TABLE 1 Global Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 2 Global Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 3 Global Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 4 North America Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 5 North America Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 6 North America Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 7 U.S. Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 8 U.S. Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 9 U.S. Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 10 Canada Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 11 Canada Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 12 Canada Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 13 Rest of North America Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 14 Rest of North America Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 15 Rest of North America Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 16 UK and European Union Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 17 UK and European Union Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 18 UK and European Union Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 19 UK Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 20 UK Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 21 UK Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 22 Germany Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 23 Germany Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 24 Germany Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 25 Spain Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 26 Spain Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 27 Spain Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 28 Italy Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 29 Italy Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 30 Italy Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 31 France Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 32 France Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 33 France Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 34 Rest of Europe Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 35 Rest of Europe Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 36 Rest of Europe Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 37 Asia Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 38 Asia Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 39 Asia Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 40 China Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 41 China Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 42 China Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 43 Japan Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 44 Japan Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 45 Japan Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 46 India Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 47 India Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 48 India Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 49 Australia Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 50 Australia Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 51 Australia Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 52 South Korea Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 53 South Korea Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 54 South Korea Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 55 Latin America Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 56 Latin America Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 57 Latin America Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 58 Brazil Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 59 Brazil Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 60 Brazil Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 61 Mexico Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 62 Mexico Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 63 Mexico Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 64 Rest of Latin America Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 65 Rest of Latin America Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 66 Rest of Latin America Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 67 Middle East and Africa Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 68 Middle East and Africa Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 69 Middle East and Africa Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 70 GCC Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 71 GCC Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 72 GCC Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 73 South Africa Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 74 South Africa Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 75 South Africa Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 76 North Africa Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 77 North Africa Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 78 North Africa Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 79 Turkey Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 80 Turkey Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 81 Turkey Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

TABLE 82 Rest of Middle East and Africa Automotive Lightweight Materials Market By Material, 2022-2032, USD (Million)

TABLE 83 Rest of Middle East and Africa Automotive Lightweight Materials Market By Vehicle, 2022-2032, USD (Million)

TABLE 84 Rest of Middle East and Africa Automotive Lightweight Materials Market By Application, 2022-2032, USD (Million)

Market Overview

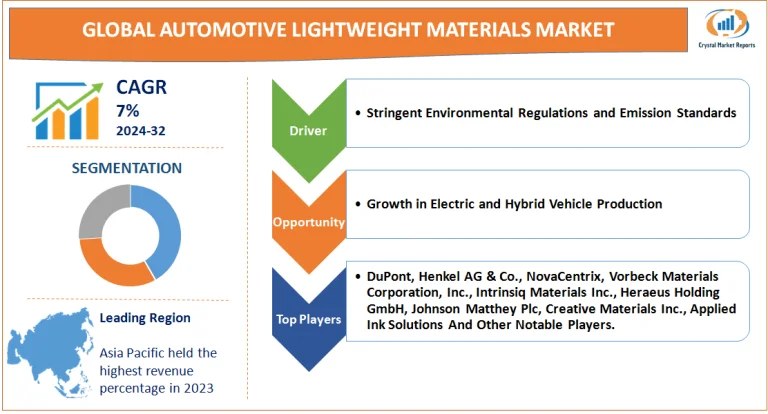

The automotive lightweight materials market encompasses the segment of the automotive industry focused on the development, production, and application of materials that reduce the weight of vehicles. These materials include high-strength steel, aluminum, magnesium, composites, plastics, and advanced polymers. Lightweight materials are used in various parts of a vehicle, including the body, chassis, engine, and interior, to enhance fuel efficiency, reduce emissions, and improve performance and handling. The automotive lightweight materials market is estimated to grow at a CAGR of 7% from 2024 to 2032. The market for automotive lightweight materials has become increasingly important in the context of global efforts to improve fuel efficiency and reduce carbon emissions from vehicles. As environmental concerns and regulatory standards for fuel economy and emissions become more stringent, automotive manufacturers are turning to lightweight materials as a key solution. The use of these materials in vehicle construction allows for significant weight reduction, which directly translates to lower fuel consumption and emissions.

Automotive Lightweight Materials Market Dynamics

Driver: Stringent Environmental Regulations and Emission Standards

A primary driver of the automotive lightweight materials market is the increasingly stringent environmental regulations and emission standards worldwide. Governments and regulatory bodies are imposing stricter fuel efficiency and carbon emission targets for vehicles to combat climate change and reduce environmental pollution. For instance, the European Union's regulations on CO2 emissions require significant reductions by 2025 and 2030, pushing automotive manufacturers to adopt lightweight materials as a key strategy to meet these targets. In the United States, the Corporate Average Fuel Economy (CAFE) standards are similarly driving the demand for lightweight materials. These regulatory pressures compel automakers to reduce vehicle weight, which is directly correlated with fuel efficiency and emissions, thereby significantly boosting the market for automotive lightweight materials.

