into industries, urging them to seek sustainable alternatives. flame retardants that are green and have a minimal carbon footprint are the need of the hour. Yet, developing such retardants without compromising on their efficacy is a monumental challenge.

Product Insights

In 2023, the two principal products that defined the market landscape were Halogenated and Non-Halogenated flame retardants. Halogenated flame retardants, due to their effectiveness and established presence, have historically dominated the revenue charts. With a robust market share, these retardants found wide acceptance, especially in sectors where fire safety standards were supremely stringent. Their propensity to disrupt the radical chain reaction during combustion made them the go-to choice for many industries. However, the rising environmental and health concerns tied to halogenated compounds posed challenges. On the other hand, Non-Halogenated flame retardants, though lagging in terms of past revenue, exhibited the highest Compound Annual Growth Rate (CAGR). Their growth trajectory was largely attributed to the escalating demand for environmentally friendly alternatives. With industries becoming progressively eco-conscious, non-halogenated flame retardants were seen as the sustainable future, and their adoption was expected to surge between 2024 to 2032.

Application Insights

In 2023, Polyolefins accounted for the highest revenue share, primarily due to their widespread use in various products, from automotive parts to consumer goods. Their inherent flammable nature mandated the use of effective flame retardants. However, in terms of growth rate, Epoxy Resins were the dark horses, exhibiting the highest CAGR. This was expected since epoxy resins, vital for the electronics industry, were witnessing exponential demand with the electronics boom, thus necessitating increased flame retardant integration for safety.

Regional Insights

Geographically, Asia-Pacific (APAC) led in both fronts: revenue generation in 2023 and projected CAGR from 2024 to 2032. Rapid industrialization, coupled with expanding construction and electronics sectors, were pivotal for the APAC market's dominance. Cities mushrooming overnight and the electronic consumption habits of the middle-class populace propelled the demand for flame retardants. However, Europe, with its stringent regulations, especially the REACH regulations, showcased a different dynamic. While it might not have seen the highest growth rate, the demand for eco-friendly flame retardants was highest here, setting trends for the rest of the world.

Competitive Trends

From a competitive standpoint, the market landscape was intensely contested. Leading players as of 2023, such as Albemarle Corporation, ICL, LANXESS, CLARIANT, Italmatch Chemicals S.p.A, Huber Engineered Materials, BASF SE, THOR, DSM, FRX Innovations, and DuPont, held significant market shares, with strategies heavily oriented towards R&D and innovation. These giants consistently endeavored to balance effectiveness with eco-friendliness, trying to stay ahead of both regulatory curves and market demands. Mergers, acquisitions, and collaborations were also rife, as companies aimed to consolidate their market positions and expand their portfolios. For the forecast period of 2024 to 2032, the competitive trend was expected to incline towards sustainable solutions, with companies likely to invest heavily in green alternatives, ensuring they remain both effective as flame retardants and environmentally benign.