Market Overview

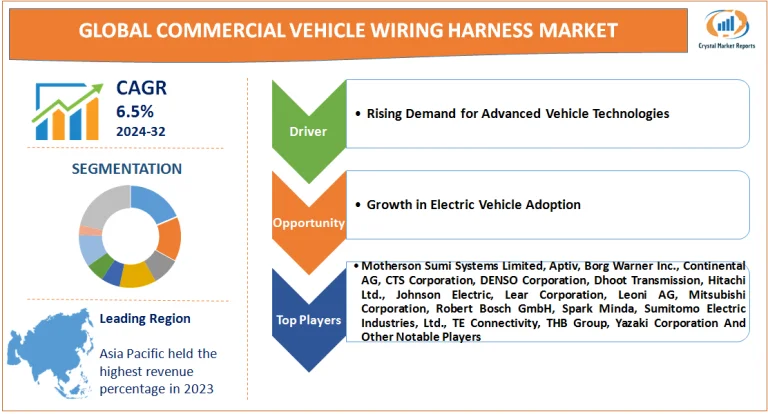

The commercial vehicle wiring harness market involves the production and distribution of wiring harness systems specifically designed for commercial vehicles. A wiring harness is an organized set of wires, terminals, and connectors that run throughout the entire vehicle and relay information and electric power, thereby playing a critical role in connecting a variety of components. In commercial vehicles, these harnesses are designed to handle complex systems and heavy-duty applications, ranging from basic lighting functions to advanced electronic systems for navigation, safety, and engine performance. The commercial vehicle wiring harness market is estimated to grow at a CAGR of 6.5% from 2024 to 2032.The market for commercial vehicle wiring harnesses is a crucial segment of the automotive industry. It has gained importance with the increasing complexity of vehicle electronics and the growing demand for efficient, safe, and reliable commercial transportation. The market is driven by the rising production of commercial vehicles, technological advancements in vehicle electronics, and stringent regulations regarding vehicle safety and emissions, which necessitate sophisticated electrical systems.

Commercial Vehicle Wiring Harness Market Dynamics

Driver: Rising Demand for Advanced Vehicle Technologies

A primary driver of the commercial vehicle wiring harness market is the rising demand for advanced vehicle technologies, particularly in the realm of safety, efficiency, and connectivity. Modern commercial vehicles are increasingly equipped with sophisticated systems such as advanced driver-assistance systems (ADAS), telematics, and efficient powertrain technologies. These advancements require complex wiring harness systems to integrate various electronic components seamlessly. For instance, the integration of ADAS in commercial vehicles, which includes features like lane departure warnings and automatic emergency braking, necessitates a more intricate network of sensors and wiring. This trend towards advanced technologies is not only driven by consumer demand but also by stringent regulatory standards focusing on vehicle safety and emissions, pushing manufacturers to adopt sophisticated electrical architectures.

Opportunity: Growth in Electric Vehicle Adoption

An emerging opportunity within the market is the growth in the adoption of electric commercial vehicles. The global shift towards electrification in the automotive sector, driven by environmental concerns and the need for sustainable transportation solutions, is leading to an increased demand for specialized wiring harnesses. Electric vehicles (EVs) have different wiring requirements compared to traditional internal combustion engine vehicles, with a focus on high-voltage harnesses for battery management systems, electric motors, and power distribution. As the production of electric commercial vehicles accelerates, the need for EV-specific wiring harness systems presents a significant growth opportunity for the market.

Restraint: Complexity in Design and Integration

A major restraint in the commercial vehicle wiring harness market is the complexity involved in the design and integration of modern wiring harness systems. As commercial vehicles become more technologically advanced, the wiring harnesses required become more complex and challenging to design and manufacture. This complexity can lead to increased production time and higher costs, posing a challenge for manufacturers in maintaining efficiency and profitability. Moreover, the integration of these complex systems into vehicles must be done without compromising on reliability and safety, adding another layer of challenge in the production process.

Challenge: Adapting to Technological Evolution

The market faces the challenge of rapidly adapting to technological evolution and changing industry standards. The automotive industry is characterized by continuous innovation, with new technologies and features being developed at a rapid pace. Wiring harness manufacturers must stay abreast of these technological changes and evolve their products accordingly. This requires constant research and development efforts, as well as the flexibility to adapt manufacturing processes to new requirements. Additionally, as the industry moves towards more sustainable practices, there is a growing need to develop environmentally friendly and lightweight materials for wiring harnesses, further adding to the challenge.