Opportunity: Growth in Electric and Hybrid Vehicle Production

An emerging opportunity in the automotive lightweight materials market is the growth in electric and hybrid vehicle production. As the global automotive industry shifts towards electrification, the need for efficient battery range and performance becomes crucial. Lightweight materials play a pivotal role in enhancing the range and efficiency of electric and hybrid vehicles by reducing the overall weight, which is particularly important given the additional weight of the battery packs in these vehicles. This shift towards electric mobility is creating new avenues for the application of lightweight materials, further expanding the market.

Restraint: High Cost and Manufacturing Complexity

A major restraint in the market is the high cost and manufacturing complexity associated with automotive lightweight materials. Advanced materials such as carbon fiber composites and certain high-strength alloys are often significantly more expensive than traditional steel and aluminum. This cost factor can be a barrier, particularly for mass-market vehicle manufacturers. Additionally, the manufacturing and integration of these advanced materials into vehicle production involve complex processes and require new manufacturing technologies and expertise, adding to the challenges faced by automakers.

Challenge: Balancing Safety with Weight Reduction

A critical challenge in the automotive lightweight materials market is balancing vehicle safety with weight reduction. While reducing vehicle weight is crucial for fuel efficiency and performance, it is essential to maintain, if not enhance, the safety standards of the vehicle. Lightweight materials must meet rigorous safety and crashworthiness standards, which can be challenging, especially for newer and less-tested materials. Ensuring that the use of lightweight materials does not compromise vehicle safety and durability requires extensive research, testing, and development, posing a significant challenge for manufacturers in the market.

Market Segmentation by Material

In the automotive lightweight materials market, segmentation by material includes Metal Alloys, High-strength Steel, Composites, and Polymers. The Composites segment is projected to experience the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032. This growth is attributed to the increasing adoption of carbon fiber and other composite materials in automotive manufacturing, driven by their superior strength-to-weight ratio and their ability to significantly reduce vehicle weight, thereby enhancing fuel efficiency and performance. Composites are particularly favored in electric and luxury vehicles, where weight reduction is crucial for battery efficiency and vehicle dynamics. Despite the rapid growth of the Composites segment, the highest revenue in 2023 was generated by High-strength Steel. High-strength steel continues to be widely used in the automotive industry due to its cost-effectiveness, strength, and ease of manufacturing compared to other lightweight materials. Its ability to provide weight reduction while maintaining safety and durability standards makes it a popular choice among mass-market vehicle manufacturers.

Market Segmentation by Vehicle

Regarding market segmentation by vehicle, the categories include Passenger Vehicles, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). The Passenger Vehicles segment is expected to witness the highest CAGR from 2024 to 2032, driven by the growing consumer demand for fuel-efficient, high-performance, and environmentally friendly vehicles. The focus on reducing carbon emissions and improving fuel economy standards is leading to the increased use of lightweight materials in passenger vehicle manufacturing. However, in 2023, the highest revenue was observed in the Light Commercial Vehicles (LCVs) segment. LCVs, which include vans, pickups, and small trucks, are extensively used in a variety of commercial applications. The demand for lightweight materials in this segment is propelled by the need to enhance payload capacity, fuel efficiency, and reduce emissions, especially in urban delivery and transportation services.

Market Segmentation by Region

In the automotive lightweight materials market, geographic analysis shows distinct trends across various regions. The Asia-Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2032. This growth is driven by the rapid expansion of the automotive industry in countries like China, India, and Japan, coupled with increasing environmental awareness and stringent emission standards. The region's focus on producing fuel-efficient vehicles and the growing demand for electric and hybrid vehicles are key factors contributing to this growth. In 2023, however, Europe accounted for the highest revenue in the automotive lightweight materials market. Europe's dominance can be attributed to its advanced automotive industry, stringent environmental regulations, and the presence of leading automotive manufacturers who are at the forefront of adopting innovative lightweight materials for vehicle production. The region's commitment to reducing vehicle emissions and improving fuel efficiency has been central to its leading revenue position.

Competitive Trends

Regarding competitive trends and key players in the market, 2023 saw companies such as DuPont, Henkel AG & Co., NovaCentrix, Vorbeck Materials Corporation, Inc., Intrinsiq Materials Inc., Heraeus Holding GmbH, Johnson Matthey Plc, Creative Materials Inc., and Applied Ink Solutions leading the market. These companies have maintained their market dominance through continuous innovation, strategic partnerships, and a focus on sustainability. From 2024 to 2032, these players are expected to continue their focus on technological advancements, particularly in developing new and sustainable lightweight materials. Their strategies are likely to include further investments in R&D, collaboration with automotive OEMs, and adapting to the evolving demands of the automotive industry, particularly in the context of electric vehicle production. The combined revenue of these companies in 2023 reflects their significant role in the market, and their ongoing strategies are anticipated to significantly shape the market dynamics over the forecast period. This competitive landscape underscores a market driven by technological innovation, the need for more efficient and environmentally friendly vehicles, and the shift towards electrification in the automotive industry.