Market Overview

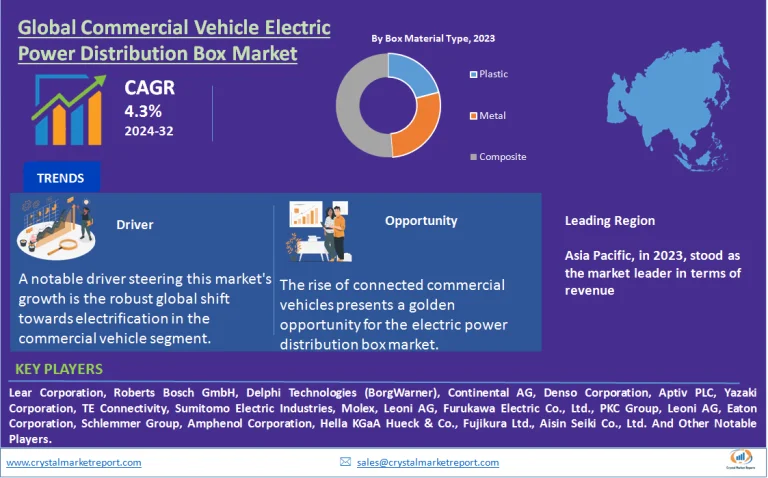

In the contemporary automotive landscape, the commercial vehicle electric power distribution box has become an integral component, especially with the advent of sophisticated electronics in commercial vehicles. Serving as a central hub, these distribution boxes manage and distribute electrical power to various parts of a vehicle, ensuring optimal performance and safety. As commercial vehicles increasingly integrate advanced electrical components, the significance of these power distribution boxes has soared. The commercial vehicle electric power distribution box market is estimated to grow at a CAGR of 4.3% from 2024 to 2032.

Commercial Vehicle Electric Power Distribution Box Market Dynamics

Driver: Electrification of Commercial Vehicles

A notable driver steering this market's growth is the robust global shift towards electrification in the commercial vehicle segment. This transition is primarily fuelled by environmental concerns, as countries grapple with the adverse effects of climate change. Governments worldwide have amplified their efforts to curb greenhouse gas emissions, with transportation identified as a major contributor. For instance, according to data from the U.S. Environmental Protection Agency (EPA), transportation accounted for nearly 29% of all greenhouse gas emissions in the United States in 2019. As a response, stringent emission norms and regulations have been established, pushing automakers to adopt electric technologies. The upsurge in electric trucks, buses, and vans necessitates efficient power distribution solutions, bolstering the demand for electric power distribution boxes.

Opportunity: Growth in Connected Commercial Vehicles

The rise of connected commercial vehicles presents a golden opportunity for the electric power distribution box market. As the Internet of Things (IoT) embeds itself deeper into automotive applications, commercial vehicles are undergoing a transformation. Features like real-time monitoring, advanced driver assistance systems (ADAS), and predictive maintenance are becoming commonplace. An article in Forbes highlighted how telematics and IoT are revolutionizing fleet management by offering insights into vehicle health, location, and driver behavior. Such intricate systems demand efficient power distribution solutions, underlining the crucial role of electric power distribution boxes.

Restraint: High Cost of Advanced Electric Systems

However, the path isn't devoid of challenges. A significant restraint is the high cost associated with advanced electric systems in commercial vehicles. Integration of advanced electronics escalates the vehicle's overall price, potentially dissuading small and medium fleet owners from making a purchase. A report by the American Trucking Association highlighted cost as a primary concern for fleet owners, especially with the integration of advanced technologies. This financial hurdle might decelerate the market growth of electric power distribution boxes, at least in the short run.

Challenge: Complexities in System Integration

Delving into challenges, the integration complexity of advanced electric systems in commercial vehicles stands out. As vehicles get smarter, ensuring seamless operation among myriad components becomes intricate. A case in point is a recent recall by a major commercial vehicle manufacturer, citing issues with the electric distribution system leading to potential safety concerns, as reported by a prominent automotive journal. Such complexities necessitate continuous R&D, skilled workforce, and meticulous testing, posing a challenge for the electric power distribution box market.

Market Segmentation by Box Material Type

In 2023, the market witnessed a dominant preference for Composite materials, which held the highest revenue due to their optimal blend of durability and lightweight attributes, ensuring energy efficiency in vehicles. Plastic materials followed closely, preferred for their cost-effectiveness and ease of molding, facilitating bespoke designs for specific vehicle models. However, the Composite segment is anticipated to register the highest CAGR from 2024 to 2032, fueled by advancing composite technologies and increasing emphasis on lightweight vehicles for enhanced fuel efficiency.

Market Segmentation by Application

In 2023, Powertrain Systems held the pole position in revenue generation, given the critical role powertrains play in vehicle performance. These systems, fundamental to the operation of any vehicle, required advanced electric power distribution solutions. Following closely were Safety Systems, essential in ensuring passenger and vehicular safety. Nevertheless, Infotainment systems are expected to witness the highest CAGR from 2024 to 2032. With the surge in demand for connected vehicles and superior in-vehicle entertainment experiences, electric distribution boxes catering to infotainment are set to see substantial growth.

Market Segmentation by Region

In the geographic landscape, Asia-Pacific dominated the market in 2023, particularly driven by the automotive hubs of China, India, and Japan. The region's dominance was cemented by rapid urbanization, booming commercial activities, and a consequential rise in demand for commercial vehicles. However, Europe is anticipated to chart the highest CAGR from 2024 to 2032, propelled by stringent emission norms, technological advancements, and a shift towards electric and connected commercial vehicles.

Competitive Trends

As of 2023, major players in this domain included companies like Lear Corporation, Roberts Bosch GmbH, Delphi Technologies (BorgWarner), Continental AG, Denso Corporation, Aptiv PLC, Yazaki Corporation, TE Connectivity, Sumitomo Electric Industries, Molex, Leoni AG, Furukawa Electric Co., Ltd., PKC Group, Leoni AG, Eaton Corporation, Schlemmer Group, Amphenol Corporation, Hella KGaA Hueck & Co., Fujikura Ltd., and Aisin Seiki Co., Ltd. These giants, having recognized the market's potential, adopted a series of strategies to consolidate their position. Strategic partnerships, as observed in Bosch's collaboration with other tech firms to enhance their electric power distribution solutions, became a common trend. Additionally, there was a marked emphasis on R&D investments, aiming to address the aforementioned challenges of system integration. Over the forecast period, from 2024 to 2032, it's expected that players will focus on innovation, merger & acquisitions, and expansion to untapped markets to gain a competitive edge.