Market Overview

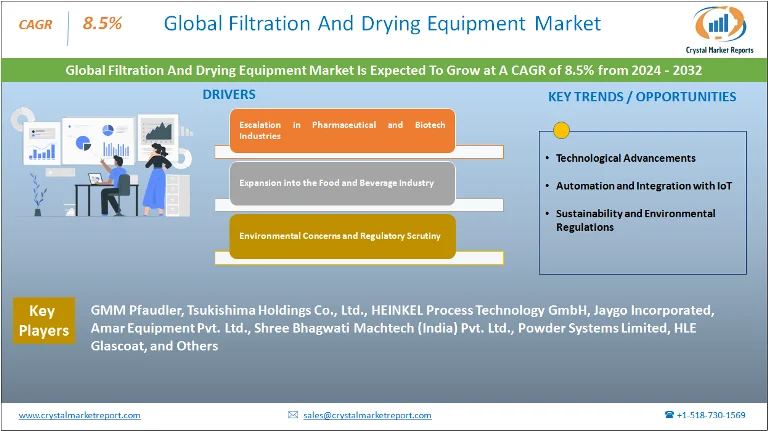

The filtration and drying equipment market encompasses a vast array of equipment primarily designed for the purpose of separating solids from liquids and ensuring the drying of various products in several industries, from pharmaceuticals and chemicals to food processing and biotechnology. As modern industries strive for efficiency and quality, the significance of these equipment continues to surge. The filtration and drying equipment market is estimated to grow at a CAGR of 8.5% from 2024 to 2032.

Filtration And Drying Equipment Market Dynamics

Driver: Escalation in Pharmaceutical and Biotech Industries

A compelling driver for the filtration and drying equipment market is the remarkable growth in the pharmaceutical and biotechnology sectors. The past few years have witnessed a rise in R&D activities, drug discoveries, and a slew of biotechnological experiments. The development and production of complex drugs, especially biologics, require stringent filtration and drying processes to ensure purity and stability.The World Health Organization reported that the global pharmaceuticals market is worth $1.2 trillion, with a growth rate of 5-6% annually. Furthermore, the biotechnology sector, according to the International Trade Administration, has been seeing consistent double-digit growth, marking its importance in the modern medical landscape.

Opportunity: Expansion into the Food and Beverage Industry

The food and beverage industry offers a lucrative opportunity for the filtration and drying equipment Market. With rising consumer demand for quality, longevity, and purity in food products, manufacturers are leaning towards advanced filtration and drying methodologies. These equipment ensure that food products are free from contaminants, have a longer shelf life, and retain their nutritional value.The Food and Agriculture Organization (FAO) highlights that global food consumption patterns are changing, with a more significant emphasis on processed and preserved foods. Additionally, the beverage industry, particularly the craft beer segment, which requires intensive filtration, has seen a steady growth, accounting for 24% of the U.S. beer market by volume.

Restraint: High Installation and Maintenance Costs

One major restraint in this market is the substantial costs associated with the installation and maintenance of filtration and drying equipment. Advanced machinery, which often employs cutting-edge technology for accuracy and efficiency, comes with a hefty price tag. Moreover, regular maintenance, which is crucial for the longevity and functionality of the equipment, adds to the operational expenses of organizations.A report by the Processing Magazine highlighted that maintenance and repair costs of filtration and drying equipment can range from 3% to 6% of the original equipment cost annually, depending on the complexity and usage. For many small to medium-sized enterprises, this proves to be a financial challenge.

Challenge: Environmental Concerns and Regulatory Scrutiny

An emerging challenge in the market is the growing environmental concerns and regulatory scrutiny associated with the waste produced during filtration and drying processes. Many industries, especially chemicals and pharmaceuticals, produce waste that may be harmful to the environment. Disposing of or treating this waste becomes a challenge, and non-compliance with environmental regulations can lead to penalties.The Environmental Protection Agency (EPA) has been tightening regulations around waste disposal, especially from industrial sources. The Resource Conservation and Recovery Act (RCRA) mandates the proper treatment and disposal of hazardous waste. Non-compliance can lead to substantial fines, with some exceeding $70,000 per day, per violation.

Market Segmentation by Technology

In 2023, among the various technologies, Centrifuges held the highest revenue position. These mechanical devices, employing rotational force to separate materials, have been historically favored in multiple industries, from pharmaceuticals to wastewater treatment, for their efficiency. On the other hand, Agitated Nutsche Filter-Dryers (ANFD), combining filtering, washing, and drying processes in a single unit, are projected to register the Highest CAGR from 2024 to 2032. Their increased adoption can be attributed to their compact nature and versatility, especially in industries where space is at a premium.

Market Segmentation by End-use

End-use analysis for 2023 reveals that the Pharmaceutical sector dominated in terms of revenue. With an ever-increasing global demand for drugs and biologics, filtration and drying play a crucial role in ensuring the production of pure and stable formulations. However, the Water & Wastewater Treatment sector is expected to exhibit the highest CAGR between 2024 and 2032. This can be associated with escalating global concerns over water scarcity and the urgency to treat and reuse wastewater, especially in emerging economies.

Market Segmentation by Region

Geographically, North America, in 2023, had commanded the most significant revenue share in the filtration and drying equipment market, driven by advanced industrial infrastructure, substantial R&D investments, and strict regulatory mandates in sectors like pharmaceuticals. Asia-Pacific, however, is anticipated to outpace other regions in terms of CAGR from 2024 to 2032. Rapid industrialization, coupled with expanding pharmaceutical and water treatment sectors in countries like China and India, underlines this growth. Additionally, the region's growing focus on sustainable practices is pushing industries to invest in efficient filtration and drying solutions.

Competitive Trends

In terms of competitive trends, 2023 witnessed fierce competition among major players. Companies like GMM Pfaudler, Tsukishima Holdings Co., Ltd., HEINKEL Process Technology GmbH, Jaygo Incorporated, Amar Equipment Pvt. Ltd., Shree Bhagwati Machtech (India) Pvt. Ltd., Powder Systems Limited, and HLE Glascoat have been pivotal in shaping the market landscape. Their strategies have often revolved around technological innovations, mergers, and acquisitions. For instance, GEA Group's introduction of more energy-efficient centrifuges or BUCHI's advancements in mini spray dryers set new industry standards. Looking forward to the period of 2024 to 2032, it is expected that companies will double down on research and development to introduce more environmentally-friendly and efficient solutions. Collaborations with end-users, like pharmaceutical companies or wastewater treatment plants, will likely be a key strategy, ensuring tailored solutions that address specific needs.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.