Market Overview

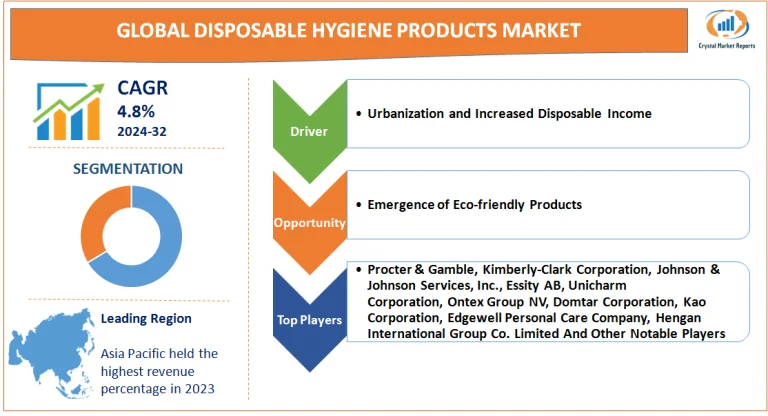

The disposable hygiene products market encompasses a broad spectrum of products designed for one-time or short-term use, primarily centered around personal hygiene and cleanliness. These items range from baby diapers, sanitary napkins, and tampons to adult incontinence products and tissues. The market's growth and reach have steadily expanded, particularly in regions where awareness about personal hygiene has significantly increased. The disposable hygiene products market is estimated to grow at a CAGR of 4.8% from 2024 to 2032.

Disposable Hygiene Products Market Dynamics

Driver: Urbanization and Increased Disposable Income

One of the most prominent drivers for the growth of the disposable hygiene products market is rapid urbanization coupled with increased disposable income. As individuals move from rural to urban settings, there's a shift in lifestyle and consumption patterns. Urban settings offer better access to modern amenities, including retail spaces where disposable hygiene products are readily available. Furthermore, with better job opportunities and increased income, urban consumers can afford these products. An instance that showcases this trend is the uptick in sales of disposable hygiene products in rapidly urbanizing nations in Asia, like India and China, where cities are expanding, and the middle class is growing. This driver doesn't merely point towards the availability of these products but also the growing awareness and value associated with personal hygiene that urban living brings forth.

Opportunity: Emergence of Eco-friendly Products

As environmental concerns gain traction globally, there's a burgeoning opportunity for eco-friendly disposable hygiene products. Consumers are becoming more environmentally conscious and seek products that align with their values. Manufacturers are now exploring materials that are biodegradable or sourced sustainably. For instance, certain brands have started introducing sanitary napkins made from bamboo fiber or organic cotton, which are both biodegradable and less harmful to the environment. This shift not only appeals to eco-conscious consumers but also offers an avenue for brands to differentiate themselves in a competitive market.

Restraint: Environmental Concerns and Waste Management

Conversely, the very nature of these products being 'disposable' also acts as a restraint. Environmental concerns over the waste generated by disposable hygiene products are substantial. Many of these products, especially traditional ones, take hundreds of years to decompose, leading to significant landfill and environmental issues. For instance, the disposal of non-biodegradable sanitary napkins and diapers has been a pressing environmental concern in several countries. Furthermore, flushing certain products like wipes can lead to blockages in city sewage systems, a problem major cities in Europe and North America have started addressing.

Challenge: Cultural Barriers and Taboos

A challenge the disposable hygiene products market faces, particularly in certain regions, is cultural taboos and misconceptions. In many societies, particularly in certain parts of Africa and Asia, menstruation and topics related to adult incontinence are taboo. This results in a lack of knowledge and awareness about disposable hygiene products designed for these purposes. For instance, in some regions, the use of tampons is met with misconceptions related to virginity. Such cultural barriers not only hamper the adoption of these products but also present challenges in terms of marketing and education for companies operating in these regions.

Market Segmentation by Product

The product landscape of this market is broad, but certain segments stand out both in terms of their Compound Annual Growth Rate (CAGR) and their contribution to overall revenue. Sanitary Napkins, given the vast population of menstruating individuals globally, have historically shown strong revenue figures. In 2023, they were among the highest revenue-generating products. Baby Diapers, on the other hand, have been showcasing a higher CAGR, especially in developing countries where the birth rate is higher and awareness and affordability of disposable baby care products have grown. Another noteworthy mention is the Adult Diapers segment. As the global population ages, especially in regions like Europe and Japan, the demand for adult incontinence products has surged. In terms of CAGR from 2024 to 2032, Adult Diapers are expected to be among the fastest-growing segments.

Market Segmentation by Distribution Channel

In 2023, Supermarkets/Hypermarkets dominated as the most significant distribution channel in terms of revenue. This dominance was due to the convenience of one-stop shopping and the broad variety they offer. However, the Online segment, with its ease of access, home delivery, and often discounted prices, has been showing an impressive CAGR. With the digital boom and post-pandemic shopping behaviors, Online channels are expected to witness an even faster growth rate from 2024 to 2032.

Geographic Segment

Geographically, Asia-Pacific (APAC) dominated the market in 2023, accounting for the highest revenue percent. This was attributed to the vast population in countries like India and China and increased awareness of personal hygiene. However, when observing CAGR, the African region stands out. With growing urbanization and increasing disposable incomes in African countries, it's anticipated that from 2024 to 2032, Africa will see the fastest growth in demand for disposable hygiene products.

Competitive Trends

The market for disposable hygiene products is quite competitive, with several major players vying for market share. In 2023, companies like Procter & Gamble, Kimberly-Clark Corporation, Johnson & Johnson Services, Inc., Essity AB, Unicharm Corporation, Ontex Group NV, Domtar Corporation, Kao Corporation, Edgewell Personal Care Company, and Hengan International Group Co. Limited had significant shares in the market. Their dominance can be attributed to their expansive product portfolios, strong distribution networks, and extensive marketing campaigns. As we look towards the forecasted period of 2024 to 2032, these players are expected to adopt strategies like mergers and acquisitions, launching eco-friendly products, and expanding in emerging markets to stay ahead. There's a clear emphasis on sustainability as the next big competitive edge, with several companies venturing into biodegradable and organic product lines to meet the growing demand from environmentally conscious consumers.