Market Overview

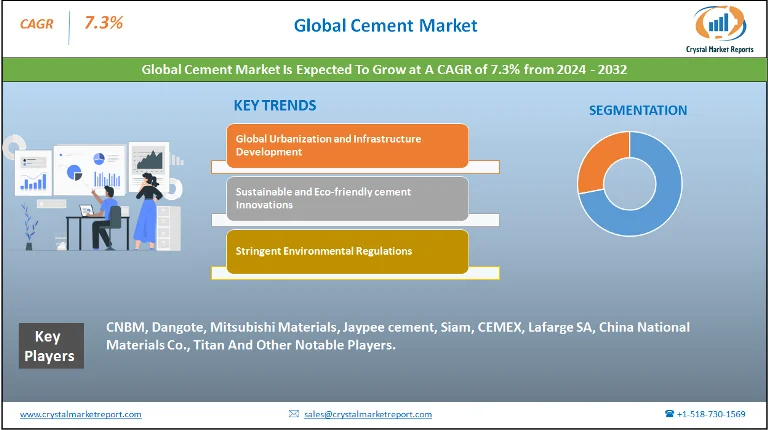

The cement market encompasses the industry segment focused on the production, distribution, and sale of cement. Cement, a key ingredient in concrete, is a binder substance used in construction that sets, hardens, and adheres to other materials to bind them together. It is typically made from a mix of minerals such as calcium, silicon, iron, and aluminum, and is commonly used in the construction of buildings, bridges, roads, and other infrastructures. The cement market is estimated to grow at a CAGR of 7.3% from 2024 to 2032. The cement market is a vital component of the global construction industry. Its growth is closely linked to the worldwide construction activities, urbanization trends, and infrastructure development. Cement is essential for creating concrete, the most widely used construction material due to its durability, versatility, and relatively low cost.

Cement Market Dynamics

Driver: Global Urbanization and Infrastructure Development

A primary driver for the cement market is the ongoing global urbanization and the corresponding need for infrastructure development. As the world's population continues to grow and migrate to urban areas, there is a significant demand for new construction projects, including residential and commercial buildings, public infrastructures like roads, bridges, and airports, and various other urban amenities. The demand for cement, being fundamental to construction, is directly tied to these activities. Developing countries, in particular, are witnessing rapid urbanization, leading to extensive construction projects and, consequently, a surge in cement consumption. This urban expansion, coupled with government initiatives in various countries to invest in infrastructure, is a major driving force behind the growth of the cement market.

Opportunity: Sustainable and Eco-friendly cement Innovations

An emerging opportunity in the cement market lies in the development of sustainable and eco-friendly cement. Traditional cement production is known for its high carbon footprint; therefore, there is a growing emphasis on producing green cement and implementing environmentally-friendly manufacturing processes. Innovations such as the use of alternative raw materials, reducing the clinker content in cement, and incorporating industrial by products like fly ash and slag, present significant opportunities. These sustainable practices not only reduce environmental impact but also open new market segments focused on green building materials.

Restraint: Stringent Environmental Regulations

A major restraint in the market is the stringent environmental regulations related to cement production. Cement manufacturing is one of the largest sources of industrial carbon dioxide emissions, leading to increased regulatory scrutiny. Complying with these environmental regulations and standards, which often involve investing in cleaner technologies and practices, can increase operational costs for cement manufacturers, impacting their profitability.

Challenge: Balancing Cost, Performance, and Sustainability

A critical challenge facing the cement market is balancing cost, performance, and sustainability. While there is a push towards sustainable cement, it is essential to ensure that these eco-friendly variants maintain the performance and durability standards required in construction. At the same time, keeping the cost of sustainable cement competitive with traditional cement is crucial for wider market acceptance. Meeting these diverse requirements - high performance, environmental sustainability, and cost-effectiveness - is a complex challenge that requires continuous innovation and strategic market positioning.

Market Segmentation by Type

In the cement market, segmentation by type includes Portland, Blended, and Other types of cement. The Blended segment is expected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032. This growth can be attributed to the increasing demand for sustainable building materials, as blended cements often incorporate supplementary materials like fly ash or slag, reducing the carbon footprint associated with cement production. Blended cements offer similar or sometimes superior properties compared to Portland cement, such as improved workability and long-term strength, making them increasingly popular in various construction projects. Despite the rapid growth of the Blended segment, in 2023, the highest revenue was generated by the Portland cement segment. Portland cement, known for its versatility and strength, continues to be the most widely used type of cement globally. Its widespread application in a range of construction projects, from small residential buildings to large infrastructure projects, contributes to its dominant position in terms of market revenue.

Market Segmentation by Application

Regarding market segmentation by application, the categories include Residential, Commercial, and Infrastructure construction. The Infrastructure segment is anticipated to witness the highest CAGR from 2024 to 2032, driven by increasing investments in infrastructure development worldwide, including transportation networks, water and sewage systems, and public utilities. The growing emphasis on sustainable and resilient infrastructure development further propels the demand in this segment. However, in 2023, the highest revenue was observed in the Residential construction segment. The residential sector's demand for cement is fueled by the global rise in urbanization, population growth, and the consequent need for housing. This sector's consistent demand for cement, owing to the ongoing development of new residential projects and the renovation of existing structures, accounts for its significant share of the market revenue.

Market Segmentation by Region

In the cement market, geographic segmentation reveals distinct growth patterns and potentials across different regions. The Asia-Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032, driven by the rapid urbanization, population growth, and significant investments in infrastructure development in countries like China, India, and Southeast Asian nations. The construction boom in these countries, largely fueled by government initiatives and the growing demand for residential and commercial buildings, is a key factor contributing to this growth. In contrast, in 2023, the highest revenue was generated in the North American region, particularly driven by the United States. The region's market dominance can be attributed to the steady growth in construction activities, both in residential and commercial sectors, along with the focus on infrastructure renewal and development. The advanced economic status and the substantial investments in construction projects contribute to North America's leading position in terms of revenue.

Competitive Trends

Regarding competitive trends and key players in the market, 2023 saw companies like CNBM, Dangote, Mitsubishi Materials, Jaypee cement, Siam, CEMEX, Lafarge SA, China National Materials Co., and Titan leading the market. These companies maintained their market dominance through a combination of extensive distribution networks, diverse product portfolios, and strategic global expansions. LafargeHolcim, for instance, focused on sustainable and innovative cement solutions, aligning with the global shift towards environmentally friendly construction materials. Heidelbergcement emphasized expanding its operational efficiency and capacity, while Cemex concentrated on enhancing its product offerings and tapping into emerging markets. From 2024 to 2032, these players are expected to continue focusing on sustainability initiatives, such as reducing carbon emissions and developing eco-friendly cement varieties, alongside expanding their presence in high-growth markets. Their strategies will likely include further investments in research and development, improving operational efficiencies, and adapting to the evolving regulatory landscape regarding environmental sustainability. The combined revenue of these companies in 2023 reflects their significant role in the market, and their ongoing strategies are anticipated to significantly shape the market dynamics over the forecast period. This competitive landscape underscores a market driven by the need for sustainable construction practices, the continuous growth in global construction activities, and the strategic positioning of key players in response to regional market demands.