TABLE 1 Global Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 2 Global Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 3 Global Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 4 North America Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 5 North America Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 6 North America Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 7 U.S. Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 8 U.S. Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 9 U.S. Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 10 Canada Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 11 Canada Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 12 Canada Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 13 Rest of North America Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 14 Rest of North America Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 15 Rest of North America Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 16 UK and European Union Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 17 UK and European Union Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 18 UK and European Union Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 19 UK Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 20 UK Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 21 UK Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 22 Germany Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 23 Germany Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 24 Germany Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 25 Spain Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 26 Spain Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 27 Spain Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 28 Italy Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 29 Italy Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 30 Italy Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 31 France Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 32 France Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 33 France Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 37 Asia Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 38 Asia Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 39 Asia Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 40 China Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 41 China Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 42 China Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 43 Japan Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 44 Japan Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 45 Japan Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 46 India Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 47 India Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 48 India Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 49 Australia Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 50 Australia Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 51 Australia Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 52 South Korea Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 53 South Korea Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 54 South Korea Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 55 Latin America Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 56 Latin America Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 57 Latin America Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 58 Brazil Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 59 Brazil Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 60 Brazil Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 61 Mexico Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 62 Mexico Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 63 Mexico Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 70 GCC Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 71 GCC Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 72 GCC Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 73 South Africa Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 74 South Africa Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 75 South Africa Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 76 North Africa Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 77 North Africa Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 78 North Africa Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 79 Turkey Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 80 Turkey Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 81 Turkey Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Dual Flap Dispensing Closure Market By Material, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Dual Flap Dispensing Closure Market By Application, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Dual Flap Dispensing Closure Market By End-Use, 2022-2032, USD (Million)

Market Overview

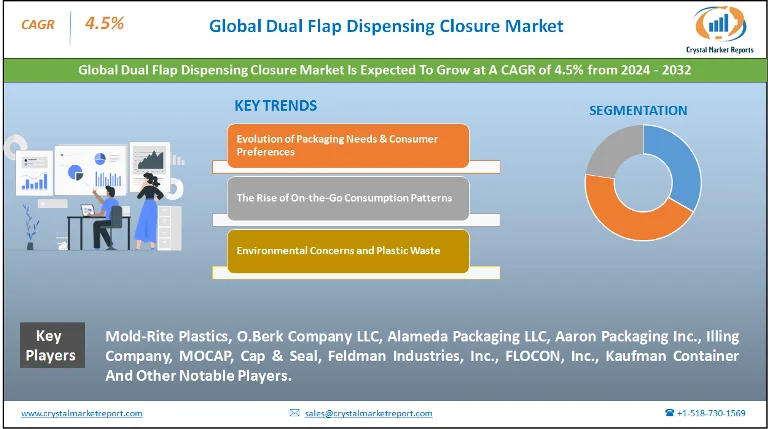

The dual flap dispensing closure market pertains to the sector of closures that encompasses lids or covers with dual flaps, primarily designed for dispensing contents in a controlled manner. These closures find extensive applications in sectors ranging from food and beverages to pharmaceuticals and personal care products. They are revered for their capacity to maintain the freshness of the product while offering easy dispensing. The dual flap dispensing closure market is estimated to grow at a CAGR of 4.5% from 2024 to 2032.

Dual Flap Dispensing Closure Market Dynamics

Driving: Evolution of Packaging Needs & Consumer Preferences

The rise in demand for dual flap dispensing closures has been propelled by the dynamic evolution of packaging needs and aligned consumer preferences. Modern consumers are inclined towards packaging solutions that offer both convenience and functionality. With dual flaps, users can choose between different dispensing sizes or mechanisms, offering them control over the dispensation of the product. Moreover, evidence of this trend can be seen in the everyday products we use. For instance, seasoning containers now often come with dual flaps: one side with larger holes for liberal seasoning and another with smaller ones for controlled sprinkling. Such intuitive designs elevate user experience, thereby driving manufacturers to adopt these closures over traditional ones.

