TABLE 1 Global Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 2 Global Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 3 Global Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 4 North America Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 5 North America Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 6 North America Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 7 U.S. Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 8 U.S. Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 9 U.S. Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 10 Canada Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 11 Canada Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 12 Canada Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 13 Rest of North America Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 14 Rest of North America Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 15 Rest of North America Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 16 UK and European Union Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 17 UK and European Union Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 18 UK and European Union Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 19 UK Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 20 UK Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 21 UK Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 22 Germany Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 23 Germany Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 24 Germany Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 25 Spain Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 26 Spain Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 27 Spain Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 28 Italy Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 29 Italy Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 30 Italy Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 31 France Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 32 France Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 33 France Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 37 Asia Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 38 Asia Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 39 Asia Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 40 China Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 41 China Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 42 China Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 43 Japan Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 44 Japan Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 45 Japan Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 46 India Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 47 India Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 48 India Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 49 Australia Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 50 Australia Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 51 Australia Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 52 South Korea Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 53 South Korea Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 54 South Korea Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 55 Latin America Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 56 Latin America Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 57 Latin America Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 58 Brazil Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 59 Brazil Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 60 Brazil Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 61 Mexico Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 62 Mexico Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 63 Mexico Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 70 GCC Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 71 GCC Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 72 GCC Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 73 South Africa Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 74 South Africa Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 75 South Africa Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 76 North Africa Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 77 North Africa Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 78 North Africa Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 79 Turkey Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 80 Turkey Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 81 Turkey Bakeware Market By End-User, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Bakeware Market By Product, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Bakeware Market By Material, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Bakeware Market By End-User, 2022-2032, USD (Million)

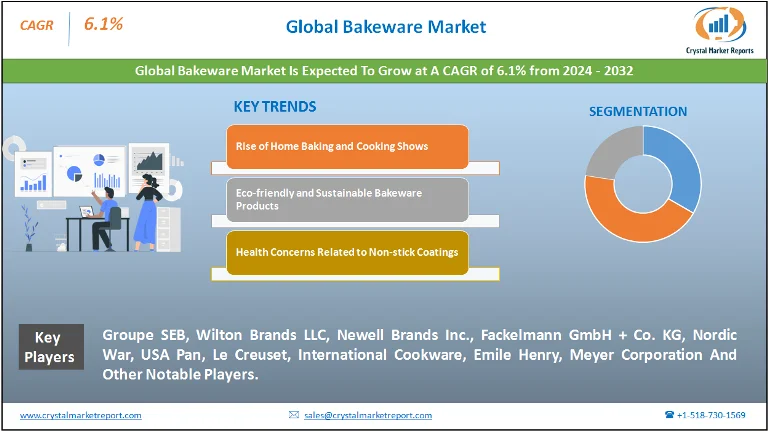

Market Overview

The bakeware market pertains to the domain of kitchen tools and implements used for baking purposes. This includes a vast array of products, from baking pans and sheets to casserole dishes and cookie cutters. A brief overview highlights that baking has been an integral part of culinary traditions worldwide, and with changing lifestyles and evolving food habits, the bakeware market has been subjected to various trends and influences. The bakeware market is estimated to grow at a CAGR of 6.1% from 2024 to 2032.

Bakeware Market Dynamics

Driver: Rise of Home Baking and Cooking Shows

A prominent driver for the bakeware market is the significant rise in home baking. This surge can be largely attributed to the popularity of numerous cooking and baking television shows. As audiences around the world tuned in to these programs, there was a notable increase in the desire to recreate the showcased dishes, leading to a heightened demand for bakeware products. Cooking shows have essentially transformed the kitchen into a stage, where the average person, armed with the right tools, can be the star. Further evidence lies in the increase in sales of specific bakeware items right after they are used in popular TV episodes. Additionally, social media platforms, particularly Instagram and Pinterest, are filled with home bakers showcasing their creations, indirectly influencing their followers to take up baking, further propelling bakeware sales.

