Market Overview

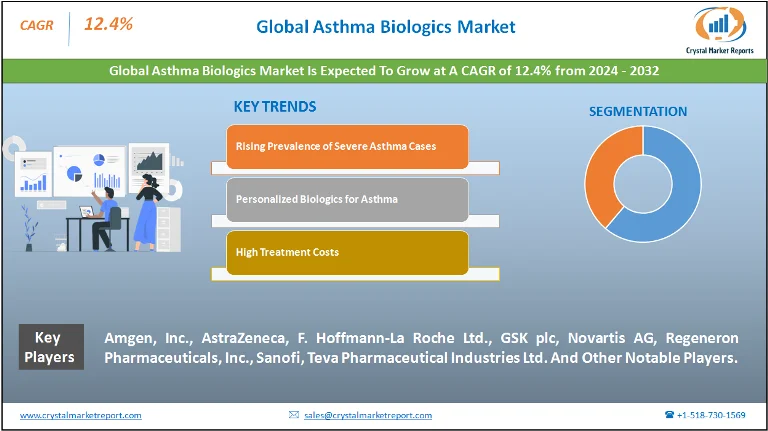

The asthma biologics market is focused on the development and sale of biological products or 'biologics' that aid in treating and managing asthma, a chronic respiratory ailment. These biologics are manufactured from a variety of natural sources and employ a range of methods to control asthma, primarily targeting and neutralizing specific cells or proteins that cause inflammation and constriction of airways. The asthma biologics market is estimated to grow at a CAGR of 12.4% from 2024 to 2032.

Asthma Biologics Market Dynamics

Driver: Rising Prevalence of Severe Asthma Cases

One of the primary drivers propelling the asthma biologics market's growth is the escalating number of severe asthma cases worldwide. Asthma, as a condition, has transitioned from being merely a widespread concern to a severe health crisis for a substantial percentage of patients. According to healthcare reports, a significant chunk of asthma patients does not achieve symptom control with standard treatments, paving the way for biologics as an effective solution. Furthermore, urbanization and the accompanied pollution have been directly correlated with rising asthma cases, amplifying the need for advanced treatments such as biologics.

Opportunity: Personalized Biologics for Asthma

An emerging opportunity in this market segment is the development of personalized biologics for asthma treatment. Each asthma patient's response to biologics can vary, and a one-size-fits-all approach might not yield optimal results for everyone. Recognizing this, pharmaceutical companies are delving into creating patient-specific biologic treatments. By studying individual patient profiles, including genetic markers and specific asthma triggers, these personalized biologics promise higher efficacy and fewer side effects.

Restraint: High Treatment Costs

While biologics promise improved outcomes for asthma patients, their high costs can't be ignored. Producing biologics is an intricate process requiring sophisticated technology and extensive research, which inevitably escalates the treatment costs. These elevated prices make biologics inaccessible to a considerable segment of asthma patients, especially in developing and underdeveloped nations, where patients either can't afford these treatments or don't have access to health insurance that would cover such expenses.

Challenge: Ensuring Consistent Efficacy

Another pressing challenge in the asthma biologics market is ensuring consistent efficacy across diverse patient groups. Biologics, due to their nature, sometimes show varying degrees of effectiveness in different demographic groups. Factors like genetic variability, presence of comorbid conditions, or even variations in disease pathology can impact the drug's efficacy. This inconsistency poses a challenge, as pharmaceutical companies need to guarantee that their products are not just effective but consistently so, across different patient populations.

Market Segmentation by Drug Class

Selective Immuno-suppressants: These drugs garnered the highest revenue in 2023, attributable to their proven efficacy in curbing the immune system's exaggerated response without compromising overall immune function. Their targeted approach, which primarily suppresses the inflammatory process involved in asthma, made them a preferred choice among healthcare professionals. A robust sales infrastructure backed by substantial medical endorsements further contributed to their market prominence. While the revenue for interleukin inhibitors trailed behind immuno-suppressants, they boasted the Highest Compound Annual Growth Rate (CAGR). The reason ? Their cutting-edge mechanism of action. These inhibitors target specific interleukins, proteins responsible for the inflammatory response in asthma, reducing the frequency and severity of asthma exacerbations. Their growing popularity is anchored in their potential to treat patients unresponsive to conventional therapies. Other drug classes, including monoclonal antibodies and bronchodilators, secured a significant market share but didn't overshadow the dominance of the aforementioned categories. Their consistent performance and diverse applications, however, ensure they remain integral to the asthma biologics landscape.

Market Segmentation by Distribution Channel

Traditional retail pharmacies held the largest revenue chunk in 2023. Their accessibility, the trust patients place in them, coupled with the benefit of immediate possession of medicines, underpinned their dominance. The distribution channel expected to manifest the highest CAGR from 2024 to 2032 is E-commerce. This shift towards online pharmacies is propelled by factors such as convenience, the breadth of options, and sometimes, cost-effectiveness. As digital health initiatives gain traction, and as the world becomes increasingly interconnected online, this segment's growth seems almost inevitable. Other channels, including hospital pharmacies and specialty drug stores, contributed sizably to the distribution matrix, capitalizing on their niche clientele and specialized services.

Market Segmentation by Region

In terms of geographical distribution, North America, particularly the U.S., led in revenue percentages in 2023. The region's advanced healthcare infrastructure, coupled with heightened awareness and accessibility to advanced asthma treatments, drove its market leadership. However, Asia-Pacific is anticipated to showcase the highest CAGR from 2024 to 2032. This surge is ascribed to increasing healthcare investments, a burgeoning middle-class demographic demanding quality healthcare, and escalating asthma prevalence in countries like India and China.

Competitive Trends

The asthma biologics market's competitive realm is marked by robust R&D initiatives, strategic mergers, and acquisitions, and an unyielding focus on innovation. In 2023, top players such as Amgen, Inc., AstraZeneca, F. Hoffmann-La Roche Ltd., GSK plc, Novartis AG, Regeneron Pharmaceuticals, Inc., Sanofi, and Teva Pharmaceutical Industries Ltd. solidified their market positions through a blend of novel product launches and global expansion strategies. These companies have been investing heavily in research to unearth novel drug formulations with higher efficacies. Collaborative efforts, both in terms of research partnerships and distribution alliances, emerged as a key strategy to penetrate untapped markets and diversify product portfolios.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.