Market Overview

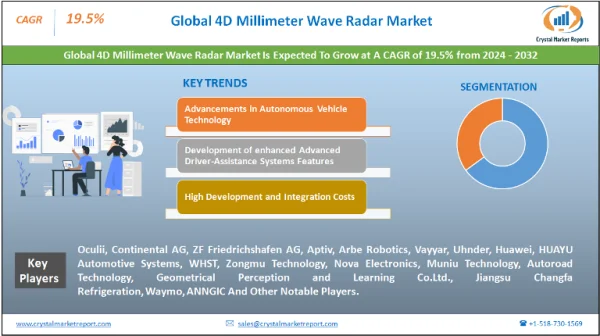

The 4D millimeter wave radar market is a segment within the automotive industry focusing on the next generation of radar technology. 4D millimeter wave radars represent an evolution from traditional 2D and 3D systems by not only detecting the distance and velocity of objects but also their elevation and three-dimensional shape. This capability is achieved through advanced signal processing techniques and the use of higher frequency bands in the millimeter wave spectrum, typically around 77 GHz or higher. The 4D millimeter wave radar market is estimated to grow at a CAGR of 19.5% from 2024 to 2032. A brief overview of this market reveals its emerging significance, particularly in the context of advanced driver-assistance systems (ADAS) and the progression towards fully autonomous vehicles. The unique capability of 4D millimeter wave radars to provide detailed information about the vehicle's surroundings, including the height and shape of objects, marks a significant advancement over earlier radar technologies. This added dimension of data is crucial for accurately identifying and classifying objects in complex driving environments, such as urban areas where pedestrians, cyclists, and other vehicles are present. The increasing demand for higher levels of vehicle autonomy and safety is a key driver for the growth of the 4D millimeter wave radar market. These systems enhance the perception capabilities of autonomous vehicles, making them more reliable and safer. Additionally, as regulations around vehicle safety become more stringent, and as consumer expectations for advanced safety features grow, the adoption of 4D millimeter wave radar technology is expected to accelerate.

Driver: Advancements in Autonomous Vehicle Technology

The primary driver for the 4D millimeter wave radar market is the rapid advancements in autonomous vehicle technology. As automotive manufacturers and technology companies push towards higher levels of vehicle automation, the demand for advanced sensing technologies, such as 4D millimeter wave radar, is escalating. These radars offer superior object detection and classification capabilities, essential for autonomous driving systems to navigate complex environments safely. Unlike traditional radar systems, 4D radars provide more detailed data about the surroundings, including the elevation and shape of objects, which is crucial for differentiating between a wide range of road obstacles and conditions. This enhanced capability is particularly important in urban settings, where vehicles encounter pedestrians, cyclists, and various static and moving objects. The growing investments in autonomous vehicle research and development, coupled with the increasing number of pilot projects and trials for autonomous cars, buses, and trucks, underscore the importance of reliable and accurate sensing technologies, thereby fueling the growth of the 4D millimeter wave radar market.

Opportunity in Enhanced ADAS Features

The development of enhanced Advanced Driver-Assistance Systems (ADAS) presents a significant opportunity for the 4D millimeter wave radar market. Modern vehicles are increasingly equipped with a suite of ADAS features, such as adaptive cruise control, lane-keeping assist, and automatic emergency braking. The incorporation of 4D radar technology into these systems can significantly improve their accuracy and reliability. For instance, by accurately detecting the height and shape of objects, 4D radars can better distinguish between a stationary vehicle and a low-hanging sign, reducing the likelihood of false alarms and unnecessary braking. This capability is especially beneficial in scenarios where optical sensors, such as cameras and LiDAR, might be compromised due to poor weather or lighting conditions. As vehicle manufacturers strive to enhance the safety and convenience of their vehicles, the integration of 4D millimeter wave radars into ADAS is expected to increase, offering a substantial market opportunity.

Restraint: High Development and Integration Costs

A significant restraint for the 4D millimeter wave radar market is the high cost associated with the development and integration of these systems. Developing 4D radar technology involves sophisticated and expensive components, as well as substantial investment in research and development to achieve the desired level of accuracy and reliability. Additionally, integrating these systems into vehicles poses challenges, as they must work seamlessly with other sensors and electronic components without interfering with each other. The cost factor is particularly pertinent for mass-market vehicle segments, where adding expensive radar systems can significantly increase the overall vehicle cost, impacting market competitiveness. Consequently, the adoption of 4D millimeter wave radars is currently more prevalent in luxury or high-end vehicle segments.

