Market Overview

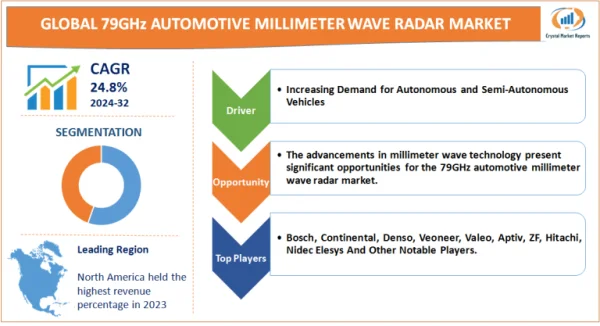

The 79GHz automotive millimeter wave radar market refers to the segment of the automotive industry that focuses on the development, production, and distribution of 79GHz frequency radars for vehicles. These radars operate in the millimeter-wave spectrum, which is a segment of the microwave band with extremely high-frequency waves, typically within the range of 30 GHz to 300 GHz. The specific use of the 79GHz frequency is significant because it offers several advantages over the more commonly used 24GHz and 77GHz bands. The 79GHz automotive millimeter wave radar market is estimated to grow at a CAGR of 24.8% from 2024 to 2032. One of the key features of the 79GHz radar system is its ability to provide high-resolution imaging. This quality is crucial for advanced driver-assistance systems (ADAS) and autonomous driving technologies, as it allows for more accurate detection and classification of objects in the vehicle's vicinity. The higher frequency band of 79GHz also enables the radar to have a smaller form factor, which is beneficial for seamless integration into vehicles without affecting their aesthetic design. The market for 79GHz automotive millimeter wave radars is driven by the increasing demand for advanced safety features in vehicles and the push towards higher levels of vehicle autonomy. Car manufacturers and technology companies are investing heavily in this technology as part of a broader trend towards safer, more efficient, and autonomous driving experiences.

Driver: Increasing Demand for Autonomous and Semi-Autonomous Vehicles

The automotive industry is witnessing a significant trend towards the development and adoption of autonomous and semi-autonomous vehicles, which is a major driver for the 79GHz automotive millimeter wave radar market. Autonomous vehicles rely heavily on advanced sensor systems for navigation and safety, where high-resolution radar plays a crucial role. The market growth is fueled by the rising consumer demand for vehicles equipped with advanced driver-assistance systems (ADAS), which improve safety by providing features like collision avoidance, lane departure warnings, and adaptive cruise control. Evidence of this trend is visible in the increasing number of vehicles equipped with ADAS features. For instance, major automobile manufacturers have been integrating radar-based systems in their newer models as a standard feature. Additionally, regulatory bodies across various countries are mandating the inclusion of certain ADAS features in new vehicles. For example, the European Union has implemented regulations that will require all new cars to be equipped with advanced safety features by 2022. This regulatory push is not only enhancing road safety but also driving the demand for high-frequency radars like the 79GHz systems.

Opportunity: Advancements in Millimeter Wave Technology

The advancements in millimeter wave technology present significant opportunities for the 79GHz automotive millimeter wave radar market. The development of more compact, efficient, and cost-effective radar modules enhances their integration into a wide range of vehicles. The evolution of semiconductor technologies, such as Silicon-Germanium (SiGe) and Gallium Nitride (GaN), has enabled the production of radar systems that are not only more powerful but also smaller in size. Additionally, the improvement in signal processing algorithms has allowed for better object detection, classification, and tracking capabilities. Such technological advancements are making 79GHz radars more attractive for automotive applications, leading to wider adoption. The rise in electric and hybrid vehicles, which require numerous sensors for efficient operation, further broadens the scope for these radars. The integration of 79GHz radars in these vehicles can enhance the efficiency and safety of the burgeoning electric vehicle market.

Restraint: High Cost of Implementation and Integration

One of the significant restraints in the 79GHz automotive millimeter wave radar market is the high cost associated with the implementation and integration of these systems into vehicles. The production of high-frequency radar systems involves sophisticated and expensive materials and components, which increases the overall cost of the radar system. Furthermore, integrating these radars into vehicles requires substantial design changes and calibration, adding to the expense. This cost factor becomes a considerable hurdle, especially for mid-range and economy vehicle segments, where adding such advanced systems could significantly increase the final price of the vehicle. This price sensitivity is particularly pronounced in emerging markets, where cost-effectiveness is a critical factor for consumers. As a result, the adoption of 79GHz radar systems is slower in these segments, limiting the market's growth potential.

Challenge: Electromagnetic Interference and Regulation Compliance

A notable challenge for the 79GHz automotive millimeter wave radar market is the issue of electromagnetic interference (EMI) and the need to comply with various regulatory standards. High-frequency radars, operating in the millimeter wave spectrum, are susceptible to interference from other electronic devices and systems, which can affect their accuracy and reliability. Ensuring that these radars function correctly in a diverse range of environments and conditions is a complex task. Additionally, manufacturers must navigate a complex web of international regulations and standards. Different countries and regions have varying requirements for automotive radar systems, making it challenging for manufacturers to develop universally compatible products. Ensuring compliance with these varied regulations not only complicates the design and manufacturing process but also adds to the cost and time required to bring these products to market. These factors pose significant challenges to the growth and widespread adoption of 79GHz radar technology in the automotive sector.