Opportunity: Eco-friendly and Sustainable Bakeware Products

An emerging opportunity in the bakeware market revolves around the demand for eco-friendly and sustainable products. The modern consumer, more informed and environmentally conscious, seeks products that have minimal impact on the environment. Bakeware made from recycled materials, sustainably sourced wood, or biodegradable components have been gaining traction. Evidence of this trend can be seen in the increasing number of products labeled as "eco-friendly" or "sustainable" on e-commerce websites and in stores. Additionally, brands are publicizing their sustainable practices, reflecting a shift in marketing strategies to cater to this new consumer demand.

Restraint: Health Concerns Related to Non-stick Coatings

A restraint facing the bakeware market is health concerns related to non-stick coatings. Teflon, a popular non-stick coating, has been under scrutiny due to potential health risks associated with its composition, primarily PFOA (perfluorooctanoic acid). Studies have indicated that PFOA exposure can lead to several health problems, including thyroid disorders and kidney diseases. This information has been widely circulated in the media, leading to a degree of consumer apprehension about using non-stick bakeware. As evidence, sales figures have shown a slight dip in non-stick bakeware purchases, while alternative materials like cast iron or stainless steel have seen a surge.

Challenge: Market Saturation and Brand Differentiation

A challenge that the bakeware market grapples with is the saturation of products and the difficulty of brand differentiation. With numerous companies offering a myriad of similar products, it becomes a challenge for brands to distinguish themselves from competitors. The ubiquity of products, especially in e-commerce platforms, means consumers can be overwhelmed with choices, often leading to decision paralysis. Furthermore, new entrants in the market find it challenging to carve a niche for themselves. An evidence of this challenge can be observed in consumer reviews where purchasers often base their decisions on minute differences in product features or rely heavily on established brand reputations.

Market Segmentation by Product

Segmenting the bakeware market by product, tins & trays have historically represented a significant revenue stream in 2023, given their fundamental utility in many baking tasks. They've been integral for a wide range of baked goods, from bread to pastries. Following closely were molds, which saw an impressive growth due to the intricate designs and novelty shapes that became trendy in the home baking community. In terms of projected Compound Annual Growth Rate (CAGR) from 2024 to 2032, cups are expected to showcase the most promising growth. As individual portion desserts and pastries become increasingly popular, the demand for cups is likely to surge. While tins & trays brought in the highest revenue in 2023, the diversity and novelty of molds are expected to push their growth in the coming decade.

Market Segmentation by Materials

When assessing the market based on materials, stainless steel bakeware dominated in 2023 in terms of revenue. Renowned for its durability and even heat distribution, stainless steel remains a favorite among both novice and experienced bakers. However, stoneware is projected to register the highest CAGR between 2024 and 2032. The reason lies in its versatility; it can go from oven to table, making it a stylish and functional choice for many. The trend towards rustic and artisanal presentations in food preparation will further augment the growth of stoneware bakeware.

Market Segmentation by Region

On the geographic front, North America represented the region with the highest revenue in 2023. The U.S., with its deep-rooted baking culture influenced by various global cuisines, has been the primary driver. Europe followed closely, with countries like France, Italy, and Germany being notable contributors. However, Asia-Pacific is anticipated to register the highest CAGR from 2024 to 2032. The increasing westernization of diets, coupled with a rising middle class in countries like China and India, is expected to drive this growth. Urbanization trends, increasing disposable incomes, and a growing affinity for Western desserts and baked goods will likely make Asia-Pacific a hotbed for bakeware market growth.

Competitive Landscape

From a competitive perspective, the bakeware market has been characterized by a few dominant players that held significant market shares in 2023. Brands like Groupe SEB, Wilton Brands LLC, Newell Brands Inc., Fackelmann GmbH + Co. KG, Nordic War, USA Pan, Le Creuset, International Cookware, Emile Henry, and Meyer Corporation U.S. have been frontrunners, primarily due to their long-standing reputations and wide product ranges. Their strategies often revolved around product innovation, tapping into emerging trends, and expansive distribution networks. However, as we look towards the forecast period of 2024 to 2032, it's expected that newer entrants will leverage niche segments, like eco-friendly bakeware or products catering specifically to health trends (like keto or gluten-free baking). Collaborations, mergers, and acquisitions are anticipated as key strategies to consolidate market position and expand product portfolios.