Challenge of Spectrum Allocation and Regulation

One of the challenges facing the 4D millimeter wave radar market is the issue of spectrum allocation and regulatory compliance. As these radars operate in high-frequency millimeter wave bands, they require specific spectrum allocations to function without interference. However, with the growing demand for wireless communication services, such as 5G, which also operate in similar frequency ranges, there is increasing competition for spectrum space. This competition raises concerns about potential interference and the need for stringent regulatory frameworks to ensure the coexistence of different technologies using the same frequency bands. Moreover, regulations vary significantly across different countries, adding complexity to the development and deployment of 4D millimeter wave radars on a global scale. Ensuring compliance with diverse regulatory requirements while maintaining the performance and reliability of these radar systems is a continuing challenge for manufacturers.

Market Segmentation by Type

In the 4D millimeter wave radar market, segmentation by type includes OEM (Original Equipment Manufacturer) and Aftermarket segments. The OEM segment currently holds the highest share in terms of revenue, largely due to the increasing integration of 4D millimeter wave radars in new vehicles by manufacturers. This integration is driven by the growing demand for advanced safety features and the progression towards autonomous driving technologies in new vehicle models. OEMs are actively incorporating these radars into their advanced driver-assistance systems (ADAS) and autonomous driving packages, making them a standard feature in many high-end and luxury vehicles, and increasingly in mid-range models as well. In contrast, the Aftermarket segment is witnessing the highest Compound Annual Growth Rate (CAGR). This growth is fueled by the rising awareness among vehicle owners about the benefits of advanced radar systems and the desire to upgrade existing vehicles with the latest safety technologies. The aftermarket provides solutions for vehicle owners who wish to enhance the safety and capabilities of their vehicles without investing in a new car, thus driving the demand for aftermarket 4D millimeter wave radar installations.

Market Segmentation by Application

Regarding market segmentation by application, the 4D millimeter wave radar market is bifurcated into Personal Vehicle and Commercial Vehicle segments. The Personal Vehicle segment accounts for the highest revenue share, reflecting the widespread adoption of ADAS features in passenger cars. The increasing consumer demand for safer and more technologically advanced vehicles, along with stringent safety regulations, has led to the broader integration of 4D millimeter wave radars in personal vehicles. This segment includes a wide range of vehicles, from luxury to mid-range models, where safety features are becoming a standard expectation among consumers. On the other hand, the Commercial Vehicle segment is experiencing the highest CAGR. The growth in this segment is driven by the rising emphasis on safety and efficiency in commercial transportation, including trucks, buses, and fleet vehicles. There is a growing trend of incorporating advanced safety and driver assistance features in commercial vehicles to reduce the risk of accidents and enhance operational efficiency. This trend is particularly prominent in the logistics and public transportation sectors, where vehicle safety and reliability are paramount. Additionally, the development of autonomous technologies for commercial applications, such as self-driving trucks and buses, is expected to further accelerate the demand for 4D millimeter wave radars in this segment.

Market Segmentation by Region

In the geographic analysis of the 4D millimeter wave radar market, distinct regional trends and growth potentials emerge. The Asia-Pacific region, especially countries like China, Japan, and South Korea, has shown the highest Compound Annual Growth Rate (CAGR), propelled by rapid advancements in automotive technology and substantial investments in autonomous vehicle research and development. The region's robust automotive industry, coupled with increasing government initiatives for vehicle safety, further accelerates this growth. In contrast, North America, particularly the United States, accounted for the highest revenue percentage in 2023. This is attributed to the early adoption of advanced driver assistance systems (ADAS), the presence of major automotive and technology companies, and significant investments in autonomous vehicle technologies. Europe also remains a key market, driven by stringent vehicle safety regulations and the strong presence of luxury car manufacturers who are early adopters of advanced safety features.

Competitive Landscape

In the competitive landscape of the 4D millimeter wave radar market, as of 2023, leading players included companies like Bosch, Continental, Denso, and NXP Semiconductors, who had established strong positions through innovation, strategic partnerships, and extensive research and development. Bosch, for instance, was recognized for its significant contributions to radar technology and collaborations with automotive manufacturers. Continental's portfolio of radar solutions, catering to a range of applications, underscored its market presence. Denso and NXP Semiconductors were noted for their technological advancements and role in driving the miniaturization and cost reduction of radar systems. From 2024 to 2032, these companies are expected to continue dominating the market, focusing on advancing radar technology to meet the evolving needs of autonomous and connected vehicles. The forecast period is likely to witness an intensified focus on developing integrated systems offering enhanced precision and reliability. Mergers, acquisitions, and collaborations are anticipated to be key strategies for these companies to expand their market presence and technological capabilities. The market is also expected to see new entrants, especially from the tech sector, introducing innovative solutions and challenging traditional market dynamics. This competitive environment is projected to drive further advancements in radar technology, making systems more sophisticated and accessible across various vehicle segments.