Market Segmentation by Type

The market segmentation of the 79GHz automotive millimeter wave radar by type is broadly categorized into short-range and medium-range radars, each with distinct roles in vehicle safety and automation systems. Short-range radars, typically operating within a range of up to 30 meters, are primarily used for applications like blind spot detection, parking assistance, and collision avoidance in low-speed environments. Their compact size, coupled with lower power requirements, makes them suitable for a wide array of vehicles, from economy to luxury models. This versatility, combined with the growing demand for enhanced safety features in all vehicle segments, positions short-range radars for the highest compound annual growth rate (CAGR) in the market. However, medium-range radars, with their capability to detect objects at distances up to 100 meters, hold the highest share in terms of revenue. These radars are integral to systems like adaptive cruise control and lane keep assistance, which are becoming standard in new vehicles, especially in the mid to high-end market segments. The increasing emphasis on advanced driver-assistance systems (ADAS) and the trend towards semi-autonomous vehicles are major factors driving the demand for medium-range radars, making them a high-revenue segment in the 79GHz radar market.

Market Segmentation by Application

In terms of application, the market is segmented into blind spot detection, adaptive cruise control systems, and other applications, including lane departure warning and emergency braking systems. Blind spot detection systems, which alert drivers to objects in their blind spots, are becoming increasingly common in a wide range of vehicles, contributing to significant market growth. However, it's the adaptive cruise control systems that are projected to have the highest CAGR, driven by the trend towards semi-autonomous driving. These systems, which automatically adjust the vehicle's speed to maintain a safe distance from other vehicles, are becoming standard in new vehicles, particularly in the mid to high-end market segments. Their integration not only enhances safety but also provides a stepping stone towards fully autonomous vehicles. The 'other' applications segment, encompassing various ADAS features, also contributes significantly to the market, driven by the overall trend towards safer and more intelligent vehicles. This diversity of applications underscores the versatility of 79GHz automotive radars and their integral role in the evolution of modern vehicles. The increasing emphasis on safety standards by regulatory bodies worldwide further bolsters the market growth across all these applications, with adaptive cruise control systems leading in terms of both CAGR and revenue due to their critical role in enhancing road safety and driving comfort.

Market Segmentation by Region

In the geographic segmentation of the 79GHz automotive millimeter wave radar market, trends vary significantly across regions, reflecting diverse regulatory environments, technological adoption rates, and consumer preferences. Asia-Pacific, with its burgeoning automotive industry, particularly in countries like China, Japan, and South Korea, is witnessing rapid growth, attributed to the increasing adoption of advanced driver-assistance systems (ADAS) and a strategic shift towards autonomous vehicles. This region is expected to experience the highest compound annual growth rate (CAGR) from 2024 to 2032, driven by the proliferation of automotive manufacturing and the growing demand for vehicle safety features. However, in terms of revenue, North America holds the highest share as of 2023, thanks to the early adoption of advanced automotive technologies, stringent safety regulations, and the presence of major automotive and technology companies. Europe also represents a significant market share, with stringent EU regulations mandating advanced safety features in vehicles, thereby driving the demand for high-frequency radar systems.

Competitive Landscape

In the competitive landscape, the 79GHz automotive millimeter wave radar market is characterized by the presence of key players who are actively engaged in strategic alliances, technological advancements, and expanding product portfolios to consolidate their market positions. Companies like Continental AG, Robert Bosch GmbH, and Denso Corporation, among others, dominate the market as of 2023. These companies have been focusing on research and development to enhance radar capabilities and integrating artificial intelligence for better object detection and classification. Strategic partnerships and collaborations have been a common trend among these players, aiming to leverage each other's strengths in technology and market reach. For instance, collaborations between automotive radar manufacturers and semiconductor companies have been crucial in developing more efficient and compact radar systems. These collaborations are expected to be a continuing trend from 2024 to 2032. Furthermore, the market is witnessing an influx of innovative startups that are challenging the established players with novel solutions and disruptive technologies. These emerging companies are expected to play a significant role in shaping the market dynamics during the forecast period. The focus on miniaturization, cost reduction, and the integration of radar systems with other sensor technologies like LIDAR and cameras is expected to be a key strategy among competitors. The competitive landscape is also influenced by regional regulatory policies, with companies needing to adapt their products to meet specific regional standards and preferences.

Working with the worlds leading market research companies.

Research reports across 90 industries.

Simple license based pricing by individual report.

Trusted by thousands for accurate and transparent reports.

Unless otherwise specified all reports are sent electronically in either .PDF or .DOC file format.

Single User License: It provides product access only to the consumer of the ordered product.

Multi User License: It allows maximum up to 10 peoples within your company to share the ordered product.

Global License: It permits the product to be shared by all employees of your firm irrespective of their geographical areas.

Fore more information on report format options and licensing please visit our FAQ's page.