Market Overview

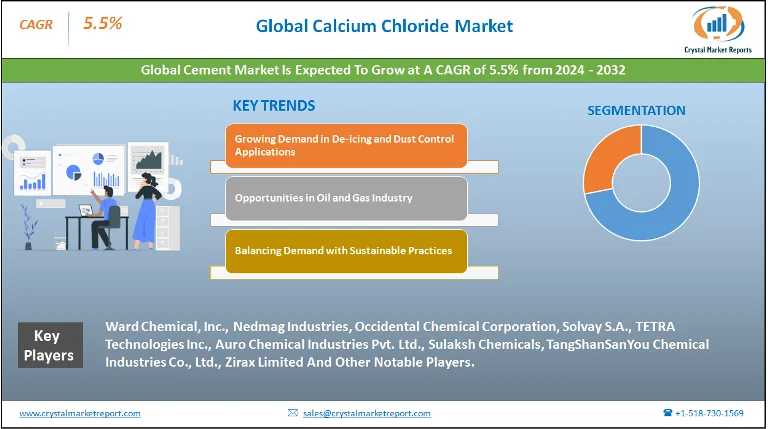

The calcium chloride market encompasses the segment focused on the production, distribution, and sale of calcium chloride. Calcium chloride is a chemical compound, typically in granular or flake form, known for its various properties such as high solubility in water, hygroscopic nature (ability to absorb moisture), and exothermic dissolution. It is a salt composed of chlorine and calcium. Calcium chloride market is estimated to grow at a CAGR of 5.5% from 2024 to 2032. Calcium chloride is used in a wide range of applications due to its versatile properties. Key uses include de-icing roads and walkways, controlling dust on unpaved roads, as a desiccant for drying gases and liquids, in the food industry as a firming agent, and in the oil and gas industry for well drilling operations. It is also used in construction for concrete acceleration and moisture control.

Calcium Chloride Market Dynamics

Driver: Growing Demand in De-icing and Dust Control Applications

A significant driver for the calcium chloride market is the increasing demand for de-icing and dust control applications. Calcium chloride is highly effective in melting ice and snow, making it essential for winter road maintenance in colder regions. Its hygroscopic nature allows it to absorb moisture from the environment, which helps in keeping road surfaces dry and reducing ice formation. This attribute also makes calcium chloride an ideal solution for dust control on unpaved roads, as it helps in binding dust particles and maintaining road stability. The expansion of transportation networks and the need to ensure road safety in adverse weather conditions are key factors contributing to the demand for calcium chloride in these applications.

Opportunity: Opportunities in Oil and Gas Industry

An emerging opportunity in the calcium chloride market lies in the oil and gas industry. In oilfield operations, calcium chloride is used for various purposes, including as a component in drilling fluids to stabilize and control the density of the fluid. Its ability to lower the freezing point of water makes it suitable for use in well drilling in cold environments. The recovery and exploration activities in the oil and gas sector, especially in shale gas and tight oil drilling, present significant opportunities for the application of calcium chloride, contributing to the growth of the market.

Restraint: Environmental Concerns

A major restraint in the market is the environmental concerns associated with the use of calcium chloride, especially in de-icing. The runoff from roads treated with calcium chloride can lead to increased soil salinity, potentially harming vegetation and affecting soil health. There are also concerns about its effects on aquatic life when it enters water bodies. These environmental impacts pose a challenge to the widespread use of calcium chloride, particularly in regions with stringent environmental regulations.

Challenge: Balancing Demand with Sustainable Practices

A critical challenge facing the calcium chloride market is balancing the growing demand with sustainable manufacturing and application practices. While calcium chloride is essential for various industrial applications, its production and use raise environmental and health concerns. Developing eco-friendly production methods, exploring alternative applications, and mitigating the negative environmental impacts are crucial for the sustainable growth of the market. Addressing these challenges requires innovation, investment in research and development, and collaboration with environmental experts and regulatory bodies.

Market Segmentation by Product Type

In the calcium chloride market, segmentation by product type includes Flakes 77%, Flakes 94%, Prills 94%, Pellets 94%, Liquid Grade, and Others. The Pellets 94% segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032, driven by their extensive use in de-icing and dust control applications. Calcium chloride pellets are effective in melting ice at lower temperatures compared to other forms and are preferred for their ease of application and storage. Despite the rapid growth of the Pellets 94% segment, in 2023, the highest revenue was generated by the Liquid Grade segment. Liquid calcium chloride is widely used in various industrial applications, including as a dust control agent, in drilling fluids, and in industrial processing. Its versatility and effectiveness in these applications contribute to its dominance in terms of market revenue.

Market Segmentation by Application

Regarding market segmentation by application, the categories include De-icing, Dust Control, Drilling Fluids, Industrial Processing, Construction, and Others. The De-icing segment is expected to witness the highest CAGR from 2024 to 2032, driven by the growing demand for effective de-icing solutions in regions experiencing heavy snowfall and icy conditions. Calcium chloride is preferred for its high efficacy in lowering the freezing point of water, making it essential for winter road maintenance. However, in 2023, the highest revenue was observed in the Dust Control segment. The use of calcium chloride for dust control is essential in maintaining road stability and visibility in unpaved roadways and in industrial sites. Its ability to absorb moisture from the air and bind dust particles makes it a widely used product in this application.

Market Segmentation by Region

In the calcium chloride market, geographic analysis shows distinct growth dynamics across various regions. The North American region, particularly the United States and Canada, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032, largely driven by the extensive use of calcium chloride for de-icing and dust control applications. The region’s harsh winter conditions necessitate effective de-icing solutions for road safety, which boosts the demand for calcium chloride. Additionally, the presence of large-scale industrial and oil and gas operations in this region contributes to the demand in other applications such as drilling fluids. In 2023, the highest revenue was generated in the Asia-Pacific region, specifically in countries like China and India. The growth in this region is attributed to the rapid industrialization, increasing construction activities, and the rising need for dust control solutions in the burgeoning mining and manufacturing sectors.

Competitive Trends

Regarding competitive trends and key players in the market, 2023 saw companies such as Ward Chemical, Inc., Nedmag Industries, Occidental Chemical Corporation, Solvay S.A., TETRA Technologies Inc., Auro Chemical Industries Pvt. Ltd., Sulaksh Chemicals, TangShanSanYou Chemical Industries Co., Ltd., and Zirax Limiteddominating the market. These companies maintained their market dominance through strategic expansions, diversified product portfolios, and a focus on sustainable and innovative solutions. Occidental Petroleum Corporation, known for its chemical manufacturing, concentrated on expanding its production capacity and exploring new applications for calcium chloride. Solvay SA emphasized on innovation in environmentally friendly production processes, while Tetra Technologies focused on catering to the oil and gas industry’s demand for calcium chloride. From 2024 to 2032, these players are expected to continue focusing on expanding their global reach, enhancing their production efficiencies, and investing in research and development to meet the evolving market demands. Their strategies will likely include adapting to regulatory changes, especially concerning environmental sustainability, and exploring new applications in emerging markets. The combined revenue of these companies in 2023 reflects their significant role in the market, and their ongoing strategies are anticipated to significantly shape the market dynamics over the forecast period. This competitive landscape highlights a market driven by the need for effective environmental and industrial solutions, and the strategic positioning of key players in response to regional and global market trends.