Opportunity: The Rise of On-the-Go Consumption Patterns

There's a palpable shift in consumption patterns, with more people consuming products on-the-go, be it food, beverages, or personal care items. Dual flap dispensing closures fit right into this scheme, as they prevent spillage and allow controlled dispensation – vital for on-the-go consumption. A simple observation can be made in travel-friendly shampoo bottles or mini condiment packs. Their closures often have a dual-flap mechanism to facilitate ease of use while traveling, providing a mess-free experience. This growing trend of on-the-move consumption presents a golden opportunity for market expansion.

Restraint: Environmental Concerns and Plastic Waste

One significant restraint faced by the dual flap dispensing closure market is the increasing scrutiny on plastic usage and the resultant environmental footprint. Given that a considerable proportion of these closures are plastic-based, they contribute to the burgeoning problem of plastic waste. Several countries, pushing for reduced plastic usage, have rolled out stringent regulations, which directly impact the market. A clear indication of this trend is the widespread campaigns and movements advocating for sustainable packaging, causing manufacturers to reevaluate their production strategies.

Challenge: Advent of Alternative Dispensing Mechanisms

While dual flap dispensing closures offer versatility, they face stiff competition from alternative dispensing mechanisms. Innovations like pump dispensers, twist caps, and single-flap ergonomic designs challenge the market dominance of dual flaps. For instance, many cosmetic brands have transitioned to pump dispensers for their precision and ease, even in products where dual flaps were traditionally used. Such shifts present a considerable challenge for the dual flap dispensing closure market.

Market Segmentation by Material

Among the materials, Polypropylene (PP) had recorded the highest revenue in 2023. It's a popular choice due to its resistance to chemicals, elasticity, and fatigue, making it ideal for repeated opening and closing actions of dual flap dispensing closures. Furthermore, PP’s dominance is expected to persist, considering its cost-effectiveness and versatility. Meanwhile, High-density Polyethylene (HDPE) showcased the highest CAGR. Its rise can be attributed to its durability, strength, and the increasing preference for eco-friendly materials. HDPE's growth trajectory indicates its potential to challenge PP’s dominance in the future. Other material-based closures, while significant, trailed behind these two in both revenue and growth rate, yet continue to fill niche requirements.

Market Segmentation by Application

In the realm of applications, Spices, Condiments, and Seasonings led the revenue charts in 2023. The everyday utility of these products and the need for controlled dispensation ensured dual flap closures' prominence in this sector. Expectedly, this segment is forecasted to maintain its lead, given the ubiquity of these products. However, the Confectionary & Baking Products segment boasted the highest CAGR. The surging popularity of home baking and gourmet cooking, coupled with the convenience of dual flap closures in dispensing precise quantities, fuels this growth. Sweeteners and Other Applications, while vital, showed moderate growth, but their role in diversifying the application of these closures cannot be undermined.

Market Segmentation by Region

Geographically, Asia-Pacific had dominated the revenue share in 2023, driven by booming economies like China and India with massive consumer bases and burgeoning food and cosmetic industries. Meanwhile, Europe is projected to exhibit the highest CAGR from 2024 to 2032, propelled by its stringent packaging regulations and a shift towards convenient, yet sustainable packaging solutions. North America, with its mature market, continues to be a steady contributor, focusing more on innovative dispensing mechanisms.

Competitive Trends

In the competitive landscape, major players had actively adopted strategies like mergers, acquisitions, and innovative product launches in 2023. Companies like Mold-Rite Plastics, O.Berk Company LLC, Alameda Packaging LLC, Aaron Packaging Inc., Illing Company, MOCAP, Cap & Seal, Feldman Industries, Inc., FLOCON, Inc., and Kaufman Container had been frontrunners, setting industry benchmarks. The emphasis has been on creating closures that are user-friendly, sustainable, and aligned with modern design aesthetics. As we navigate through 2024 to 2032, companies are expected to delve deeper into sustainable solutions, automation in manufacturing, and expanding their global footprints.