Market Segmentation by Vehicle Type

In the commercial vehicle wiring harness market, segmentation by vehicle type includes Light Duty Commercial Vehicles, Heavy Trucks, Buses & Coaches, and Off-road Vehicles. The Heavy Trucks segment is expected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032. This growth can be attributed to the increasing demand for heavy trucks in transportation and logistics, driven by global trade and e-commerce growth. Heavy trucks require robust and complex wiring harness systems to support their large electrical loads and sophisticated electronic systems, fueling the demand in this segment. Despite the rapid growth of the Heavy Trucks segment, in 2023, the highest revenue was generated by the Light Duty Commercial Vehicles segment. This dominance is due to the widespread use of these vehicles in a variety of sectors, including delivery services, utilities, and construction. The versatility and high volume of light-duty commercial vehicles contribute to their leading position in terms of market revenue.

Market Segmentation by Application

Regarding market segmentation by application, the categories include Engine Harness, Chassis Automotive Wiring Harness, Body & Lighting Harness, HVAC Automotive Wiring Harness, Dashboard/ Cabin Harness, Battery Automotive Wiring Harness, Seat Automotive Wiring Harness, Sunroof Automotive Wiring Harness, and Door Automotive Wiring Harness. The Engine Harness segment is anticipated to experience the highest CAGR from 2024 to 2032. This trend is driven by the increasing complexity of engine systems in commercial vehicles, especially with the integration of advanced technologies for emissions control and fuel efficiency. Engine harnesses are integral in connecting various sensors and electronic components within the engine, making them crucial for vehicle performance. However, the Body & Lighting Harness segment accounted for the highest revenue in 2023. This segment's leading position is due to the essential role of these harnesses in powering and connecting a vehicle's lighting systems and other body-related electrical components, which are fundamental in all types of commercial vehicles.

Market Segmentation by Region

In the commercial vehicle wiring harness market, geographic segmentation reveals varied trends and growth dynamics across different regions. The Asia-Pacific region, particularly countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032. This expected growth is driven by the rapid industrialization and urbanization in these emerging economies, coupled with the increasing production of commercial vehicles to meet the growing demand for transportation and logistics services. The expansion of manufacturing capabilities and the presence of a large consumer base in the Asia-Pacific region also contribute to this growth trend. In contrast, in 2023, the highest revenue share was accounted for by Europe. This dominance can be attributed to the region's well-established automotive industry, stringent regulatory standards for vehicle safety and emissions, and the presence of major commercial vehicle manufacturers and component suppliers.

Competitive Trends

In terms of competitive trends and key players in the market, companies like Motherson Sumi Systems Limited, Aptiv, Borg Warner Inc., Continental AG, CTS Corporation, DENSO Corporation, Dhoot Transmission, Furakawa Electric Co., Ltd., Hella GmbH & Co., KGaA, Hitachi Ltd., Johnson Electric, Lear Corporation, Leoni AG, MAHLE GmbH, Martin Technologies, Mitsubishi Corporation, Nidec Motors & Actuators, Robert Bosch GmbH, Robertshaw Controls Pvt. Ltd., Spark Minda, Sumitomo Electric Industries, Ltd., TE Connectivity, THB Group, Valeo, WABCO, and Yazaki Corporation were among the prominent players in 2023. These companies have established strong market positions through continuous innovation, strategic partnerships, and a focus on quality and reliability. Yazaki Corporation, for instance, has been a leader in automotive wiring harness manufacturing, focusing on expanding its global footprint and investing in new technologies. Sumitomo Electric Industries has concentrated on developing high-quality wiring harnesses for various vehicle types, while Aptiv PLC has emphasized advanced wiring solutions for more complex vehicle systems. Lear Corporation has been instrumental in integrating innovative technologies into its wiring harness products to meet the evolving demands of the automotive industry. From 2024 to 2032, these companies are expected to continue focusing on technological advancements, expanding into emerging markets, and adapting to the rapidly evolving automotive industry trends. Their strategies will likely include further investments in research and development, exploring new applications in electric and autonomous vehicles, and responding to the increasing demand for sophisticated and reliable wiring systems. The combined revenue of these companies in 2023 reflects their significant role in the market, and their ongoing strategies are anticipated to significantly influence market dynamics over the forecast period. This competitive landscape highlights a market driven by technological innovation, regulatory compliance, and the need to cater to a diverse and evolving range of commercial vehicle applications.